On this page

- Overview of Today’s Session

- Snapshot of the New Regime

- Notification Obligations and Thresholds

- What Is Notifiable?

- Connected Entities

- Waiver vs Notification

- Process and Timelines

- Information Requirements and Fees

- Substantial Lessening of Competition (SLC)

- Impact on Deal Documentation

- What In-House Counsel Must Do

- Deal-Specific Actions

- Key Takeaways

- Q&A Highlights

- Closing

Miles Guggenheimer (Practice Leader, Corporate Transactions, LegalVision)

Welcome everyone to our webinar on Deal-Ready: Navigating Mandatory Merger Compliance for In-House Counsel.

My name is Miles Guggenheimer. I’m a Practice Leader in LegalVision’s Corporate Transactions team.

Before we begin, you’ll receive the recording and slides in your email. Submit your questions in the Q&A box and we’ll answer them at the end. Please complete the feedback survey after the webinar and stay until the end to enter our Apple AirPods monthly draw.

You’re also eligible for a free consultation with LegalVision to learn how we can help your in-house team manage your high-volume business-as-usual legal tasks. Provide your contact details in the survey at the end of the webinar.

Overview of Today’s Session

To kick off, we’ll discuss what’s changing under the new merger regime. The new regime has been causing a lot of stress and anxiety for deal-makers over the last year, but it’s finally upon us.

We’ll look at:

- a snapshot of what’s changing under the new laws;

- notification obligations and thresholds;

- process and timelines;

- deal documentation impacts; and

- action items for in-house counsel.

At the end, we’ll also run a Q&A session, so please submit any questions during the presentation.

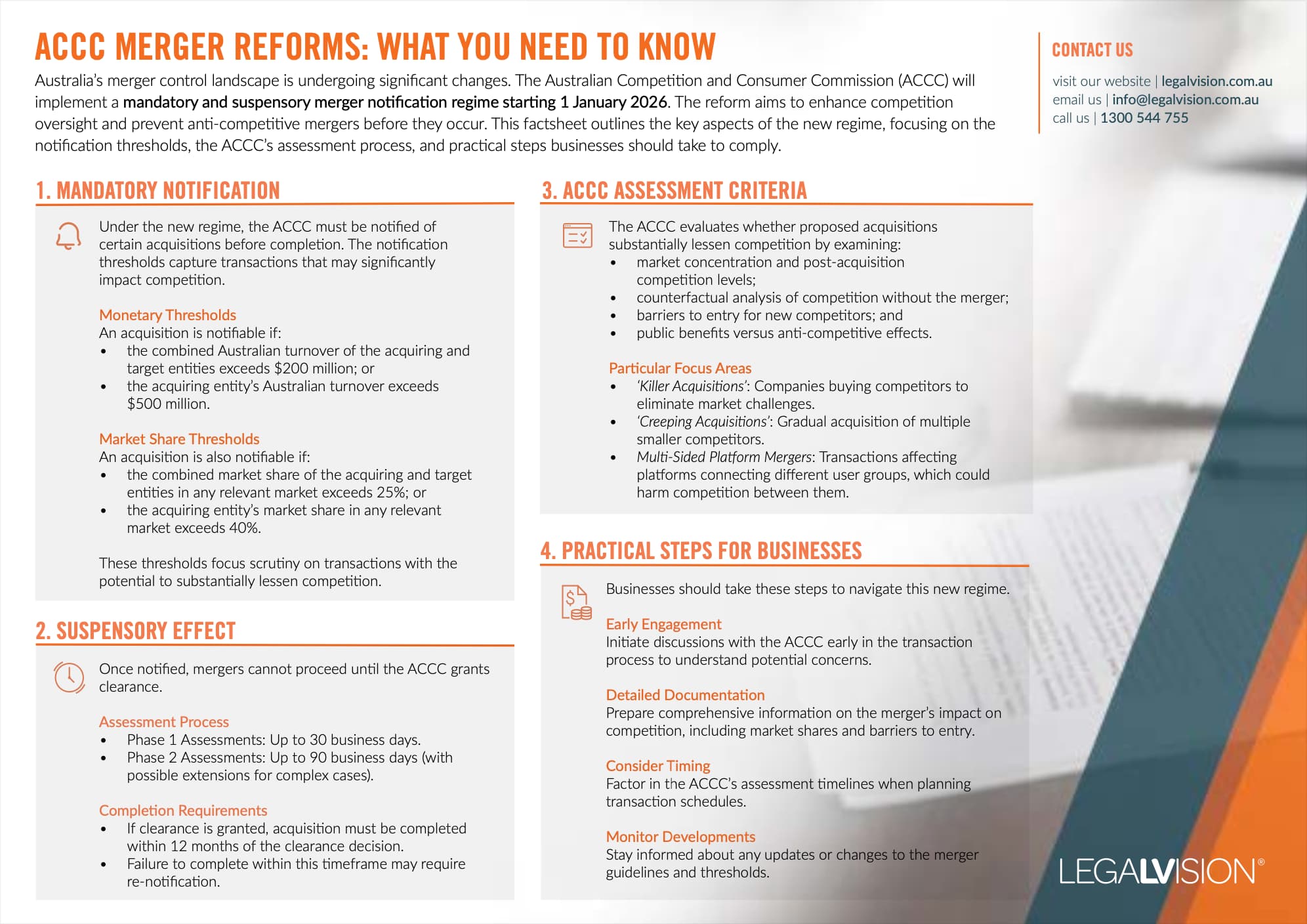

The Australian Competition and Consumer Commission (ACCC) will implement a mandatory and suspensory merger notification regime starting 1 January 2026. This factsheet outlines the key aspects of the new regime, focusing on the notification thresholds, the ACCC’s assessment process, and practical steps businesses should take to comply.

Snapshot of the New Regime

This is the biggest change to merger laws in decades and has created significant discussion over the past year. It has been mandatory since 1 January this year, meaning it is now in effect.

This new regime aligns Australia’s merger compliance with jurisdictions such as the US and EU, bringing us into line with global best practice. To avoid delays, penalties, and voided transactions, it’s essential that deal teams and large organisations understand these new laws.

Key Changes

The regime moves from:

- a voluntary regime to a mandatory and suspensory regime;

- no thresholds to clear revenue and value thresholds with a three-year look-back period; and

- a court-based enforcement process to an ACCC administrative process.

Timelines now move from ACCC guidelines to fixed timelines (subject to clock stops).

Most controversially, there are new fees. We’ve gone from no fees to $56,000 to nearly $1.6 million for Phase 1 and Phase 2 applications.

Consequences

Transactions are void if completed without clearance. There are financial penalties and personal liability for breaches. Deal-makers must factor in at least three to six months when planning future transactions under this regime.

Simple action items:

- review the deal pipeline now;

- update M&A processes; and

- educate internal teams.

Continue reading this article below the form

Notification Obligations and Thresholds

We recommend redlining these three tests internally. You only need to meet one test to trigger notification.

1. Economy-wide test

The combined Australian revenue of the acquirer and target is greater than $200 million, and:

- target revenue is greater than $50 million; or

- transaction value is greater than $250 million.

2. Large acquirer test

The acquirer has Australian revenue greater than $500 million, and:

- target revenue is greater than $10 million; or

- transaction value is greater than $250 million.

3. Serial acquisition test

There is a three-year look-back across related-market acquisitions. Thresholds aggregate similar acquisitions over three years, excluding transactions under $2 million.

Key points:

- ensure deal teams redline these tests internally;

- track acquisitions over a three-year period; and

- transaction value is global, not just Australian.

What Is Notifiable?

Share acquisitions

Must result in a change of control, similar to the section 50AA Corporations Act test. The ACCC will consider sole or joint control.

Asset acquisitions

The definition is deliberately broad. If you acquire business capacity or competitive advantage, it is likely caught. This includes:

- leases;

- licences;

- IP;

- joint ventures;

- data; and

- contractual rights.

It must not be in the ordinary course of business.

A recent example is a large-scale commercial lease treated as an asset acquisition requiring notification because the parent company exceeded revenue thresholds.

Connected Entities

The ACCC looks at the total global footprint, not just the contracting entity.

- Revenue thresholds aggregate the entire corporate group.

- A small subsidiary can trigger notification if parent entities are large.

- Shelf companies will not avoid analysis.

The focus is on real control. If a corporation can dictate a subsidiary’s financial or operating policies, they are connected.

Key exemptions

- Ordinary course: inventory or consumables acquisitions.

- Internal restructures: transactions within the same group.

Key points:

- asset acquisitions are often overlooked;

- exemptions are complex—seek advice; and

- consider ACCC pre-notification engagement.

Waiver vs Notification

The ACCC provides two pathways.

Waiver

For transactions posing no competition risk. Removes full notification requirement and allows faster completion.

Standard notification

Default for threshold-triggering deals. Requires formal filing and Phase 1 review before closing.

A waiver is more efficient, but notification provides legal certainty against later challenge.

Suitable for:

- waiver: minimal or no competition overlap;

- notification: threshold-triggering or complex deals.

Both require substantial information. Engage with the ACCC early for guidance.

Process and Timelines

Early engagement with the ACCC is critical. Pre-notification engagement can save weeks by identifying issues before the clock starts.

About 80% of deals clear in Phase 1 or early Phase 2. Accurate information is essential to avoid clock stops.

Phase 2

Triggered if the ACCC suspects substantial lessening of competition. Requires deeper investigation.

Public benefit test

Approval possible if public benefit outweighs harm, but this is a high bar.

Tribunal

Last-resort limited merits review.

Clock stops occur if RFIs are issued. Complete information is essential.

Timelines

- build 6–12 months into planning;

- straightforward deals: ~6–8 weeks;

- complex deals: 6+ months.

Information Requirements and Fees

Assume everything submitted may be seen by competitors and customers.

Start document collection early:

- three years of board papers;

- transaction documents;

- financial reports; and

- organisational charts.

Short-form applications

Revenue, acquisitions, market share, transaction documents, organisational charts, competitor and customer information.

Long-form applications

All short-form material plus:

- board papers;

- sales processes; and

- barriers to entry.

Fees

- waiver: $8,000;

- Phase 1: $56,800;

- Phase 2: $475,000–$1.6 million.

Fees are non-refundable.

Substantial Lessening of Competition (SLC)

Core ACCC test: whether a merger reduces market rivalry or consumer choice.

The expanded test captures deals strengthening market power even if competition is not reduced immediately. Serial acquisitions over three years are considered cumulatively.

Remedies

- structural (divestitures) preferred;

- behavioural (undertakings, pricing commitments) possible.

Timing is critical. Remedies must be proposed within specific windows.

Impact on Deal Documentation

ACCC condition precedent

Now standard in sale agreements with competition risk. Completion cannot occur without clearance.

Gun-jumping prohibitions

Apply from signing, not completion. Parties must:

- restrict information sharing;

- separate operations; and

- train staff.

Protocols must be in place before signing.

Longer signing-to-completion gap

Long-stop dates must reflect ACCC timelines:

- simple: ~6 months;

- complex: 9–12 months;

- tribunal risk: 12–18 months.

Avoid sunset clauses expiring before clearance.

FIRB interaction

FIRB and ACCC timelines must be coordinated.

What In-House Counsel Must Do

Review pipeline

Identify deals triggering mandatory filings and adjust timelines.

Update processes

Revise M&A playbooks, precedents, and internal processes.

Educate stakeholders

- boards and executives on timelines and costs;

- deal teams on gun-jumping risks.

Budget

Fees, legal costs, and extended timelines significantly increase transaction cost.

Build relationships

- competition advisers;

- ACCC;

- in-house counsel networks.

Deal-Specific Actions

Initiation

Assess thresholds early.

Planning

Budget, timeline, key issues.

Pre-notification

Engage ACCC early and prepare materials.

Deal stage

Ensure CPs, long-stop dates, gun-jumping protocols.

Post-signing

Proper lodgement and documentation of acquisition history.

Key Takeaways

- assess every deal under the new laws;

- factor in at least 3–6 months;

- budget for significant fees and legal costs;

- gather information early;

- implement gun-jumping protocols; and

- engage early and proactively with the ACCC.

Q&A Highlights

Waiver process

Applications submitted via the ACCC acquisition portal. Early discussions available through the portal.

Below-threshold deals

ACCC can still investigate if SLC risk exists. Voluntary notification may be appropriate.

Serial acquisition threshold

Rolling three-year snapshot, not a reset.

University spinouts

No blanket exemption; most likely below thresholds.

2026 changes

Possible shift from “void” to “voidable” for non-notified mergers.

Revenue test scope

Captures upstream parent companies and entire corporate group.

Closing

That concludes today’s webinar. You may find our publication helpful, which summarises the key changes. We also have an upcoming webinar on buying or selling an online business.

If you have further questions, please reach out. While this is a free webinar, we value your feedback—please complete the short survey.

Thank you for joining today.

We appreciate your feedback – your submission has been successfully received.