Whether an old or new employer must pay an employee’s entitlements when a business is sold depends on whether the business has been transferred. For a transfer to occur, both you and the other party must meet the timings, duties and connection requirements set out by Fair Work Australia. This article will highlight who is responsible for employee entitlements after the sale of a business so that you can make informed decisions and meet your business obligations.

Requirements for a Sale of Business

The requirements set out by Fair Work Australia include that the employee must:

- begin working for their new employer within three months of ending their job with the previous employer; and

- have identical or nearly identical duties to when they were under their previous employer.

Additionally, you and the other employer must have a connection that can be established with:

- the sale of business assets;

- association between entities; or

- outsourcing.

If these requirements have been met, there will be a transfer of business. If you are the new employer, you must recognise the time your employees have worked for their old employer when working out some of their entitlements. These include:

- sick and carer’s leave;

- requests for flexible working arrangements; and

- parental leave.

However, there are also a number of employee entitlements that you do not have to recognise as a new employer. These include:

- redundancy;

- annual leave; and

- long service leave.

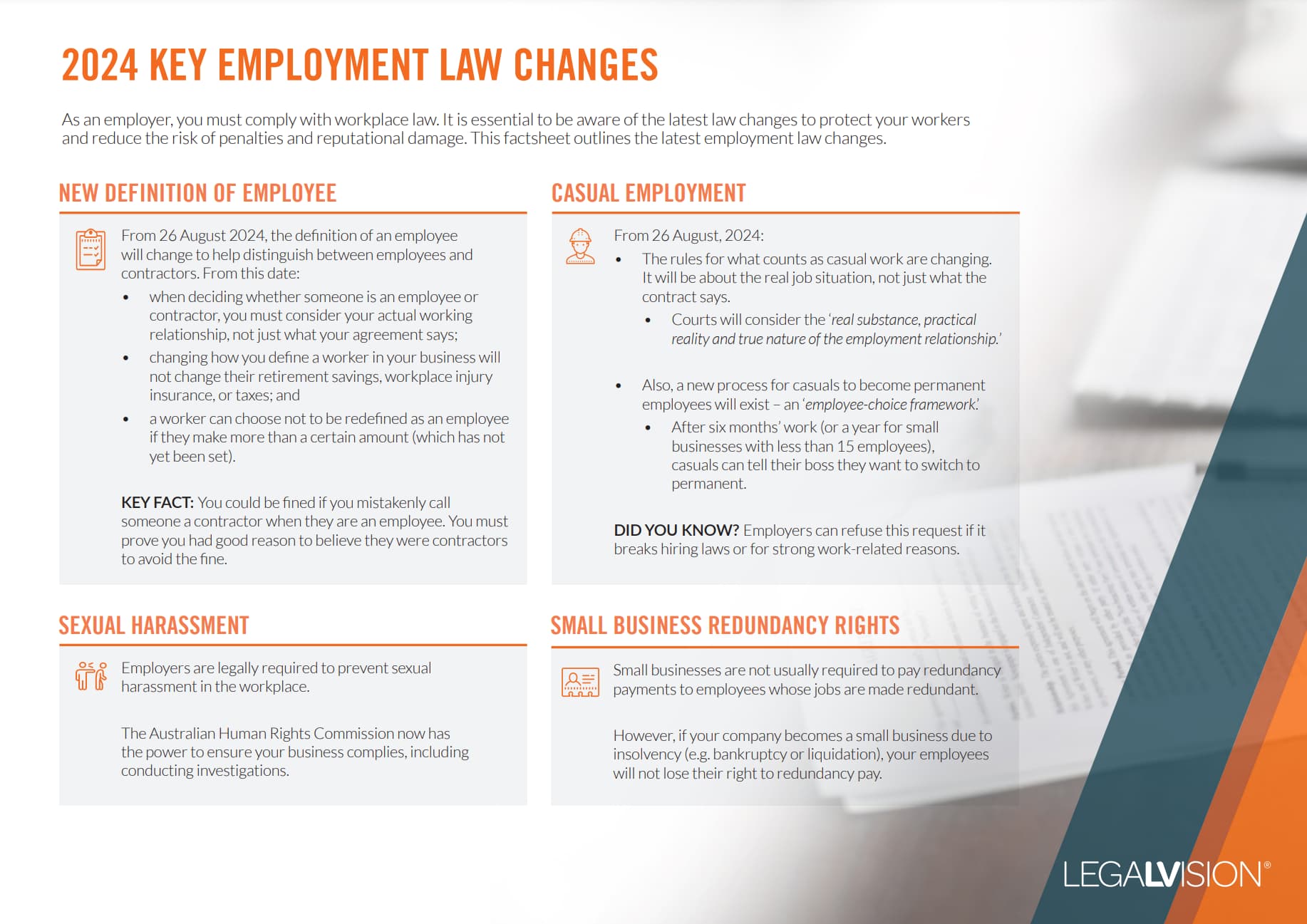

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Redundancy

As the new employer, you do not have to recognise an employee’s service with the old employer when determining redundancy entitlements as long as you are not an associated entity with the old employer.

If you are the old employer, you will need to pay out the employee’s redundancy entitlements upon termination.

The employee will not be entitled to redundancy pay if they reject the new employer’s job offer where the:

- terms and conditions are similar to those of the old job;

- employee’s service with the old employer has been recognised for their redundancy pay; and

- employee accepting the job would create a transfer of employment.

Annual Leave

As the new employer, you may decide to honour annual leave depending on whether the two businesses are associated entities. Where you are associated with the old employer, you may decide to have the employee’s annual leave carried over from the old employer

However, if you decide not to carry over the employee’s annual leave, the former employer must pay the accumulation to the employee.

Long Service Leave

You will usually need to recognise an employee’s service with their old employer when calculating long service leave, except where:

- the employee was not entitled to long service leave under a registered agreement on 31 December 2009;

- an agreement was made on or after 1 January 2010 that replaced the former agreement; and

- the new agreement states that service under an old agreement does not count toward long service leave.

Unfair Dismissal

You will generally need to recognise an employee’s service with their old employer for the purposes of unfair dismissal except when the:

- employee is a transferring employee;

- businesses are not associated entities; and

- employee is informed in writing before their employment begins that their service with the old employer will not be recognised.

Notice of Termination

The employee’s position with their old employer ends when a business is transferred. If you are the old employer, this means that you must either give notice of termination or provide payment in lieu of notice. You are also required to pay the notice period if the transfer of the business occurs before the notice period ends.

Key Takeaways

The entity responsible for paying employee entitlements will depend on whether an effective transfer of business has occurred. If you are the new employer, you will generally be responsible for covering entitlements. However, there are a number of entitlements that you do not have to recognise, including long service leave and annual leave.

If you require assistance with transferring your business, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.