On this page

As a business owner, you want to keep your employees engaged and incentivised. That is a great aspiration, but what if you are not hugely profitable? If you are a startup, you might not have enough cash to pay and retain top talent. A great cash-free way to incentivise your employees is to give them ownership in your company. One way you can do this is through an employee share option plan (ESOP). This article covers five points you should consider when implementing an ESOP.

What is an ESOP?

An Employee Share Option Plan is a scheme where you can offer your employees or contractors options in your company. An option gives the holder, for example, the employee, the right to acquire shares in your company. Options can be hugely valuable to the option holder, especially if you expect your company value to increase over time.

So what do you need to consider when implementing an ESOP?

1. Do You Satisfy the Startup Tax Concessions?

If you are an Australian startup company, your employees may qualify for certain tax concessions under your ESOP. The criteria include:

- that your company has been incorporated for less than ten years;

- the persons you are offering options to are employees, director or contractors engaged by your company; and

- the persons you are offering options to do not own more than 10% of the company.

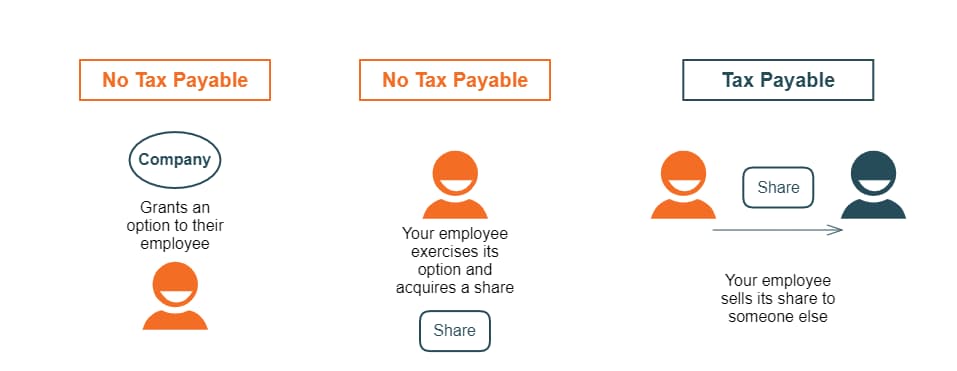

If you satisfy these and other criteria, your employees may qualify for certain tax concessions. This means that your employees will not pay any tax when you grant them the option, or when they exercise the option. They will only pay tax when they sell their shares (if they have converted their options) or options.

Call 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

2. How Big Should My ESOP Pool Be?

You will need to get your shareholders to give their approval before issuing options under your ESOP. It is more efficient if you get your shareholders to pre-approve issuing options under your ESOP up to a certain amount. This is a better alternative to going back to your shareholders every time you issue new options. This pre-approved amount will be your “ESOP pool”. Your shareholders agreement usually contains the pre-approval.

For example, company ABC might have 100 shares on issue. Its shareholders approve an ESOP pool of up 10% of the company’s share capital from time to time. Therefore, you can issue up to 10 options under your ESOP.

3. What Should the Exercise Price Be?

You need to choose the exercise price for your options. This is the price your employees must pay to exercise their option, that is, convert it into a share. Your company’s value will determine this price. If you satisfy certain criteria, you may be able to use one of the proscribed safe-harbour valuation methodologies for valuing your company for your ESOP.

The most commonly used valuation method is the net tangible assets test. Most startups do not have many tangible assets. Therefore this valuation method often produces a low company value. Here is an example:

Company XYZ has 1,000 ordinary shares on issue. It has no preference shares on issue and has $5,000 cash in the bank – $5,000 worth of laptops and no other tangible assets.

- Company XYZ’s net tangible assets = $10,000 ($5,000 + $5,000)

- Your share price based on this value = $10 ($10,000/1,000)

Therefore, the exercise price for an option issued under your ESOP must be at least $10.

4. Should My Employees’ Options Be Subject to Vesting?

You need to decide whether the options you issue under your ESOP should be subject to vesting. If options are subject to vesting, they will be unvested when they are issued. However, they will “vest” based on an agreed timeline or criteria (vesting schedule). While an option is unvested, the holder cannot sell its unvested options. Further, if the holder leaves or stops working for the company (other than temporarily), it must usually surrender its unvested options for nothing.

5. When Should My Employees Be Able to Exercise Their Options?

You need to decide when an option holder can exercise its options. The two most common alternatives for when an option holder can exercise its options are:

- when they vest; or

- when an exit event occurs. For example, the company lists on a stock exchange, or a third party buys the company.

If you let your employees exercise their options when they vest, then depending on their vesting schedule, you could be giving your employees or contractors the right to become shareholders quite soon. This might not be the ideal outcome, as you will need to involve them in all the decisions requiring shareholder approval.

Usually, it will be preferable only to allow your employees to exercise their options when an exit event occurs. Typically this is still attractive to your employees because they will only want to sell their shares as part of an exit event in any case. It is at this point when the company jumps up in value, and employees will get a great price for their shares.

Remember that employees only have to pay the exercise price you set when you initially issued the options to exercise them. However, they can sell their shares straight away on the stock exchange or to a third party at the new (hopefully) immensely higher price.

LegalVision’s Employee Share Schemes Guide is a comprehensive handbook for any startup founder or business owner looking to attract and motivate top employees with an Employee Share Scheme.

Key Takeaways

Before deciding to implement an ESOP, you should consider:

- if your company qualifies for the startup tax concessions;

- how big your ESOP pool should be;

- what the exercise price of each option will be;

- if the options should be subject to vesting; and

- when employees can exercise their options?

If you have any questions about putting in place an ESOP, contact LegalVision’s business lawyers on 1300 544 755 or fill out the form on this page.

Frequently Asked Questions

Yes definitely. An ESOP is a great way to incentivise your employees, particularly if you do not have enough cash to attract top talent. Note that you still have to meet your employment law requirements, including minimum wage requirements.

Under an ESOP that qualifies for the startup tax concessions, you can only offer options to people that hold less than 10% of the company. Most founders will own more than 10% and, therefore, cannot issue themselves with options under the ESOP.

Yes, you can also offer options to contractors or directors engaged by the company.

You can still put in place an ESOP. It just means your employees will be taxed differently (potentially at earlier points in time), and your disclosure requirements may be different.

We appreciate your feedback – your submission has been successfully received.