In Short

- Engaging overseas workers can reduce costs and provide access to a global talent pool.

- The Fair Work Act 2009 (Cth) may apply to overseas workers, depending on contract formation and work location.

- Compliance with both Australian and local employment laws is essential when hiring overseas staff.

Tips for Businesses

When hiring overseas workers, ensure contracts are clear about where they are formed and where work is performed. Seek legal advice to understand obligations under both Australian and local laws, and consider using an Employer of Record to manage compliance effectively.

As a business owner, you may consider using overseas outsourcing services to save costs. Before you do so, it is important to weigh up the pros and cons of this arrangement, specifically, what your legal obligations may be when using overseas workers. This article will outline the main considerations for your business when using overseas workers.

Benefits of Overseas Workers

Due to the economic conditions of overseas countries, your business may be able to engage them for a cheaper rate than Australian workers without compromising quality. As such, using overseas workers can be a cost-effective way to hire high-quality labour for your business.

Hiring overseas workers also allows you to access a global workforce with skillsets unique to the Australian market. This can assist your business in improving its:

- service and product delivery;

- international competitiveness; and

- presence.

Common examples of overseas workers a business may use are:

- virtual assistants;

- customer service representatives;

- software developers;

- engineers; or

- data analysts.

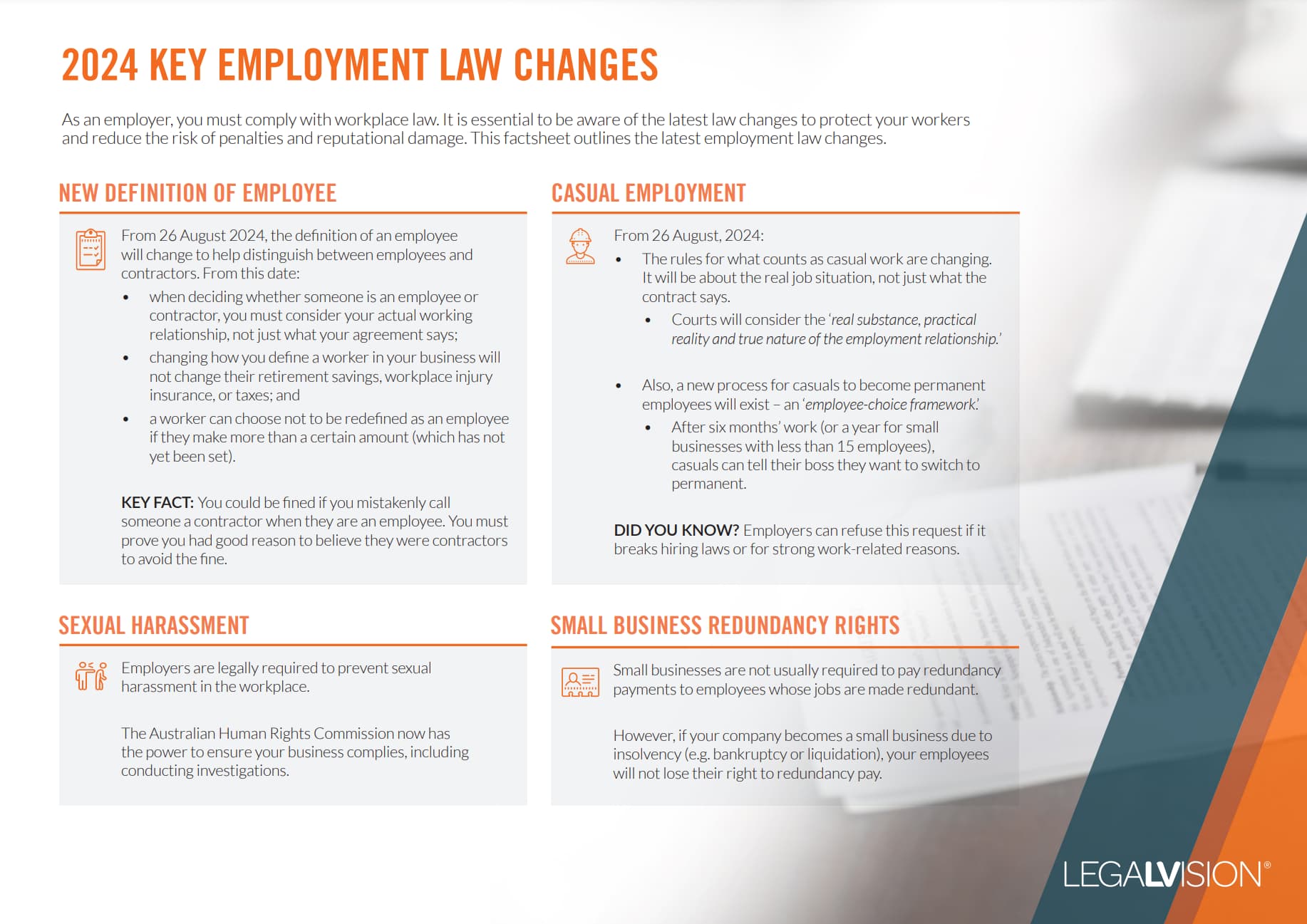

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Do Australian Laws Apply to Overseas Workers?

A common assumption made by businesses hiring workers overseas is that Australian employment laws do not apply to these workers. However, this may not always be the case. The main employment law covering Australian workers is the Fair Work Act 2009 (FWA).

The FWA will apply to an Australian-based employee, which is an employee:

- who is engaged by an Australian employer; or

- whose primary place of work is Australia (whether or not they are based in Australia).

However, the FWA will not apply to employees engaged by an Australian employer if:

- they are engaged outside of Australia; and

- the work they are performing is outside of Australia.

To understand how this works in practice, consider the Fair Work Commission’s (FWC) decision below.

Continue reading this article below the formCase Example

An overseas employee made a termination claim against his employer, an Australian mining company. The FWC first needed to consider whether the FWA applied to determine if it could hear the case.

Was the Employee Engaged Outside of Australia?

The employee received an employment contract that he signed and emailed back to the company while he was overseas. To determine whether this engagement was in Australia, the FWC considered whether the contract was formed in Australia.

The FWC decided that the contract was formed when the company received the employee’s acceptance email. As this email was received at the company’s place of business, NSW, the contract was, therefore, formed in Australia.

Did the Employee Perform Work Outside of Australia?

The employee was engaged to work outside of Australia, which was never in dispute.

Decision

The FWC held that the employee was not engaged outside of Australia. Accordingly, they were covered by the FWA and Australian employment laws would apply.

What Does This Mean for My Business?

This decision makes it clear that Australian employment laws can still apply to your workers who are based and performing work overseas. This is because most of your communication will be through email, and the FWA will likely apply to these arrangements.

Accordingly, for most overseas workers, their employment contract will be formed in Australia when their acceptance is received by an Australian company via email.

Local Laws

It is also important to remember that the local laws of your overseas workers may apply. For example, if you engage an employee in India, the laws of India will apply, as will the laws of Australia.

You may need to consider obtaining local advice to make sure you are not in breach of any local laws if you are using overseas workers.

Employer of Record (EOR)

An alternative to engaging your overseas workers directly is engaging them through an EOR. In exchange for a fee, an EOR will provide you with an overseas worker to perform work for your business. Under this arrangement, the EOR will be responsible for compliance with local laws and regulations.

This may be a less risky and burdensome approach, although you will need to consider the additional costs of using an EOR.

Key Takeaways

Simply because your workers are based and working overseas does not mean that the FWA will not apply. Therefore, you need to consider Australian laws and local laws when you are engaging overseas workers. The recent FWC case highlights how, when a contract is formed via email, it is likely that an overseas worker will actually be covered by Australian laws. Therefore, you should be mindful when hiring overseas workers and ensure that you are aware of your employment obligations.

If you need assistance determining if the FWA applies to an overseas worker, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Misclassifying an overseas contractor as an employee can lead to penalties, backpayment of entitlements, tax non-compliance, and legal disputes. It is important to draft clear contracts and seek legal advice to avoid these risks.

You need to comply with local laws on minimum wages, taxes, employment benefits, and termination rights. Seeking advice from local experts or using an Employer of Record can help ensure compliance.

We appreciate your feedback – your submission has been successfully received.