Employing foreign workers may be necessary to address labour shortages and skills gaps within your business. As an employer, you should conduct appropriate checks to ensure that the foreign worker has the appropriate working rights to commence employment at your business. You will have additional obligations if you are also a standard business sponsor. This article will outline your obligations as an employer and an approved business sponsor concerning hiring foreign workers.

1. Check the Applicant’s Right to Work in Australia

It is your responsibility as an employer to make sure that your foreign workers have legal working rights in Australia that match your business requirements. This applies even if you have engaged the employees from a labour-hire working arrangement. Australian citizens, permanent residents and New Zealand citizens have full working rights in Australia. However, everyone else requires a visa, and only some visas allow for working rights.

You can check your employee’s visa type and what conditions apply to them via the VEVO feature on your immigration account. In addition, you can ask them to provide you with their visa details.

You should conduct checks:

- before commencing work;

- within two days of visa expiry; and

- each time there is a material change in the employee’s circumstances.

However, it is recommended that you check these requirements every three months or develop a system where you conduct frequent monitoring. Additionally, if you knowingly employ illegal workers, it can result in penalties against your business. Depending on the type of sanction, a maximum penalty of up to $315,000 may apply.

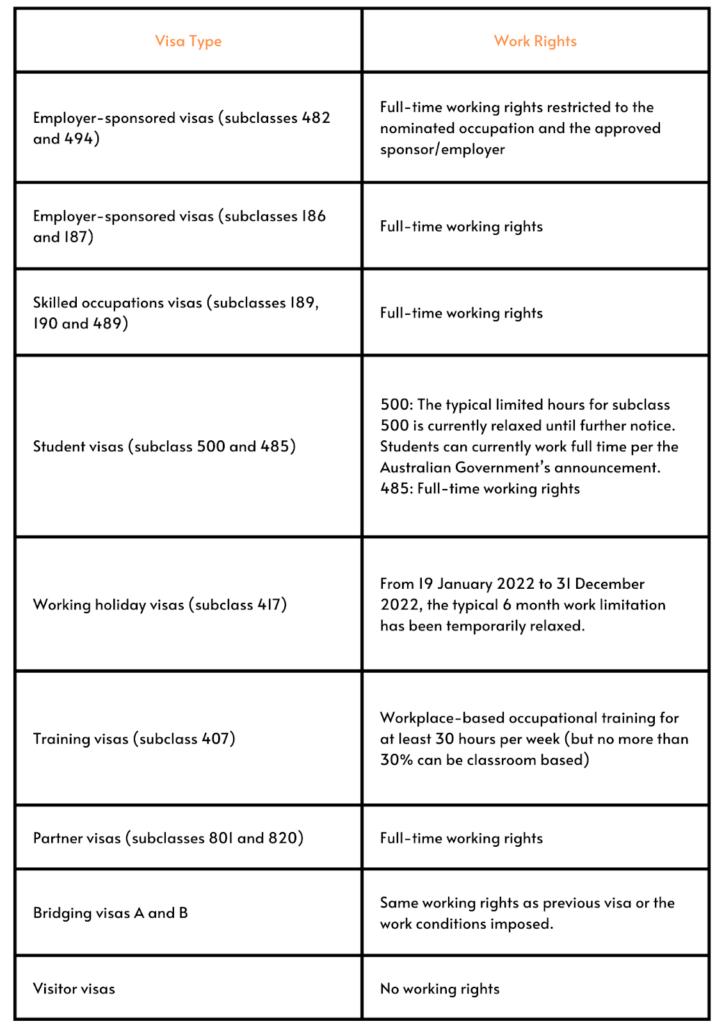

Types of Visas

Below is a list of the main types of visas and their working rights in Australia:

2. Comply with National Employment Standards

In addition to complying with immigration laws, you must also comply with the National Employment Standards (NES). This applies to all employees working in Australia regardless of their immigration status.

Continue reading this article below the formCall 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

3. Sponsorship Obligations

Once you become an approved business sponsor and can hire foreign workers, there are several obligations you must satisfy. These obligations start when your sponsorship is approved and generally finish two to five years after the sponsorship ends. It applies to all sponsoring businesses.

Cooperate With Inspectors

Generally, an inspector may:

- enter your business premises;

- inspect any work or process;

- interview people;

- inspect and make copies of documents; and

- seek information about a person’s name and address if they believe a breach has occurred.

Equivalent Terms and Conditions of Employment

As an employer, you must ensure that your foreign employees are on the same employment terms and conditions as your Australian workers.

The Department will consider circumstances where foreign employees are in a ‘less favourable’ or ‘more favourable’ position than an Australian worker in the same or similar role. Consequently, this will also affect the success of the visa application.

Keep Records

As an approved business sponsor, you must keep records of any relevant information relating to the sponsorship of a foreign worker. This includes:

- any correspondence with the Department of Home Affairs; and

- employment records for sponsored employees.

Readily Provide Information

In some circumstances, you may need to provide information concerning your foreign worker’s employment to the Australian Border Force (ABF).

If these circumstances arise, you must inform the Department within 28 days.

Ensure Sponsored Employee Works in the Nominated Position

You must ensure the employee works in the position, program or activity that you have nominated them for. The employee is not allowed to work for another business (unless it is an associated entity). You are also restricted from supplying them to work for another business unless a legitimate labour agreement exists.

Pay the Associated Costs

When employing foreign workers, you are responsible for covering the costs of recruiting, sponsoring, and nominating the foreign worker. You cannot transfer or recover any of these costs from the employee or their family.

Discrimination

You must not engage in any discriminatory recruitment practices.

Additional Obligations: SAF Levy

In addition, you will need to pay a government tax levy for workers you nominate under temporary and permanent employer-sponsored visas. This is known as the Skilling Australian Funds (SAF) levy. The money raised will go into the Skilling Australians Fund (SAF), a new government initiative to grow the number of apprenticeships and traineeships in Australia.

This affects all nomination applications made under subclasses 482, 494, 186 and 187 from 12 August 2018 (as well as subclass 457 where applicable). Accordingly, the amount you pay depends on the annual turnover of your business which will be provided through your Australian tax return with your nomination application.

4. Consequences for Breach of Obligations

Unlawful Workers

If your employee becomes an unlawful worker, the government may request the payments from you if they are satisfied that you were aware that the employee has become unlawful or you were complicit or negligent. For example, this includes:

- costs for them and their family to leave Australia, including reasonable travel costs such as an economy flight and taxi costs to the airport; and

- costs incurred by the government to locate and remove any unlawful non-citizen workers.

Additionally, you may be liable to pay up to $10,000. The unlawful citizen will be liable for the excess.

Sponsoring overseas workers as an Australian business is complicated. Let us simplify it for you with this free employer guide.

Key Takeaways

Overall, there is more to sponsoring foreign workers than just obtaining the required visa. There is an ongoing obligation for you to make sure that you and your employees comply with immigration laws and National Employment Standards in Australia. As a sponsoring business, you must pay the Skilling Australians Fund (SAF) levy. Furthermore, you must also keep up-to-date on COVID-19 requirements.

If you need help employing a foreign worker, our experienced immigration lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

There are many obligations to fulfil once you become a sponsor, but these include ensuring your employees have legal working rights, paying the SAF levy, complying with the National Employment Standards, cooperating with inspections, providing information when requested and ensuring Covid-19 procedures are followed. The obligations generally end two to five years after the sponsorship ends.

The Skilling Australian Funds (SAF) levy is a government initiative to grow apprenticeships and traineeships in Australia. It must be paid for each employee you nominate under temporary and permanent employer-sponsored visas. The amount you pay will depend on your annual business turnover.

We appreciate your feedback – your submission has been successfully received.