In Short

- The Fair Work Commission (FWC) assesses unfair dismissal claims by determining if the dismissal was harsh, unjust or unreasonable.

- Factors considered include the presence of a valid reason related to the employee’s conduct or capacity, whether the employee was informed of this reason, and if they were given an opportunity to respond.

- The FWC also examines if the dismissal involved a genuine redundancy and if the employer adhered to consultation obligations.

Tips for Businesses

To minimise the risk of unfair dismissal claims, ensure that any termination is based on a valid reason related to the employee’s performance or conduct. Clearly communicate these reasons to the employee and provide them with an opportunity to respond. If redundancy is the reason for dismissal, confirm that it is genuine and that all consultation requirements have been met.

An unfair dismissal application can be made by an employee to the Fair Work Commission (FWC) in certain circumstances. Namely, to succeed in an unfair dismissal application, the person bringing the claim must show that:

- they were dismissed in a way that was harsh, unjust or unreasonable;

- there was no genuine redundancy; and

- they are not prevented from bringing a claim under the Fair Work Act 2009, including under the Small Business Dismissal Fair Code.

If these factors are met, the FWC may find that you unfairly dismissed your employee. Since a successful unfair dismissal application can result in your business becoming liable for a payout of up to $87,500 (as of January 2025), it is in your best interest to dismiss an employee in a lawful and fair manner. This article explains in detail the criteria for an unfair dismissal application.

What is Considered ‘Harsh, Unjust or Unreasonable’?

There is no clear-cut definition of what is ‘harsh, unjust or unreasonable’ in the Fair Work Act. For this reason, the FWC will look at a range of factors particular to the circumstances when determining if a dismissal was harsh, unjust or unreasonable. This includes whether you:

- had a valid reason for the dismissal based on your employee’s conduct or capacity to work;

- gave your employee notice of this reason;

- provided your employee with an opportunity to respond to the reason;

- allowed your employee to have a support person present at the discussions relating to the dismissal; and

- provided any warnings to your employee about their unsatisfactory performance.

What is Genuine Redundancy?

A redundancy is genuine if you no longer require an employee to perform their position due to changes in the operational requirements of your business. As long as you comply with your obligations and requirements under the law and in the employment agreement in relation to consulting with your employee about the redundancy, then the redundancy should be genuine.

Additional requirements include that you:

- must comply with any obligation in a modern award or enterprise agreement that applies to the employee, otherwise known as consultation obligations; and

- can only make the employee redundant if there is no possibility of redeploying them within your business or associated entities.

Who is Covered by Unfair Dismissal Laws?

Only an employee who is covered by the national workplace relations systems can apply for unfair dismissal to the FWC. In addition, your employee must meet the following three requirements. Ultimately, if your employee is eligible and believes they have been unfairly dismissed, they have 21 days following their dismissal to lodge a claim with the FWC.

1. Completed the Minimum Employment Period

Completing the minimum employment period is one of the first requirements for lodging an unfair dismissal claim. For small businesses, this means that an employee has completed at least one year of employment.

A small business is any business with less than 15 employees at the time of dismissal. Casual employees are not generally included unless they are regular and systematic casuals. It is important to seek legal advice if you are uncertain whether you qualify as a small business employer.

For any business that is not a small business, your employee must have completed at least six months of employment.

2. Covered By An Industrial Instrument

Your employee must have been covered by a modern award or enterprise agreement at the time of the dismissal. You can find out if your employee is covered by an award by using the FWC’s search portal or by getting in touch with an employment lawyer.

3. Earn Less Than The High-Income Threshold

Your employee must have earned less than the maximum high-income threshold at the time of the dismissal. From 1 July 2024, this was $175,000. However, you should note that the threshold is subject to change each financial year.

As an employer, you should also be aware that employees may still be protected from unfair dismissal if they earn above the high-income threshold but are otherwise covered by a modern award or enterprise agreement.

What Is The Small Business Dismissal Code?

If you are a small business owner with less than 15 employees, you should familiarise yourself with the Small Business Fair Dismissal Code (the Code). If you dismiss an employee per the procedures in the Code, you can raise an objection to the employee’s unfair dismissal claim. The FWC will be tasked with determining whether you have met the Code if a claim is brought.

Under the Code, it is fair for a small business employer to dismiss an employee without notice or warning if the employer has reasonable grounds to believe that the employee’s conduct is sufficiently serious to justify immediate dismissal. Serious misconduct can include:

- theft;

- violence;

- fraud; and

- serious breaches of workplace health and safety procedures.

For the dismissal to be fair, it may be sufficient (although not essential) that you report an allegation of theft, fraud or violence to the police. You should base this report on reasonable grounds, meaning you conducted a thorough investigation into the instance of serious misconduct.

For dismissals for reasons other than serious misconduct, small business employers must have:

- warned the employee that they are at risk of dismissal and provided specific reasons for this; and

- given the employee an opportunity to fix the problem.

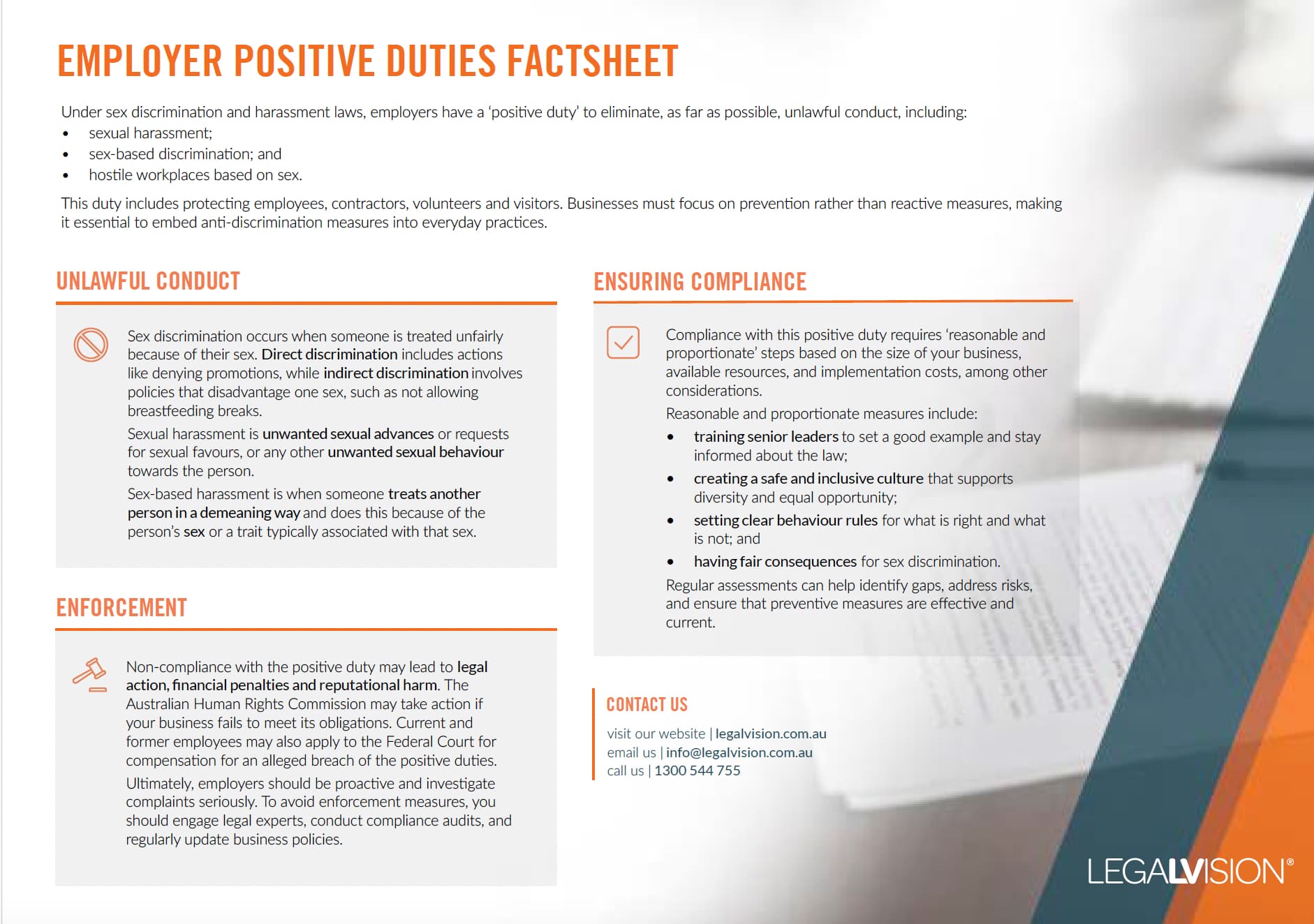

This fact sheet outlines employers’ ‘positive duty’ under sex discrimination laws, highlighting proactive measures to prevent unlawful conduct.

Remedies for Unfair Dismissal

The Fair Work Commission may order remedies for unfair dismissal if it is determined that the employee was protected from unfair dismissal at the time of being dismissed and had been unfairly dismissed. Such remedies may include:

- reinstatement for the employee; or

- payment of compensation for economic loss suffered.

As an employer, you should ensure that you are compliant with your legal obligations when dismissing an employee to avoid the employee making a successful claim for unfair dismissal. Implications for unfairly dismissing an employee can lead to financial penalties and payments, as well as reputational damage to your business.

Key Takeaways

The Fair Work Commission (FWC) will deem a dismissal unfair if the dismissal was:

- harsh, unjust or unreasonable;

- not a case of genuine redundancy; and

- in the instance where you are a small business with 15 or fewer employees, you failed to dismiss your employee according to the Small Business Fair Dismissal Code.

However, employees also need to meet certain criteria to bring a claim of unfair dismissal, including completing the minimum employment period and being covered by an industrial instrument. If your business is found liable for unfair dismissal, you may face harsh penalties, including payments to the employee.

If you are responding to an unfair dismissal application, our experienced employment lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Unfair dismissal is where you dismiss an employee in a manner that is ‘harsh, unjust or unreasonable.’

To be eligible to lodge a claim, an employee must:

+ have completed the minimum employment period, meaning they have worked in your business for at least 6 months, or 12 months (if you are a small business employer);

+ be covered by a modern award or an enterprise agreement; and

+ earn less than the maximum high-income threshold, which is $175,000 as at 1 July 2024.

We appreciate your feedback – your submission has been successfully received.