In Short

-

Definition: Royalties are payments made for the use of another party’s intellectual property or rights, such as copyrights, patents, or trademarks.

-

Tax Obligations: In Australia, royalties paid to non-residents are subject to a standard withholding tax rate of 30%, which may be reduced under a double-tax agreement.

-

Software Payments: Payments for software rights, like reproduction, modification, or distribution, can be classified as royalties, affecting tax treatment.

Tips for Businesses

Review your licensing agreements to identify any royalty payments and understand their tax implications. Ensure compliance with Australian tax laws, especially when dealing with non-resident entities. Seek professional advice to navigate complex arrangements, particularly concerning software-related payments.

Royalties are a cornerstone of various business arrangements, particularly in technology, media, and intellectual property industries. For businesses operating in Australia, understanding what constitutes a royalty is vital as it has significant tax implications, especially when dealing with non-resident entities. This article explores the concept of royalties, their tax treatment under Australian law, and specific considerations for software-related payments. This article aims to equip you with the knowledge necessary to navigate royalty arrangements and comply with taxation requirements.

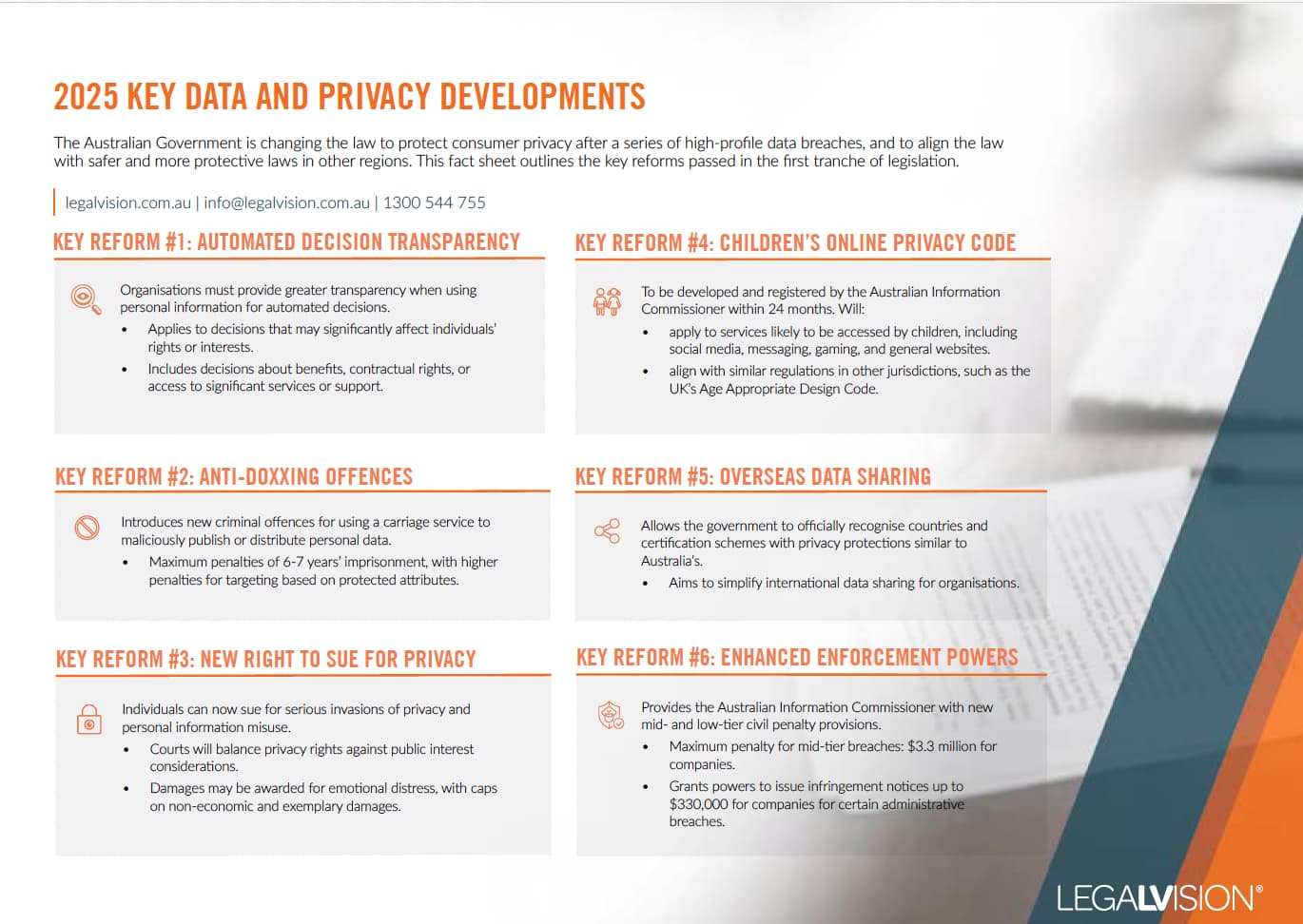

This fact sheet outlines the Australian Government’s strengthened consumer privacy laws in 2025 following major data breaches and their alignment with global standards.

What Are Royalties?

In a business context, royalties refer to payments made for the use of certain rights, assets, or property owned by another party. According to the Australian Taxation Office (ATO), royalties include payments or credits for:

- the use of or correct use of intellectual property such as copyright, patent, design or model, plan, secret formula or process, or trademark;

- the supply of scientific, technical, industrial or commercial knowledge or information;

- access to industrial, commercial, or scientific equipment;

- the use of media, such as motion picture films, films or audio or video tapes or disks, or any other means of image or sound reproduction or transmission for use in connection with television, radio or other broadcasting; and

- assistance related to applying or benefiting from the above rights.

These payments are often agreed upon as part of licensing arrangements and can take the form of ongoing payments, lump sums, or other periodic fees. Understanding what qualifies as a royalty is essential for businesses because it determines the tax obligations associated with the payment.

The Tax Treatment of Royalties

The classification of a payment as a royalty triggers specific tax obligations, particularly for payments made to non-residents. In Australia, such payments are typically subject to non-resident withholding tax. This tax is levied on the gross amount of the royalty payment and must be withheld and remitted to the ATO by the payer.

The standard withholding tax rate for royalties paid to non-residents is 30%. However, the rate may be reduced under a double-tax agreement (DTA) between Australia and the non-resident’s country of residence. DTAs are designed to prevent double taxation and encourage cross-border trade and investment.

Continue reading this article below the formRoyalties in Software Arrangement

The rapid advancement of technology and the rise of digital transactions have introduced complexities in defining royalties. This is particularly in software-related arrangements. The ATO has recently updated its guidance on this topic, addressing how payments under software agreements are treated for tax purposes.

In Draft Taxation Ruling TR 2024/D1, the ATO adopts a “rights-based approach” to classify software-related payments. The ruling clarifies that payments are considered royalties if they grant rights to:

- reproduce, modify, or distribute software;

- use software in a way that involves access to intellectual property rights.

Conversely, payments for a simple end-user license that allows the purchaser to use the software without additional rights to reproduction or modification may not be classified as royalties. The distinction lies in the specific rights granted and the nature of the transaction. Hence, seeking professional advice before entering such arrangements would be essential.

Digital and Cloud-Based Transactions

Modern software distribution methods, such as digital downloads and cloud-based services, have added further layers of complexity to royalty classification. Under TR 2024/D1, the ATO considers whether payments for these services involve granting rights to use or access intellectual property.

However, if the arrangement includes rights to replicate or adapt the software, the payments may be treated as royalties. As a business, it is essential to seek professional advice by carefully reviewing the terms of your software agreements to identify the rights being granted. This will assist with determining whether the payments fall within the scope of royalties and, consequently, whether withholding tax applies.

Compliance with Withholding Tax Obligations

Compliance with withholding tax obligations is crucial if your business makes payments classified as royalties to non-residents. Here are key steps to ensure compliance:

- Assess the Nature of Payments: review the terms of your agreements to determine whether the payments qualify as royalties. Consider consulting with LegalVision’s tax team, as the classification may be unclear.

- Determine Withholding Tax Rates: check the standard withholding tax rate of 30% and verify with a tax professional on whether a reduced rate applies under a DTA with the recipient’s country of residence.

- Withhold and Remit Tax: deduct the appropriate amount of withholding tax at the source and remit it to the ATO by the due date.

- Maintain Accurate Records: keep detailed records of payments, withholding amounts, and any correspondence regarding tax treaty relief. These records are crucial for audit purposes.

- Monitor Regulatory Changes: stay informed about updates to ATO guidance and rulings, such as TR 2024/D1, including maintaining close communications with tax professionals, to ensure ongoing compliance.

Implications of Non-Compliance

Failing to meet your withholding tax obligations can have severe consequences for your business. These include financial penalties, interest charges, and reputational damage. Additionally, the ATO closely monitors royalty payments to non-residents and may scrutinise your arrangements if compliance issues are detected.

Key Takeaway

Understanding the concept of royalties and their tax implications is critical for businesses engaged in cross-border transactions. Payments classified as royalties often carry withholding tax obligations, particularly when made to non-residents.

With the evolving nature of software arrangements, businesses must pay close attention to the rights granted under their agreements to determine whether payments fall within the definition of royalty. By constantly communicating with tax professionals, you can mitigate risks and ensure your business remains compliant with Australian tax laws.

If you are uncertain about your legal obligations surrounding royalties, our experienced taxation lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

How are royalties taxed in Australia?

Royalties paid to non-residents are subject to a withholding tax rate of 30% unless a double-tax agreement (DTA) applies to reduce this rate. The payer must withhold and remit the tax to the Australian Taxation Office (ATO).

How does the ATO classify software-related royalty payments?

The ATO classifies payments related to software as royalties if they involve rights to reproduce, modify, or distribute the software. Payments for simple end-user licenses may not be considered royalties.

We appreciate your feedback – your submission has been successfully received.