The National Disability Insurance Scheme (NDIS) provides access to essential services and support for those with disabilities in Australia. As a service provider under the NDIS, you may nonetheless still experience payment issues. This can cause concerns for both you and participants in the scheme. This article will delve into the common payment problems faced by NDIS providers and explore effective solutions to address these challenges.

What is an NDIS Agreement?

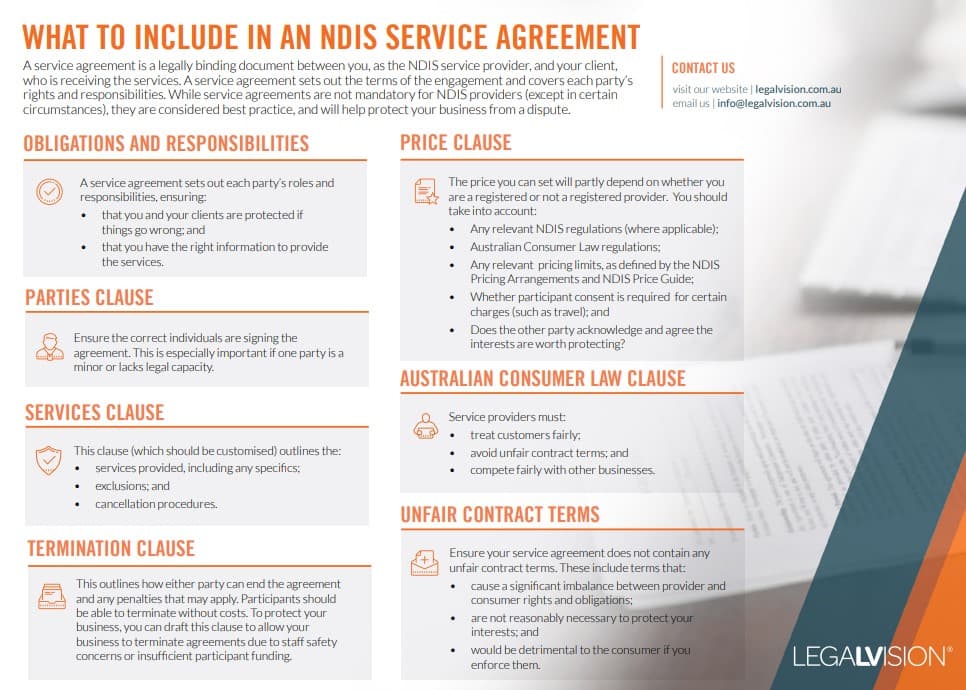

Before diving into the complexities of NDIS payment issues, you must address the client service agreement. This should set out the payment terms as well as your and the client’s rights and obligations. When dealing with payment issues, the first step is always to review the client service agreement.

This fact sheet will help you to identify the key terms you must include in your NDIS service agreement.

Who Signed the Client Agreement?

One key element to consider is who signed the client agreement. The person who signed the legal agreement is the person who may be liable for any costs incurred. For example, the agreement may have been signed by the NSW Office of the Public Guardian (OPG). It is important to note that each state and territory has its own version of the OPG under varying titles. In this case, it would be challenging to recover any money, and you ultimately will not be able to commence any proceedings against the OPG. However, if an individual participant signed the agreement, and there is a clause stating that they are liable for all costs incurred, you may be able to recover funds directly from them.

Despite being likely able to recover from an individual, you should consider whether this is an appropriate course of action to take. Usually, it is not preferred or commercially viable, as most participants are vulnerable people with few or no assets.

Continue reading this article below the formWas there a Plan Manager or Support Coordinator?

Additionally, it is crucial to determine whether there was a plan manager or support coordinator involved in the participant’s NDIS plan. It is best practice to obtain the participant’s consent to liaise with the plan manager and/or support coordinator. This allows you to ensure there is funding available for the services the participant has booked.

If there has been an overspend, the plan manager may submit a manual claim which the National Disability Insurance Agency (NDIA) will assess.

Is the Participant NDIA-Managed?

For NDIA-managed participants, payment issues should be rare. You can log into the portal to monitor available funds and create service bookings accordingly. However, situations may arise when participants are:

- underfunded;

- high-risk; and

- unable to have service stopped without breaching the code of conduct.

In such cases, you should promptly contact the NDIA to seek approval to continue services. If a support coordinator is involved, they should also be informed. You should also promptly lodge an unscheduled review of the participant’s plan. This is also called a section 48 or s48 review.

How Can I Recover Payment From the NDIA?

For non-payment issues where payment has been authorised or where services were continued due to a duty of care, you can lodge manual claims with the NDIA.

If you are dissatisfied with the outcome of any complaint lodged, you can seek assistance from the Commonwealth Ombudsman.

What Are My Other Options?

Along with the above steps, you have other options to address payment issues you may wish to consider. These include;

- initiating private recovery actions against the participant or their nominee;

- selling the debt to debt collectors; and

- checking insurance policies to determine if they cover non-payment, which could take care of legal costs.

Most importantly, it is always ideal to avoid payment issues in the first place, and you must have steps in place to mitigate them. This includes understanding the participant’s plan and required support, as well as having a clear service agreement in place. There may also be ancillary or additional agreements that should be in place, depending on the particular supports being provided. For these reasons, it is important to enlist lawyers who have a detailed understanding of the NDIS regime and legal framework. They can assist with the drafting of your agreements.

Key Takeaways

Navigating the complexities of NDIS requires careful documentation, clear communication, and a commitment to resolving disputes in the participant’s best interest. In particular, payment issues can pose significant challenges for both participants and you as an NDIS service provider. To address these challenges effectively, it is crucial to:

- understand the client agreement;

- identify responsible parties; and

- implement effective internal management strategies to minimise the risk of non-payment.

By adhering to the outlined solutions and taking the necessary actions, participants, providers, and the NDIS can work together to ensure a smoother payment process and better support for those in need.

If you would like assistance with NDIS debt recovery, contact our experienced debt recovery lawyers as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.