As an employer, terminating your employees can be a complex but, at times, inevitable process. Termination marks the end of an employee’s employment. This can arise if:

- you dismiss an employee;

- you make their position redundant; or

- your employee chooses to resign.

This article outlines how you can lawfully terminate an employee and avoid a claim for unfair dismissal.

Risks Associated With Termination

You must take great care when terminating your employee’s employment. Federal workplace laws provide protections to employees in certain circumstances where their employment is terminated.

These laws allow an employee to commence proceedings against their former employer following the termination of their employment. There are two main areas in which employees may bring a claim against your business following a termination:

- General Protections Claim: an employee may commence proceedings for unlawful termination if their employment is terminated for a discriminatory reason; or

- Unfair Dismissal Claim: if an employer does not take care in terminating or dismissing an employee then the dismissal may be considered by the Fair Work Commission as unfair.

General Protections

General protections encompass a broad range of rights and protections afforded to employees. This includes protecting them in the event that you engage in adverse action against them for:

- their personal attributes;

- exercising workplace rights;

- engaging in industrial activities; or

- being part of a union.

One major risk associated with terminating employees under the Fair Work Act is the potential for claims of adverse action. Adverse action can include:

- dismissal;

- demotion; or

- any other form of unfavourable treatment towards an employee.

Employers must ensure that any termination decisions are not motivated by prohibited reasons such as an employee’s race, sex, age, or any other protected attribute. Discriminatory termination can lead to:

- costly legal proceedings;

- damage to your business’ reputation; and

- substantial compensation payments.

Unfair Dismissal

Unfair dismissal can arise when you dismiss an employee in a way that is harsh, unjust or unreasonable. Your employee can make an unfair dismissal claim if they:

- have worked in your business for at least 6 months or 12 months (for small businesses); and

- are covered by a modern award or enterprise agreement, or earn less than the maximum high-income threshold, which is $167,500 from 1 July 2023 onwards.

Process of Employment Termination

Generally, a dismissal will not be harsh, unjust or unreasonable where you:

- have a valid reason for the dismissal relating to the employee’s conduct;

- notify your employee of the reason for dismissal in accordance with the relevant award, enterprise agreement or employment contract;

- give your employee an opportunity to respond;

- provide one or more warnings about your employee’s unsatisfactory performance before being dismissed;

- provide your employee a chance to improve their performance; and

- ensure that the dismissal relates to your employee’s unsatisfactory performance.

You may also terminate an employee for serious misconduct. Some examples of this behaviour include:

- theft;

- violence;

- serious breach of company policy; or

- continual failure to follow lawful and reasonable directions.

Additional Considerations

As an employer, you should also take into account the following matters when terminating the employment of an employee:

Notice Requirements

Unless you are terminating employment for serious misconduct, you must provide your employee with notice of their termination. The length of the notice period will depend on the minimum periods set out in the relevant award, enterprise agreement, employment contract or the National Employment Standards (NES).

For example, the minimum notice periods in the NES are as follows:

| Period of Continuous Service | Minimum Notice Period |

| 1 year or less | 1 week |

| More than 1 year but less than 3 years | 2 weeks |

| More than 3 years but less than 5 years | 3 weeks |

| More than 5 years | 4 weeks |

You should note that if your employee is 45 years old and has completed at least two years of continuous service for your business, you must add an additional week to the notice period.

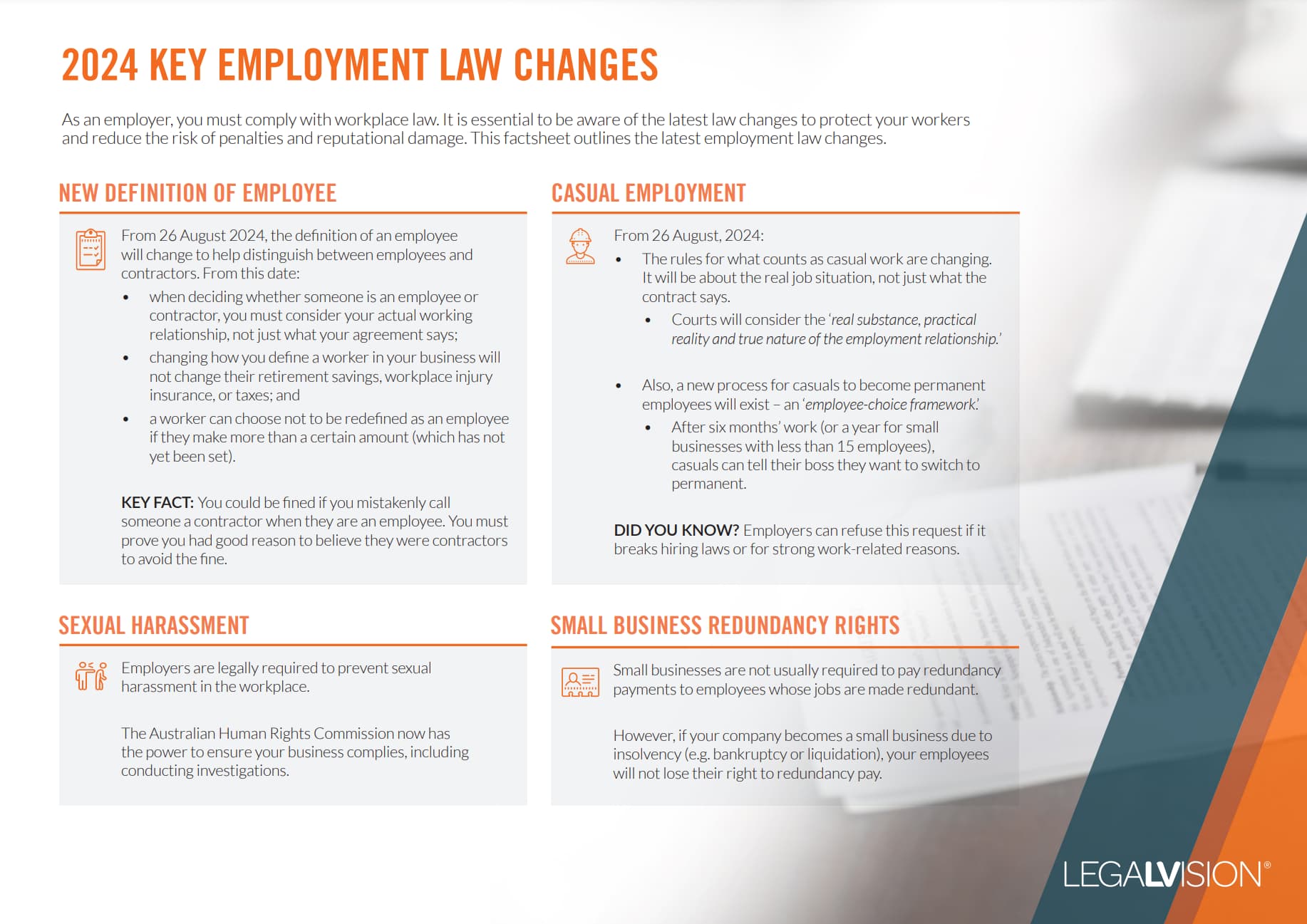

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Final Pay

Your employees are entitled to payment of their outstanding employee entitlements on termination of their employment. Final pay should include:

- wages;

- payment in lieu of notice (if any);

- accrued annual leave and long service leave entitlements; and

- severance pay entitlements (e.g. for redundancy).

The final payment should be made on the employee’s last day of work, wherever possible. However, some Awards stipulate that employers may pay an employee their final payment within 7 days of the employment ending. In addition, employment agreements may also specify when final pay must be paid.

Am I Entitled to Deduct or Withhold Any of the Final Pay?

You are only allowed to deduct wages from an amount owing to an employee if it is for the direct benefit of the employee. While there may be some incidents where you may be tempted to withhold an employee’s wages in incidents of property damage or theft, you should refrain from doing so in order to avoid unlawful conduct.

However, under some awards, if notice is not provided, you may have the ability to deduct or withhold up to one week’s worth of pay from your employees.

Key Takeaways

Before commencing the employment termination process, you should understand your obligations under the employee’s employment contract, award and at law. You must take care in terminating the employment of an employee in order to minimise the risk of them commencing proceedings against you.

If you need help with an unfair dismissal claim, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.