In Short

- Unapproved therapeutic goods are products not listed on the Australian Register of Therapeutic Goods (ARTG) and are generally prohibited from import and sale in Australia.

- The Therapeutic Goods Administration (TGA) provides specific pathways to legally import and supply these goods, including the Special Access Scheme (SAS), Authorised Prescriber (AP) Scheme, and Clinical Trials.

- Strict adherence to TGA regulations is essential. Non-compliance can lead to significant penalties, including fines and legal action.

Tips for Businesses

Before importing or selling unapproved therapeutic goods, ensure you understand the TGA’s regulatory pathways and requirements. Consult with legal professionals to navigate the complexities and maintain compliance. Regularly review TGA updates to stay informed about any changes in regulations.

The Therapeutic Goods Administration (TGA) regulates the importation and supply of therapeutic goods in Australia. While most therapeutic goods must be included in the Australian Register of Therapeutic Goods (ARTG) before they can be legally imported or sold, certain circumstances allow unapproved therapeutic goods to be brought into the country and supplied to patients. This article outlines the key legal considerations for businesses and healthcare professionals dealing with unapproved therapeutic goods in Australia.

Unapproved Therapeutic Goods

Unapproved therapeutic goods do not appear in the ARTG. These may include medicines, medical devices, or biologicals that have not yet undergone the TGA’s evaluation process for quality, safety, and efficacy. While generally prohibited, specific pathways allow the legal importation and supply of unapproved therapeutic goods in Australia.

Pathways for Importing Unapproved Therapeutic Goods

Special Access Scheme (SAS)

The SAS allows healthcare practitioners to access unapproved therapeutic goods for individual patients under certain circumstances. There are three categories within the SAS:

- Category A: for patients who are seriously ill and likely to die without treatment;

- Category B: requires TGA approval before supply; and

- Category C: for goods deemed to have an established history of use.

Authorised Prescriber (AP) Scheme

Under this scheme, medical practitioners can obtain permission to prescribe a specified unapproved therapeutic good (or class of unapproved therapeutic goods) to specific patients for a particular medical condition.

Clinical Trials

Unapproved therapeutic goods can be imported for use in properly conducted clinical trials via the:

- Clinical Trial Notification (CTN) scheme; and

- Clinical Trial Approval (CTA) scheme.

Personal Importation Scheme

Individuals can import limited 3-month quantities of unapproved therapeutic goods for personal or family use, subject to certain restrictions, as set out by the TGA here.

Continue reading this article below the formLegal Requirements for Sponsors

As a “sponsor” importing or supplying unapproved therapeutic goods under TGA regulations, you must fulfil several legal obligations:

- Record Keeping: Maintain detailed records of the source and delivery of unapproved therapeutic goods;

- Verification of Prescriber Compliance: Verify that prescribers have met all necessary requirements before releasing unapproved therapeutic goods;

- Reporting Requirements: Submit six-monthly reports to the TGA detailing the quantities of unapproved therapeutic goods supplied under the SAS and AP schemes. Report any suspected adverse events or product defects within 15 days of becoming aware of them;

- Advertising Restrictions: Unapproved therapeutic goods cannot be advertised to the general public but may be advertised to health professionals. Strict advertising requirements will apply to any advertisement of unapproved therapeutic goods, even where the audience are health professionals. For more information on advertising regulations to health professionals see here;

- State and Territory Compliance: Comply with state and territory regulations regarding the storage, handling, and use of scheduled medicines; and

- Special Considerations for Medicinal Cannabis: In addition to meeting the TGA requirements, sponsors of medicinal cannabis need to ensure that they hold all appropriate licenses and permits from the Office of Drug Control and relevant state authorities.

Compliance and Penalties

The TGA can impose significant penalties, including fines and criminal charges, for failure to comply with regulations. Sponsors must stay informed about their legal obligations and maintain strict compliance practices.

While pathways exist to import and supply unapproved therapeutic goods in Australia, sponsors must navigate a complex and highly regulated legal landscape. They must diligently understand and meet their obligations under TGA regulations, state and territory laws, and other relevant legislation. Given the potential consequences of non-compliance and the intricacies of the regulatory framework, anyone involved in this specialised area of healthcare provision should seek professional legal advice.

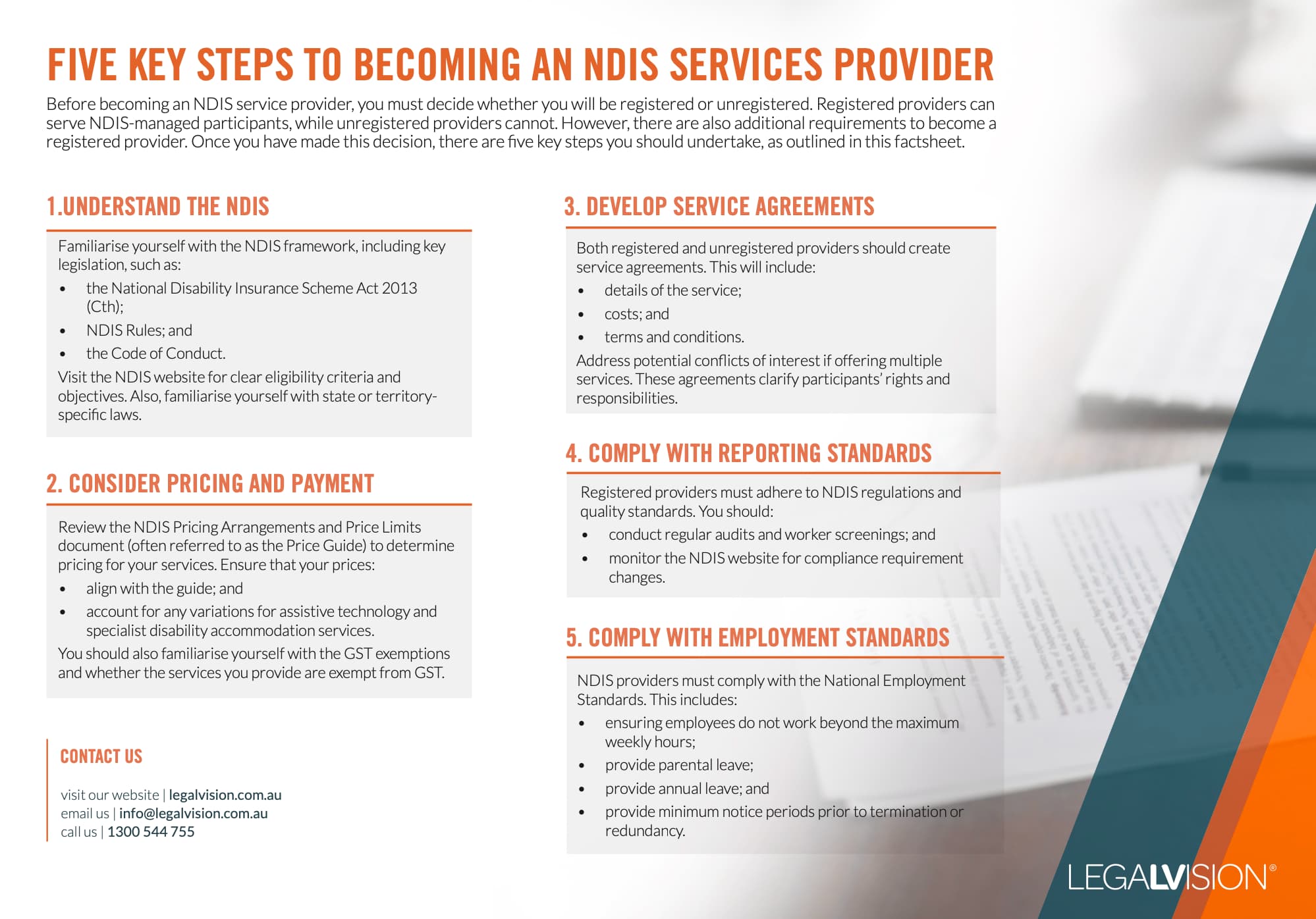

Understand five key steps you should know to become an NDIS service provider with this free LegalVision factsheet.

Key Takeaways

Unapproved therapeutic goods can be legally imported through specific pathways like the Special Access Scheme and Authorised Prescriber Scheme. Sponsors must fulfil strict legal obligations, including record-keeping, reporting, and advertising restrictions for unapproved therapeutic goods. Non-compliance with TGA regulations can result in severe penalties, emphasising the need for expert legal guidance in this complex area.

If you need help with importing or selling therapeutic goods, our experienced healthcare lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Medicinal cannabis has unique requirements under the Special Access Scheme (SAS). Category B supply allows medical practitioners to access medicinal cannabis products not included on the register of therapeutic goods for a single patient. The medical practitioner must import the product on a patient-by-patient basis. They will need a specific permit from the Office of Drug Control for each import. Sponsors are responsible for verifying that the prescriber of the product has met specific requirements before supplying the product.

While you cannot advertise unapproved therapeutic goods to the public at all, the rules for advertising to healthcare professionals are a bit different. You can provide information to healthcare professionals, but there are strict limitations. Any communication must be factual, balanced, and not promotional in nature. You can inform them about the product’s availability and how to access it through the appropriate schemes, but you cannot make claims about its efficacy or encourage its use over approved alternatives.

The TGA takes non-compliance very seriously, and penalties can be severe. For individuals, fines can reach up to 5,000 penalty units (currently over $1 million), while corporations may face fines of up to 50,000 penalty units (over $10 million). In some cases, non-compliance can even result in criminal charges and potential imprisonment.

We appreciate your feedback – your submission has been successfully received.