If you operate your business through multiple companies, you may find it difficult to pay your taxes. Forming a tax consolidated group will allow you to operate as a single entity for income tax purposes. This is effective because it reduces compliance costs for your company. This article will explain when and how you can form a tax consolidated group.

When Can You Form a Tax Consolidated Group?

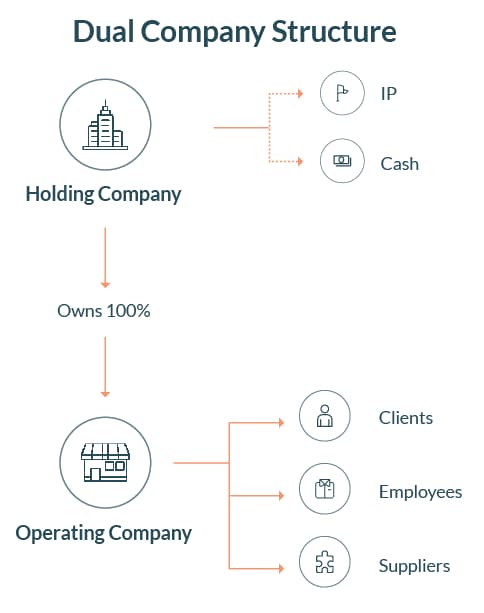

It is common for many startups to set up as a dual company structure. It is also common for more sophisticated businesses to have multiple companies or entities under one umbrella. This involves one company (known as the holding company) fully owning one or more other companies (known as operating companies). Typically the holding company will own all of the company’s valuable assets including intellectual property, such as trade marks and software, cash and any physical assets. The operating company will be responsible for the day to day operation of the company and will enter into contracts with employees and clients.

Businesses often choose to have a dual company structure to protect their major assets. For example, if a customer were to sue the business, they could only sue the operating company that they had a relationship with. However, they would not have access to any of your company’s valuable assets, held in the holding company. Businesses may also create structures with multiple entities if they want to separate branches of the business. For example, you may create companies in different locations or for different products within your business. If you have more companies, this helps to reduce the risk to your business if something goes wrong.

Why Would You Form a Tax Consolidated Group?

Many businesses question whether the compliance and administrative costs of setting up multiple companies are worth it. If you set up multiple entities, you need to lodge tax returns for each company. If you consolidate the groups together, then you will only need to lodge a single income tax return for the entire group and pay a single set of PAYG instalments.

Tax Sharing Agreement

One of the main disadvantages of forming a tax consolidated group is that although the holding company has the responsibility for paying tax, every company is fully responsible for the group’s activity. For example, if the holding company fails to pay the group’s income tax, the operating companies will be responsible for paying back. You can manage this situation by each company executing a Tax Sharing Agreement which distributes the responsibility between the group members. This means that if the holding company does not pay the group’s income tax, then a group member would only be responsible for the portion that the agreement sets out. This agreement can also address what happens if that new companies join the group or companies leave it.

Continue reading this article below the formSteps to Form a Tax Consolidated Group

1. Get Tax Advice

Before forming a tax consolidated group, it is best practice to get formal business structuring and tax advice. The consolidation regime contains complex rules that you should understand. If you form the group sometime after the entity has been created, the tax consequences may be more severe. Once you decide to form a tax consolidated group, you cannot reverse it.

2. Check Your Company Minutes and Resolutions

You should check your company constitution and shareholders agreement to determine your company’s requirements about making this decision. It is important to document your decision through company minutes and resolutions.

3. Notify the Australian Tax Office (ATO)

To implement the consolidation of the groups, the holding company or its registered tax agent must notify the Australian Tax Office by completing and lodging a Notification of Formation of an Income Tax Consolidated Group Form. The holding company must notify the ATO of the group’s formation before the date that:

- you lodge your income tax return for the income year that the consolidation occurs; or

- your income tax return would be due, if your head company does not need to lodge one.

Key Takeaways

Tax consolidated groups help companies with multiple entities to reduce compliance costs and make it easier to pay tax. You should carefully consider whether consolidating your companies to form a group is appropriate for your business. You cannot reverse this decision. If you would like assistance with your company’s business structure or forming a tax consolidated group, you can contact LegalVision’s taxation lawyers or fill out the form on this page.

We appreciate your feedback – your submission has been successfully received.