Commission only roles are popular in many different industries, but it is important as an employer to understand your obligations so as to pay correct entitlements to your employees and contractors. If you pay incorrect salaries or wages, you may be required to pay back pay to the employee and fines as set out in the Fair Work Act 2009 (Cth). If you are planning on employing workers on a commission only basis, there are a couple of issues that you need to consider. Firstly, you need to consider whether your workers are contractors or employees. If your workers are considered to be employees, then you next need to confirm that the commission only structure will be allowed under employment law. This article outlines important considerations for your business if you want to engage in a commission only employment structure.

Relevant Awards

Two Awards currently allow for commission only structures, the Commercial Sales Award 2010 and the Real Estate Industry Award 2010.

The Commercial Sales Award 2010 covers:

- commercial travellers;

- merchandisers; and

- advertising sales representatives.

The Real Estate Industry Award 2010 only covers real estate workers.

You should review the coverage of these Awards to see whether your employees fall within these categories. You may also pay a commission only salary if your employees come under an enterprise bargain or registered agreement that specifically allows for commission only structures.

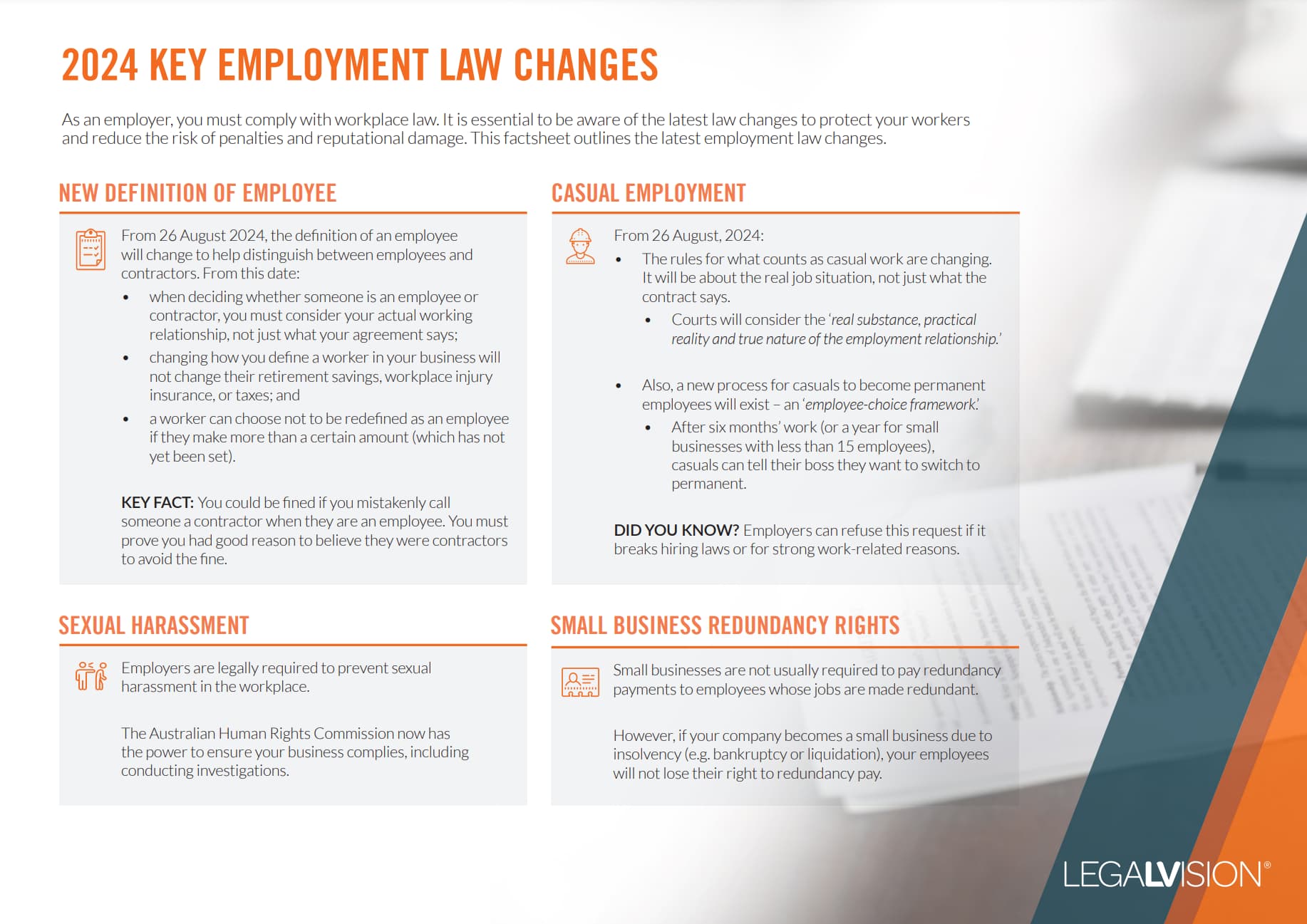

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Bonuses and Incentives

If you are looking to hire employees, then you must pay the worker either minimum wage requirements or the minimum requirements for any relevant Award, enterprise or registered agreements. The minimum wage is regularly increased, usually in July every year, so you should keep this in mind when working out the applicable wage. You can, of course, pay commissions, incentives or bonuses for employees on top of their base salary. However, this cannot replace the employees’ actual salary.

Continue reading this article below the formPiece Rates

Similarly to a commission only structure, wage payments via piece rates are only allowable if specified under an award, enterprise or registered agreement. One other exception is if you and your employee have a written agreement that sets out that the employee receives payment for each product made or picked, in which case this structure is allowable.

Commission Only Structures and Independent Contractors

In the alternative, you may consider hiring your workers on a commission payment basis as contractors. If you would like to do this, you need to be sure that you these workers are genuine contractors and that you are not setting up a sham contract. A worker is likely to be a contractor if they own and operate their own business. Additionally, contractors usually:

- supply their own equipment;

- have the power to delegate work to subcontractors; and

- manage their own taxation obligations.

An employment lawyer can advise you as to the legality of your proposed employment scheme.

Key Takeaways

Once you decide what the best approach is when deciding on how to bring someone on to work for you, you will likely require some sort of agreement, either an employment agreement or contractor agreement that outlines the commission payment structure. However, you must ensure that your use of this structure is legal under applicable modern awards or agreements. If you breach your legal obligations to employees, you may face legal action and a court may order you to pay compensation or fines.

If you have any questions regarding how to correctly pay your employees, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.