A company structure is a great way of running your business as it offers a high level of legal protection. However, you may be at a stage where your business owns a large amount of intellectual property and other important assets, is beginning to seek investment opportunities, or expanding its operations into different business units. If this is the case, moving your business to a dual company structure may be appropriate. This article outlines the dual company structure, why it could make sense for your business, and how to transition from a single to dual company structure.

What is a Dual Company Structure?

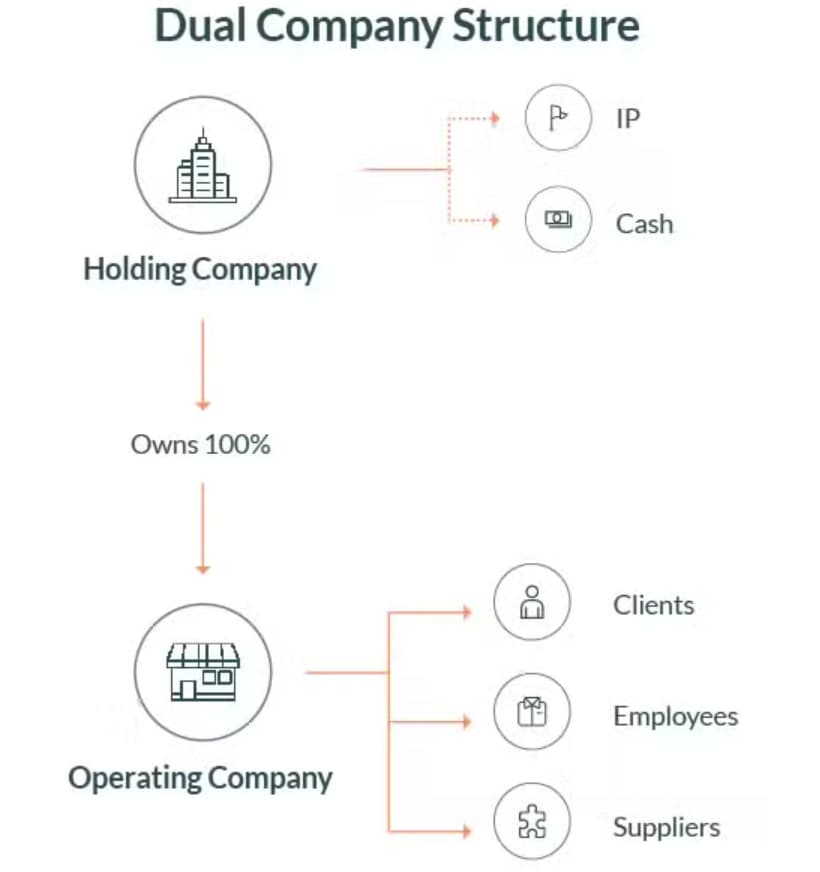

A dual company structure involves:

- a holding company, where the shares are owned by the founders/investors; and

- one or more operating companies, where the shares are 100% owned by the holding company.

As the names suggest, the holding company’s sole responsibility is to hold all of the business’ important assets, such as:

- intellectual property;

- stock;

- machinery; and

- any cash from investment.

On the other hand, the operating company enters into contractual arrangements with customers, employees, suppliers and other parties.

What are the Benefits of a Dual Company Structure?

Asset Protection

One of the key advantages of a dual company structure is asset protection. Since the holding company is the legal owner of key assets, those assets would be protected from legal claims, such as third-party claims made by suppliers or customers.

Investment Opportunities

Whilst not strictly necessary for taking on investors, a lot of sophisticated investors like to see that the business they are putting money into is run through a dual company structure, and much of this has to do with the above benefits of asset protection.

Continue reading this article below the formCall 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Steps to Change From a Single to Dual Company Structure

Restructuring from a single to a dual company structure can be lengthy and heavily hinges on tax advice. We recommend chatting with your accountant or tax advisor as a first step. Restructuring will usually attract capital gains tax consequences, but there may be ‘CGT roll-over relief’ available to you.

Broadly speaking, there are two ways of performing this restructure.

1. Restructuring Up

Restructuring up involves placing a new holding company above the existing company. This is a better option from an asset protection perspective, as the new holding company will be ‘clean’ (i.e. free from any historical claims).

Depending if you are relying on a particular form of CGT roll-over relief, the steps that are broadly involved are as follows:

- incorporate the new holding company, usually with the exact same shareholding as the existing company;

- transfer the shares in the existing company to the new holding company to ensure the existing company is now wholly owned by the holding company. This may need to be the subject of a share sale agreement;

- obtain any third-party consent to the change of control in the existing company. For example, you may need to review leases or key supplier contracts; and

- assign all intellectual property owned by the existing company to the new holding company. This would be subject to an IP licence and assignment agreement.

2. Restructuring Down

Restructuring down involves using your existing company as the holding company and incorporating a new operating company. Consequently, your existing company will wholly own the new one. Whilst this option is more straightforward to complete, it carries more risk. For example, the existing company could have existing claims or be exposed to potential claims (from an employee, supplier, client or government). As such, you would be exposing key assets that it holds (as a holding company) to risk. However, the risk may be low if the existing company is relatively new and has not begun trading.

Depending on tax advice, the steps involved in restructuring down are as follows:

- incorporate a new operating company that is wholly owned by the existing company;

- transfer certain business assets to the new operating company, like supplier contracts, employee contracts, leases, and other business assets (excluding IP). This would be subject to an asset sale agreement; and

- enter into an IP agreement between the holding company and the operating company.

After proving your startup’s success in your home country, you may be thinking about the next step for growth — expanding overseas.

This free guide aims to introduce startup founders to the Australian startup market.

Key Takeaways

A dual company structure is a more sophisticated business structure that offers a higher level of protection and is more attractive to investors. Restructuring from a single to dual company structure is an involved process that hinges heavily on tax advice.

For more information about your business or corporate structure or how to move to a dual company structure, our experienced business lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

A dual company structure is where you incorporate two companies. A holding company would own the business’ key assets, and an operating company would enter into all operational contracts (e.g. supply agreements, employment agreements, etc.). The holding company would wholly own the operating company and they would be separate legal entities.

There are several benefits to a dual company structure, including asset protection and investment opportunities. A dual company structure adds a further layer of protection between a business’s operations and its assets, and investors tend to find that structure more attractive.

We appreciate your feedback – your submission has been successfully received.