In Short

- Vendor financing offers a practical means for franchise vendors to facilitate the sale of their franchise by providing financial assistance to potential buyers.

- This method can increase the pool of prospective buyers and expedite the sale process.

- Careful assessment of the buyer’s financial position and a clear financing agreement are crucial to mitigate risks.

Tips for Businesses

When considering vendor financing for franchise sales, ensure thorough due diligence on buyers’ creditworthiness to reduce default risk. Draft detailed financing agreements, outlining payment terms and obligations, to protect your interests. Consider seeking specialist legal advice to navigate potential complexities and maintain regulatory compliance.

When looking to sell your franchise, finding the right buyer can be very difficult. If you are struggling to find someone to purchase your franchise, you may receive an offer for vendor financing. A vendor finance occurs when you accept part of the payment for the franchise upfront. Then, the purchaser pays the rest over time after the sale goes through. Essentially you are “lending money” to the purchaser to fund the sale. Vendor financing may be problematic and can expose you to certain risks.

This article explains when vendor financing may be appropriate and outlines the preventative measures you can take to ensure protection during the vendor finance arrangement.

When is Vendor Financing Appropriate?

Vendor financing is appropriate when no other buyer is willing to pay the full purchase price upfront, and the seller is confident in the profitability and sustainability of their business under new ownership. It can be a viable option if the buyer demonstrates a strong ability to manage and grow the business, ensuring they can meet their financial obligations. This approach might also be suitable in markets where traditional financing is challenging to obtain, therefore broadening the pool of potential buyers and facilitating the sale. Sometimes, vendor financing is necessary when the seller must urgently exit the business.

Potential Issues With Vendor Financing

One of the biggest issues with vendor financing is the risk of the other party being unable to repay the loan you have granted them. You may wish to require that the purchaser provide security for the loan to ensure you have recourse if the borrower cannot pay the loan. Generally, you can obtain one or more of the following as security:

- a personal guarantee from the purchaser’s director(s);

- shares in the purchasing entity company;

- a mortgage over a property the purchaser owns;

- a general security agreement securing the assets of the business; and/or

- inter-company guarantees from a holding company or related entity.

Enforcing any of these forms of security is expensive and time-consuming. You can only enforce some of these guarantees through court proceedings, including

- personal guarantees;

- mortgages; and

- general security agreements.

This could involve considerable legal costs.

Continue reading this article below the formCall 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Personal Guarantee as a Security

Personal guarantees are a common security that is often provided under vendor financing loans. This is when an individual personally guarantees the payment of the loan.

Property as a Security

Providing property as security for a loan is another way borrowers often obtain loans. This can be land and/or other property. Although preferred, providing land as a security may be difficult as most land already has the bank registered as a mortgagee. You will need the bank’s consent if the land is provided as security for a separate loan.

General Security Deed

A General Security Deed is an agreement that allows the lender to have access to the business’ assets if the borrower cannot repay the loan.

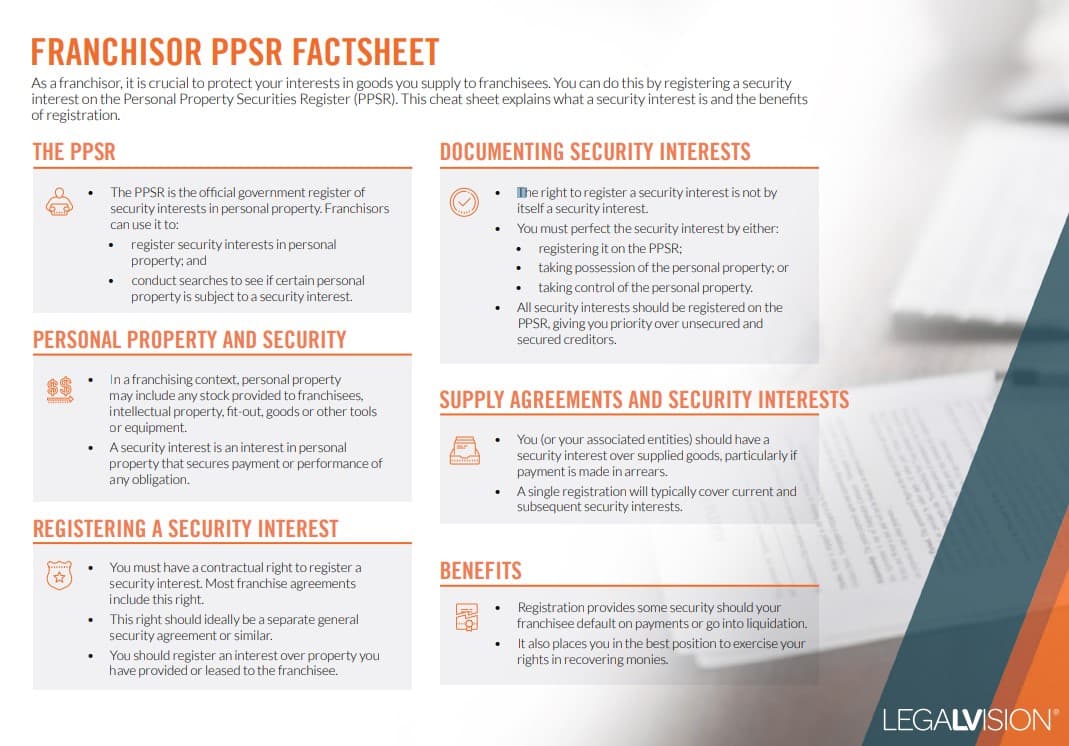

Securing the remainder of your payment through a general security agreement can be a complex process, as there may be competing security interests registered on the PPSR. It is, therefore, important that you confirm what other security interests the purchaser has before opting for this form of security.

This cheat sheet explains the PPSR, what a security interest is and the benefits of registration.

Key Takeaways

Vendor financing is a complex process and may carry with it various difficulties and risks. If proceeding with a vendor financing arrangement is your only option, there are certain steps you can take to reduce your risks and ensure the loan is repaid to you.

If you have any questions about selling a franchise, our experienced franchise lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Vendor financing is appropriate when other buyers can’t pay the full price upfront, the seller is confident in the business’s success under new ownership, and when traditional financing is hard to obtain. It can be suitable if the buyer can manage and grow the business and the seller needs to exit urgently.

Common forms of security include personal guarantees from the purchaser’s directors, shares in the purchasing company, mortgages over property, general security agreements securing business assets, and inter-company guarantees from related entities.

We appreciate your feedback – your submission has been successfully received.