As a business owner, you have probably heard of Pay As You Go (PAYG) withholding. But you may not completely understand what it is and what obligations come with it. PAYG requires businesses to withhold money when paying workers and divert it to the Australian Tax Office (ATO) on the worker’s behalf. If a business violates its PAYG withholding requirements, the company and its directors may face a penalty up to the amount that should have been withheld or paid. This article explains everything you should know about PAYG withholding, including:

- whether your business must register and pay;

- the practical steps you must take; and

- what happens if an employee resigns?

1. What Is PAYG Withholding?

Most Australian workers pay income tax, calculated as a percentage of their annual income. The total amount of tax owed by a worker is only known after the worker files their tax return at the end of the financial year, which is why some employees may receive a refund as too much tax may have been withheld by their employer.

Therefore, PAYG withholding allows an employer to deduct money from the worker’s pay and send it to the ATO on the worker’s behalf throughout the year. This should occur every time the employer pays an employee, and the employer should notify them of the amount withheld in tax on their paysheet.

When a worker completes their tax return at the end of the financial year, the ATO confirms whether the amount withheld by their employer was the correct amount of tax owed by the worker.

Tax Refunds and Tax Bills

The amount of money withheld may differ from the tax your worker owes, as it is typically calculated on the basis that they earn the same amount of money for every pay period.

If too much tax is withheld from the worker under the PAYG system, the ATO will provide the worker with a tax refund. On the other hand, if not enough money is withheld, the worker will be required to pay an additional tax bill.

You may also be required to withhold amounts relating to debts owed by the worker, such as:

- Higher Education Loan Program (HELP);

- Trade Support Loan (TSL); or

- Financial Supplement debt (SFSS).

2. Do I Need to Register for and withhold PAYG?

You are obliged to register for PAYG withholding if you:

- have employees (including deemed employees that could be contractors);

- pay your directors;

- have contractors and voluntarily agree to withhold PAYG payments from contractors; or

- make payments to businesses that do not have an ABN.

You must be registered for PAYG before you deduct amounts from a worker’s payment.

Continue reading this article below the form3. What types of payments do I need to withhold from?

The main type of payment that you should withhold is salary and wage payments to an employee. Other payments that may require PAYG withholding include

- payments to Australian performing artists contracted to perform in a promotional activity; and/or

- payments made to foreign residents for entertainment, sports, construction or casino gaming junket activities

4. What Steps Do I Need to Take regarding PAYG Withholding?

Step 1 – Register for PAYG Withholding

You will generally need an ABN to register for PAYG. Once you have an active ABN, you can register for PAYG:

- online through the ATO’s business portal;

- over the phone at 13 72 26;

- through your registered tax agent or Business Activity Statement (BAS) agent; or

- online through your Standard Business Reporting (SBR) software.

Step 2 – Withhold Amounts From Wages or Payments

You should consider each worker your business engages to determine whether you need to withhold payments. This will include any:

- employee (including deemed employee);

- paid director;

- business without an ABN; or

- a contractor who you voluntarily withhold payments from.

You should then require those workers to complete a tax file number (TFN) declaration, lodge the form with the ATO and retain a copy for your records.

To determine the amount to withhold, you can use the ATO’s tax withheld calculators, including for:

- individual employees; and

- those whose tax you withhold under a voluntary agreement.

The calculators take into account matters such as:

- income tax rates;

- HELP;

- TSL; and

- SFSS contributions.

You should then lodge your BAS and pay the withheld amounts to the ATO.

Step 3 – Provide Payment Summaries

You must provide PAYG withholding payment summaries to the relevant workers by 14 July for the preceding financial year. This is a statement that outlines how much they earned and how much they withheld in tax.

Additionally, you must provide a PAYG withholding payment summary annual report to the ATO by August 14 for the preceding financial year.

5. What Happens When the Employment Terminates?

In some cases, when an employment ends, you may need to:

- make employment termination payments; and

- report those payments to the ATO.

These payments include PAYG withholding. You may also be required to complete a PAYG payment summary – employment termination payment if you make this payment to a worker employed for a period before 1 July 2012.

You must provide the PAYG withholding payment summary to the relevant employee. To protect your business, you should also keep a record of the employee’s income withheld in tax and TFN declaration.

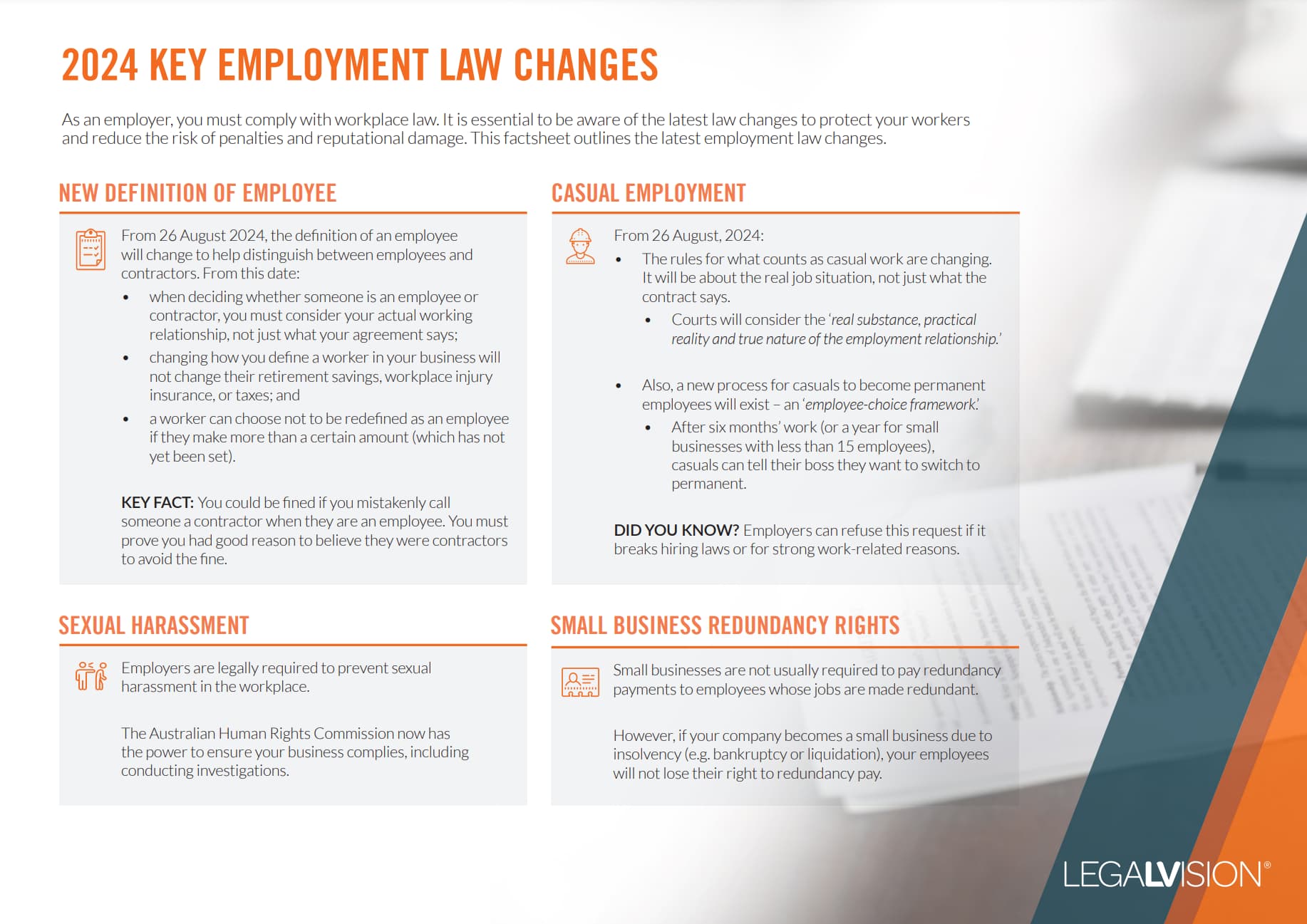

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Key Takeaways

PAYG withholding enables workers to pay their tax bill periodically throughout the year, instead of in one lump sum. This requires businesses to register and pay the withheld money to the ATO on behalf of its workers. A company is obliged to register for PAYG if it has:

- employees (including deemed employees);

- directors;

- workers without ABNs; and

- contractors if the business voluntarily agrees to withhold money.

The business must:

- request a TFN declaration form from its workers;

- withhold and divert the calculated tax payable to the ATO; and

- provide summaries to workers and the ATO.

If you are uncertain about your legal obligations surrounding PAYG withholding or other employment issues, contact LegalVision’s taxation lawyers on 1800 532 904 or fill out the form on this page.

Frequently Asked Questions

What is PAYG withholding?

Employers must withhold tax on salary and wage payments to their employees and remit this to the ATO.

What steps do I need to take with respect to PAYG withholding?

The key steps you must take with respect to PAYG withholding are:

- Step 3 – provide payment summaries;

- Step 1 – register for PAYG withholding; and

- Step 2 – withhold amounts from wages or payments.

We appreciate your feedback – your submission has been successfully received.