In Short

- Understand Payroll Tax Obligations: Operating in multiple Australian states requires awareness of varying payroll tax rates and thresholds.

- Apply Nexus Provisions: Use sequential tests to determine the correct state for payroll tax payments when employees work across jurisdictions.

- Maintain Accurate Records: Keep detailed wage records for each state to ensure compliance and avoid penalties.

Tips for Businesses

Ensure your employment agreements and workplace policies comply with both federal and relevant state laws. Implement clear policies to manage employees across various locations effectively. Consider consulting with employment law professionals to navigate complex multi-state obligations.

If you operate a business in multiple Australian states or territories, you must understand how payroll tax applies to the wages you pay in each location. Payroll tax rates and thresholds vary across jurisdictions. When your workforce is spread across multiple states, you must allocate the tax-free threshold proportionately based on wages paid in each state. This article explains how interstate wages are treated, your obligations, and how nexus provisions determine where payroll tax is payable.

Nexus Provisions and Interstate Wages

If an employee works entirely in one state or territory during a given month, you must pay payroll tax in that state. For employees working across multiple jurisdictions, you use nexus provisions to decide which state receives payroll tax for their wages. These provisions connect where employees work to where payroll tax is owed. They also prevent double taxation by ensuring payroll tax is paid in only one state for each employee.

Nexus provisions involve applying four sequential tests, as follows:

- Principal Place of Residence: First, determine the employee’s principal place of residence during the month. If the employee has one principal residence, you pay payroll tax in the state where that residence is located. For employees with multiple residences, the location on the last day of the month determines payroll tax location;

- Employer’s ABN Address or Principal Place of Business: If the employee does not have a principal residence in Australia, payroll tax is payable in the state where your business’s ABN address is registered. If your business lacks an ABN and operates in multiple states, you pay payroll tax in the state where your business is located;

- Location Where Wages Are Paid or Payable: If the first two tests don’t apply, payroll tax is payable in the state where wages are paid or payable. For wages paid in multiple states, you pay payroll tax in the state where largest portion of wages is paid; and

- Location Where Services Are Mainly Performed: If none of the other tests apply, payroll tax is payable in the state where the employee performs more than 50% of their duties. This test applies when:

- employees have no principal residence;

- the employer has no ABN address or business location in Australia; and

- wages are not paid in Australia.

Current Payroll Tax Rates and Thresholds by State

| State | Tax Rate | Annual Tax-free Threshold |

| NSW | 5.45% | $1.2 million in annual Australian taxable wages |

| Victoria | 4.85% | $900,000 in annual Australian taxable wages |

| Queensland | 4.75% (for businesses under $6.5 million in Australian taxable wages); or 4.95% (for businesses above $6.5 million in Australian taxable wages) | $1.3 million in annual Australian taxable wages |

| South Australia | 4.95% | $1.5 million in annual Australian taxable wages |

| Western Australia | 5.5% | $1 million in annual Australian taxable wages |

| Tasmania | 4% (for businesses up to $2 million in Australian taxable wages); or 6.1% (for businesses above $2 million in Australian taxable wages) | $1.25 million in annual Australian taxable wages |

| Northern Territory | 5.5% | $1.5 million in annual Australian taxable wages |

| ACT | 6.85% | $2 million in annual Australian taxable wages |

Calculating the Tax-Free Threshold for Interstate Businesses

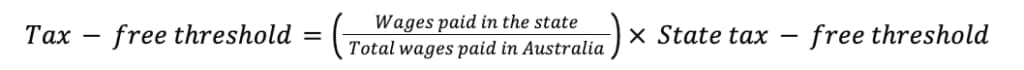

When paying wages in multiple states, you must adjust the tax-free threshold based on where your employees are paid. The formula varies by state and territory, so seeking advice in the relevant jurisdiction/s is essential. For example, the formula in NSW is: :

This formula is applicable whether you operate as a single entity or are part of a payroll tax group. This formula ensures you only claim the portion of the threshold applicable to the state where you employ people.

Grouped Business Reporting

If your business is part of a payroll tax group, you must report wages for all group members as a single entity. A payroll tax group forms when businesses have shared ownership or use the same employees. Only the Designated Group Employer (DGE) or Single Lodger (SL) can claim the group’s tax-free threshold.

The DGE must report wages from all members, including those operating outside the state. Each group member must follow nexus provisions and apportion wages correctly to avoid penalties. For example, if one member pays wages in NSW and others operate interstate, the DGE must report all wages appropriately. In some states, such as NSW, group members may need to use different client IDs to prevent errors in tax liability.

Record-Keeping and Compliance

To comply with payroll tax laws, you must maintain accurate records of wages paid for at least five years. These records should show how you calculated payroll tax in each state. Failure to declare wages or underpay taxes can lead to penalties and interest. If you discover an error, most states allow voluntary disclosure. Prompt reporting of errors can help reduce penalties.

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Key Takeaway

Managing employee payroll tax across multiple states requires understanding Australian jurisdictions’ varying rates and thresholds. Using the nexus provisions, you can accurately determine which state has the taxing rights for your employees’ wages, ensuring you avoid double taxation. Each revenue office requires a proportion of tax-free thresholds based on where wages are paid. Keeping accurate records and applying nexus rules will help you comply with payroll tax regulations and avoid penalties.

If you are uncertain about your legal obligations surrounding payroll tax or other employment issues, our experienced taxation lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

What is payroll tax, and when do I need to pay it?

Payroll tax is a state-based tax on wages paid to employees. You must pay payroll tax if your wages exceed the state or territory’s tax-free threshold.

How do I determine which state to pay payroll tax in if my employees work in multiple locations?

Use the nexus provisions, which include four sequential tests:

- the employee’s principal residence;

- the employer’s ABN address;

- where wages are paid; and

- where services are mainly performed.

We appreciate your feedback – your submission has been successfully received.