As a business owner, you are responsible for providing your employees with the relevant entitlements depending on their classification and type of work. Recently, the Fair Work Ombudsman has investigated multiple bug companies, such as Michael Hill and Shangri-La Hotels, for underpaying their employees. In general, a common mistake leading to underpayment is employers misunderstanding their obligations towards casual employees. This article will explain what a casual employee is and the entitlements you must provide them with to ensure that you are meeting your obligations at law.

What is the Definition of a Casual Employee?

The law states that a casual employee is an individual who accepts a job knowing there is no firm advance commitment to ongoing work with an agreed pattern of work. Factors to consider when determining whether there is an expectation of advance commitment include whether:

- you can offer the employee work, and they can then accept or reject the offer;

- you will offer work when the business needs employees;

- the employment relationship is described as casual; and

- you pay the employee casual loading.

If your employee’s work schedule is regular and systematic, a court may consider it as permanent rather than casual. This mistake opens the door for your employee to seek back pay for unpaid permanent employment entitlements. So, you must review and confirm that your casuals are, in fact, casual.

Typically casual employees have similar working arrangements. These include that they:

- have no guaranteed hours of work;

- work irregular hours on an ad-hoc basis;

- do not receive sick or annual leave; and

- can end their employment without notice.

Casual Loading

Currently, you must pay casual employees a 25% loading on top of their hourly rate. Casual loading compensates for entitlements like annual leave and paid sick leave that permanent employees receive. Therefore, it is essential that you expressly outline this in the employee’s casual employment agreement.

For example, if an employee’s ordinary wage is $20 an hour, they should receive $25 an hour with casual loading.

Continue reading this article below the formCasual Conversion

Many casuals work on a regular and systematic basis, even though there may not have been a firm advance commitment to ongoing work with an agreed pattern of work. Casual conversion is a pathway for casual employees to become permanent employees. It allows casuals to request they convert to part-time or full-time employment, given that they have worked regular casual shifts at your business for the past 12 months.

However, you can refuse the conversion request if they have consulted with the employee and there are reasonable grounds for refusal. For example, if the employee has not been working consistently or regularly over the past 12 months, you may be able to refuse the request.

You must provide the employee with their reasons for refusal in writing and within 21 days of the request. If an employee disagrees with this decision, they can apply to the Fair Work Commission.

Long-Term Casual Entitlements

If you have an employee who is a long-term casual employee, they do have some extra entitlements. Long-term casuals are casuals who have worked on a regular basis for 12 months. As mentioned above, they are entitled to request to convert their employment to permanent work. Additionally, if they have worked 7-10 years, they may be entitled to paid long service leave. They are also entitled to:

- two days of unpaid carer’s leave;

- two days of unpaid compassionate leave per occasion;

- ten days of paid family and domestic violence leave;

- unpaid community service leave.

What Do I Need To Include In A Casual Employment Agreement?

Although casual employees have no firm advance commitment to ongoing work with an agreed pattern of work, it is important you still ensure that your business is protected by a robust casual employment agreement. Casual employment agreements are generally more ‘light on’ than permanent employment agreements but still need to include key clauses, such as the type of employee and rate of pay.

1. Type of Employee

A casual employment agreement must clearly state that the employee is being employed

on a casual basis, with no firm advance commitment that the work will continue indefinitely at

an agreed pattern. It is important to make this clear from the outset and in writing to minimise the chance of a dispute arising about the true nature of the employment.

2. Rate of Pay

In order to avoid any disputes in the future, you should ensure that your employment

contracts include how much your employee will be paid. You must also ensure that your

employee is being paid the correct amount and is not underpaid. All employees are entitled

to the national minimum wage, but may also be covered by a modern award or enterprise agreement. If your employee is covered under a modern award or enterprise agreement, this

will set out their minimum entitlements, such as their minimum pay rates.

It is vital that you separately identify the 25% casual loading from the employee’s base rate of pay in a casual employment agreement. This minimises the risk of an employee arguing that they have not been paid 25% casual loading in their base hourly rate and, therefore, are entitled to an additional payment of 25% casual loading.

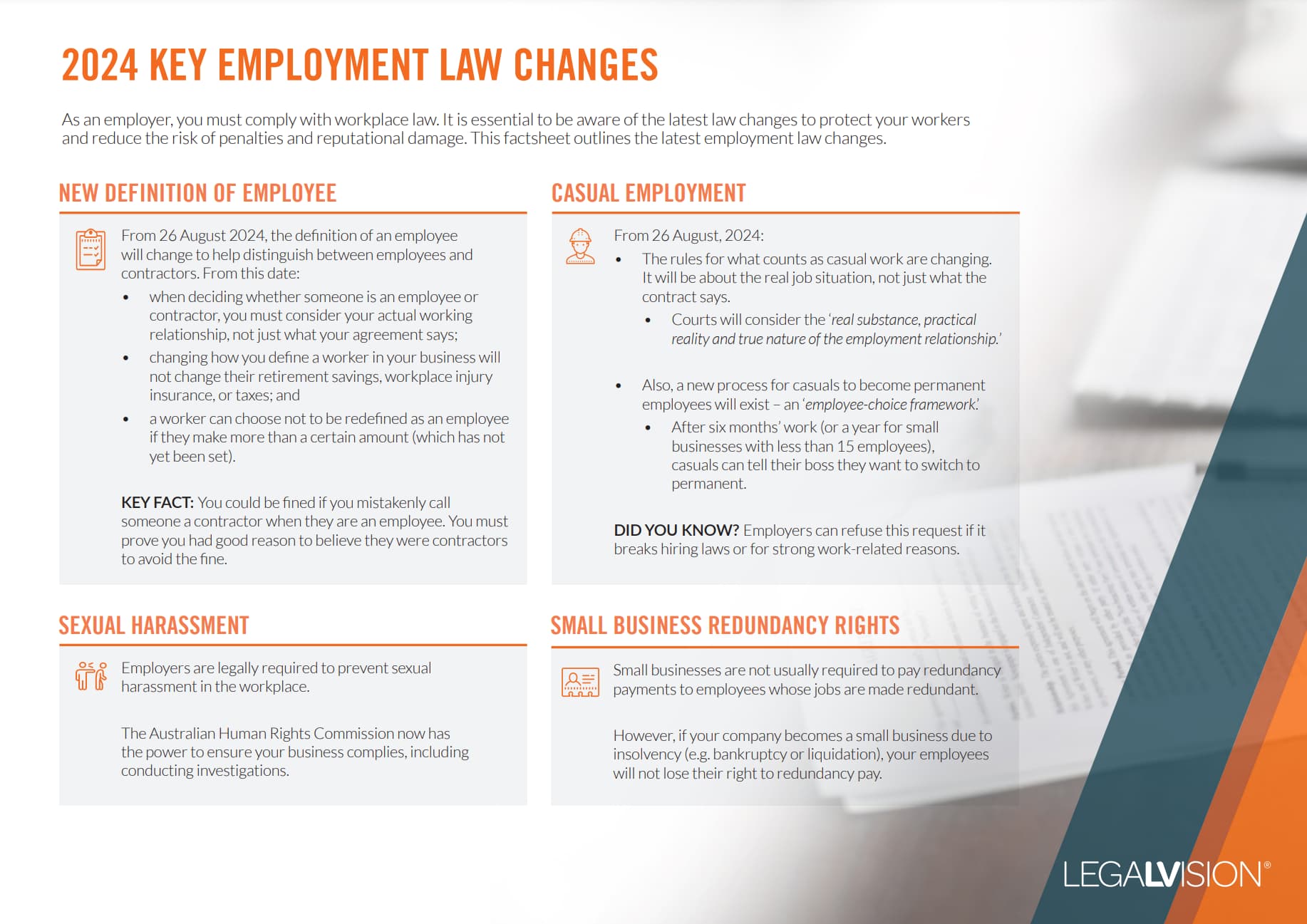

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

3. Confidential Information and Intellectual Property (IP)

A casual employment agreement should still include robust clauses that clearly state employee obligations around confidentiality, as well as clarify who owns any IP an employee may create during the course of their employment.

A confidentiality clause should clearly identify:

- what information is considered confidential;

- the obligations the employee has surrounding the confidential information; and

- that such obligations last after the employee’s engagement ends with your business.

Additionally, a robust IP clause should clearly assign all rights and ownership to your business.

Key Takeaways

It is essential to ensure you are correctly characterising your casual employees. You should have a casual employment agreement that clearly outlines their engagement. This contract must outline that they are casual and receive a casual loading. It is not enough just to rely on paying them the extra 25% casual loading and not be concerned about the practical aspect of how the employee is engaged. If you have any questions about ensuring that your casual employees are really casual, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.