It is quite common for individuals working for registered NDIS service providers to be engaged as sole traders. However, you may ask, what are the legal requirements for this arrangement? It is essential that, as an NDIS provider, you are compliant with your legal obligations. Particularly, you must appropriately classify your workers as employees or contractors. Employees and contractors are distinctly different legal concepts. To this end, you will notice an employee’s entitlements vary significantly compared to that of a contractor. There can also be severe financial penalties for companies and any individuals who knowingly or recklessly misclassify workers as contractors. As such, you must ensure that your classification of your workers is legally sound. This article will explain whether you can use sole traders to provide services to your NDIS clients.

Should My Workers Be Employees or Contractors?

NDIS-registered providers such as yourself may engage contractors. Further, you may have them work for your business in a sole trader capacity. However, you must understand if your workers have the correct legal classification. This classification is important as it will determine whether you are paying your workers correctly.

Factors Determining if a Worker is an Employee or Contractor

The court’s first step when determining if your workers are employees or contractors is to look at their employment agreement with you. As it currently stands, when determining whether a worker is an employee or contractor, the courts will look to the terms of the written agreement between the parties in light of a multifactorial test. The courts will specifically look at the following factors as it pertains to the written contract:

Table of Recognised Factors

| Employee | Contractor | |

| Hours of Work | Employees have set hours unless they are casual employees. | Contractors decide what hours they need to complete specific tasks, in agreement with the business. |

| Expectation of Work | Employees have an ongoing expectation of work except where they are casual employees | Contractors are typically engaged to complete a specific task or project. |

| Liability | Employees bear no financial risk or liability, given they are covered under their employer’s insurance. | Contractors should obtain their own insurance, as appropriate and will take responsibility for any poor work or injury. |

| Tools and Equipment | Tools and equipment are provided by the employer or reimbursed by the employer. | Contractors typically provide their own tools and equipment. |

| Degree of control over how work is performed | Employees work under the direction and control of their employer. They will be required to comply with company policies. | Contractors have control over the way in which their work is completed. |

| Ability to subcontract and delegate | Employees cannot subcontract another individual to perform their role. | Contractors typically can subcontract work to another individual to complete specific tasks. |

Summary

As such, your workers are likely contractors if:

- Your employment contract with your worker states they are still running their own business and hold the relevant qualifications.

- Your company has little right to exercise control over the way and times your worker performs their work.

- You contract the worker to only perform specific tasks.

- Your worker has the ability to subcontract out the work.

Provided your commercial relationship with your worker meets these criteria, your worker is likely a contractor. Additionally, your worker should be able to provide similar services to other companies. This factor is quite decisive in determining whether your worker is an employee or contractor.

However, there are some proposed changes to the Fair Work Act (the Act), described below, that may amend this position by looking at the above factors in relation to the totality of the relationship instead of purely the terms of the written agreement. This will create a stricter test, and therefore, NDIS registered service providers should be increasingly careful when deciding to engage workers as sole traders.

Impacts of Classifying a Worker as an Employee

If your worker is an employee, the individual will receive certain entitlements under the Act. To this end, your workers will also benefit from any modern award or enterprise agreement that applies to them. This classification will also determine if any PAYG withholding needs to apply to payments made to the individual. Similarly, this classification will also determine whether any payroll tax will be payable on your worker’s taxable wages.

Ultimately, it can be difficult to determine the appropriate classification of workers and engaging lawyers to assist can often be very helpful.

What Are the Risks of Misclassification?

Where an individual is mistakenly misclassified as a contractor, they may sue the company for backpay of all unpaid employee entitlements. Contractors do not receive a minimum wage or leave entitlements. As such, your company may be liable for back payment of these entitlements. This will depend on what you have paid your workers to date.

Further, where employers and any individuals within the company are found to have knowingly or recklessly misclassified the employee as a contractor, the courts may apply financial penalties. Currently, the maximum financial penalty that may be applied under the Act is $18,780 for individuals and $93,900 for corporations.

Continue reading this article below the formProposed Amendments to the Act

The proposed amendments to the Act will attempt to create a stricter test when determining whether a worker should be engaged as a contractor or employee. Courts would continue to consider the factors outlined above, however, instead of exclusively looking to the terms of the written agreement, they will look to the totality of the practical arrangement between the parties. These proposed changes are intended to disincentivise companies from engaging individuals as contractors under carefully drafted, compliant contracts when the relationship is practically an employment relationship. This means that NDIS-registered service providers must ensure that the workers are qualified individuals who are functionally running their own businesses, and the company practically exercises very little control over their practices.

How Do I Protect My Business?

Currently, the best way to protect your business is to have a written agreement in place that accurately represents a contractor arrangement. However, as above, the proposed amendments to the Act will mean that simply having a compliant written agreement in place will not satisfy the company’s obligations. Instead, the company will need to ensure that the entire relationship reflects a contractor arrangement. This will include the company considering the following factors before engaging an individual as a contractor:

- Does the sole trader have an ABN?

- Is the worker experienced and qualified to perform the services?

- Is there an exclusive relationship between the individual and the company?

- Are there any required hours of work?

- What degree of control does the contractor have over the way in which work is performed?

- Does the individual have appropriate insurance coverage?

- Is the individual providing their own tools and equipment?

Going forward, it will be best practice for NDIS providers to engage lawyers for assistance in making this determination under the stricter test.

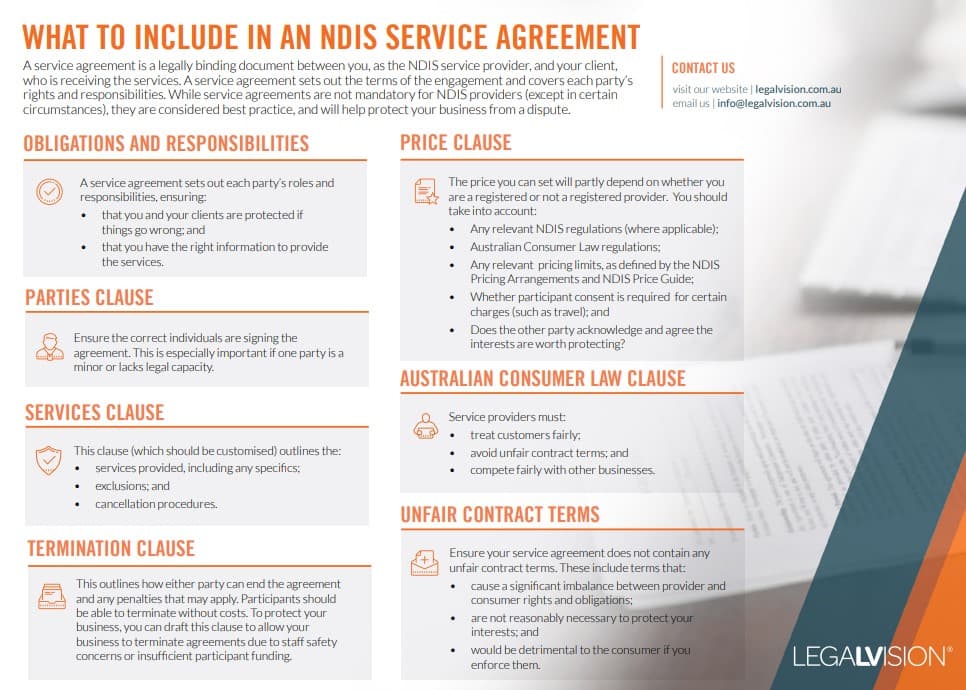

This fact sheet will help you to identify the key terms you must include in your NDIS service agreement.

Key Takeaways

Sole traders can provide fantastic services for your NDIS participants. Deciding whether or not you can engage a worker as a sole trader depends on whether your business forms the view that this individual is an employee or contractor at law. Currently, you should consider the factors outlined above in light of the terms of the written agreement between your company and the sole trader when making this determination. It will also be beneficial to engage a lawyer prior to commencing the engagement to draft an agreement that is compliant with the current legal position. Going forward, you will need to tread carefully when engaging sole traders and ensure that they are not functionally acting as employees of the business.

If you require any assistance with making this determination, contact our experienced NDIS lawyers as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.