In Short

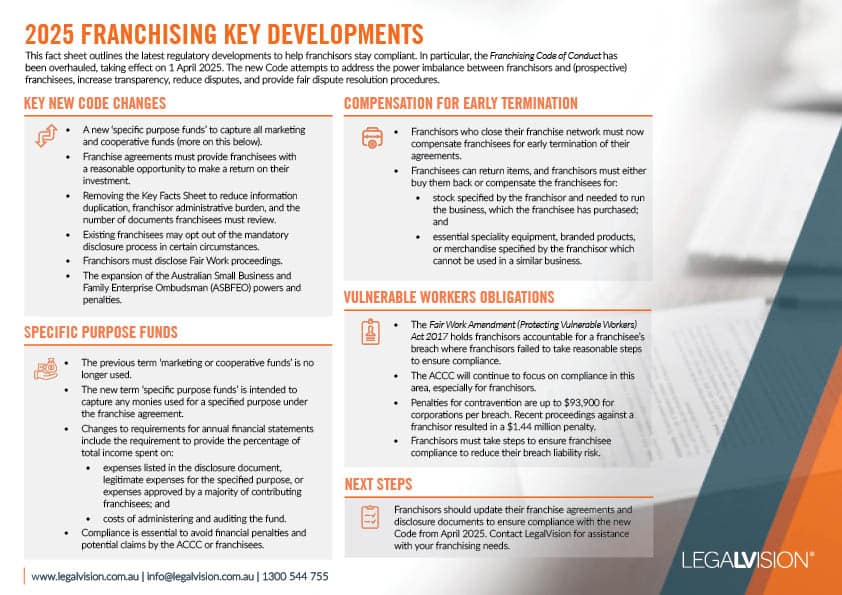

- The Franchising Code of Conduct will be renewed on 1 April 2025, with significant changes based on a 2024 independent review and updated laws.

- Notable updates include revised disclosure requirements and the removal of the key facts sheet, amended restraint of trade rules, and expanded franchisee protections regarding investment returns and mandatory compensation.

- The new laws will apply predominantly to new franchise agreements, however a limited number of provisions will apply to existing agreements.

Tips for Businesses

Franchisors should start reviewing their agreements and disclosure documents now to ensure they align with the upcoming changes. Transparency, fairness, and compliance will be critical under the new rules. Franchisees should seek legal advice to understand how these changes affect their rights and obligations within their franchise agreements especially when it comes to renewals, extensions and transfers of older agreements.

On this page

- Future Proofing the Code

- Changes to Marketing and Cooperative Funds

- Penalties for Enforcing Restraints of Trade for Non-Renewal or Extension

- Expansion of Motor Vehicle Dealership Protections

- Reasonable Opportunity for Investment for all Franchises

- Compensation for Early Termination

- Reasonable Legal Costs

- Updated Disclosure Requirements

- Changes to 7-Day Termination Provisions

- Increased Ombudsman Disclosure for ADR

- Increased Penalties

- Application of New Regulations

- Interaction with Other Industry Codes

- Key Takeaways

- Frequently Asked Questions

The Franchising Code of Conduct (the Code) underwent a comprehensive overhaul following an independent review and the government’s response. The renewed Code, due to commence on 1 April 2025, will ensure it continues to evolve along with industry needs. Ahead of the changes, the government released the Exposure Draft in October 2024 and detailed explanations of the proposed changes, inviting feedback from the franchising industry – similar to the process in 2021. Following this consultation period, in December 2024, the final version of the laws was released by the Government containing the updated Code (New Regulations). This article summarises the significant changes to the Code that will impact both franchisors and franchisees.

Future Proofing the Code

Reviews of the Code

The updated Code is similar to its current form but incorporates improvements and changes. The new format aligns with other laws by:

- using sections instead of clauses; and

- undergoing a review every five years.

Although the section numbers will no longer match previous numbers, many substantive rights and obligations are mirrored. For example, the template Disclosure Document at Annexure 1 of the older Code is reinserted as Schedule 1 in the New Regulations.

Purpose of the Code

The New Regulations state the purpose of the updated Code is to:

- address the power imbalance between franchisors and (prospective) franchisees;

- improve the standards of conduct and best practices by increasing transparency and reducing disputes; and

- provide fair dispute resolution procedures.

Changes to Marketing and Cooperative Funds

In the New Regulations, marketing and cooperative funds are jointly referred to as ‘specific purpose funds’ to avoid unnecessary distinctions.

This expanded definition covers funds allocated for anything specified in the franchise agreement, including shared resources, network platforms and technology upgrades for a specific, common purpose. Franchisors must notify franchisees about any benefits they may receive from their contributions to these funds, aiming to promote greater transparency.

Continue reading this article below the formCall 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Penalties for Enforcing Restraints of Trade for Non-Renewal or Extension

Under the previous version of the Code, a restraint of trade provision was not effective in certain circumstances where:

- the franchisee correctly sought to extend the franchise agreement (following notice requirements) where this was an option in the agreement;

- the franchisee was not in serious breach of the franchise agreement and had not contravened any confidentiality or intellectual property provisions;

- the franchisor refused the extension or renewal; and

- the franchise agreement did not allow the franchisee to claim meaningful compensation for goodwill.

The New Regulations change this approach to:

- expressly include renewals;

- require the franchisee to have met any pre-conditions for the renewal or extension before the franchise agreement expires;

- penalise a franchisor who entered into a franchise agreement (or related agreements) with a restraint of trade provision that breaches the New Regulations; and

- penalise a franchisor for enforcing such a non-compliant restraint of trade provision, instead of making the restraint of trade ineffective.

Expansion of Motor Vehicle Dealership Protections

Inclusion of Service and Repair Work by Motor Vehicle Dealership

The New Regulations clarify that the Code will cover service and repair work carried out by motor vehicle dealerships. This aligns with current industry expectations that these services are part of the dealership. However, the updated definitions will not include standalone service and repair businesses that are not part of a motor vehicle dealership franchise.

Application of New Protections

Some of the protections previously available only to motor vehicle dealerships have been expanded to all franchise agreements. These are discussed in more detail below.

Reasonable Opportunity for Investment for all Franchises

Under the New Regulations, all franchise agreements must give franchisees a “reasonable opportunity to make a return on their investment”. This requirement, previously limited to motor vehicle dealerships, now applies to all franchises. A franchisor can face significant penalties if the capital investment needed to establish the business cannot be feasibly recovered during the agreement’s term.

Franchisors will not be expected to:

- guarantee profits or the success of franchisees; or

- protect franchised businesses from inherent risks.

Compensation for Early Termination

If a franchisor closes the franchise network, it must compensate the franchisee for the early termination of the agreement. This also applies if the franchisor leaves Australia, rationalises its network or changes its distribution model. Previously, this obligation was only for motor vehicle dealerships but has now been expanded.

The New Regulations specifies the compensation will need to consider:

- outstanding stock prescribed by the franchisor and necessary for business operation;

- essential specialty equipment required by the franchisor to be purchased that cannot be re-used in a similar business; and

- branded or merchandised products that cannot be repurposed.

Franchisors must include provisions detailing the compensation method in the franchise agreements. This should cover at the very least:

- lost profits;

- wasted capital expenditure;

- winding-up costs; and

- lost goodwill.

Failure to do so could result in significant penalties.

Reasonable Legal Costs

Under the New Regulations, a franchisor’s fixed legal costs must not be unreasonable and disingenuous. This applies to preparing, negotiating, or executing the franchise agreement.

Franchisors should check if the costs they charge fairly reflect their incurred legal fees, as they risk penalties for overcharging.

Updated Disclosure Requirements

Removal of Key Facts Sheet

The New Regulations removed the Key Facts Sheet due to duplication of information. Instead, the Disclosure Document will incorporate unique insights previously found in the Key Facts Sheet. This includes specific details about competing interests in the franchisee’s territory.

A key facts sheet should accompany any disclosure document given to a franchisee before 1 April 2025. This is because the disclosure is effective under the older version of the Code.

Under the previous Code, major costs were not considered significant capital expenditure if they were disclosed in the franchise document. Major costs included:

- refurbishments;

- branding updates; and

- equipment upgrades.

Once disclosed, franchisors were allowed to require franchisees to pay these costs during the agreement. If these costs were not disclosed, agreed to, or required by law, they were prohibited.

The New Regulations refine this approach. Significant capital expenditure now includes estimated costs outlined in the disclosure document. They are also now permitted as long as they are clearly explained. Although the required information has not changed significantly, disclosure documents must now clearly outline any expected major expenses.

Franchisors may face penalties if they fail to discuss these disclosed expenses with franchisees before signing an agreement.

Notification of Non-Renewal

The New Regulations require franchisors to notify franchisees of decisions not to renew or extend a franchise agreement. Previously, the only obligation was to notify of an intention to do either.

Opt-Out of Disclosure Process for Renewals or Transfers

The New Regulations include the option for existing franchisees to opt out in writing from:

- receiving a new Disclosure Document and a copy of the Code before entering into a new franchise agreement; or

- receiving a 14-day cooling-off period after signing a renewed franchise agreement.

This will make renewals more efficient and allow existing franchisees to continue under new negotiated terms quickly. This is especially helpful when transferring additional franchises to an existing franchisee. However, take note that:

- the 14-day disclosure period (renamed as the consideration period) will still apply to renewing or extending franchisees who choose to opt-out after receiving the detailed franchise agreement; and

- existing franchisees can still request a disclosure document later on – at most once every twelve (12) months – even if they opt out during the renewal, extension or transfer.

Prohibition on Franchisor Signing During Consideration Period

Under the older version of the Code, a franchisor cannot ‘enter’ into a franchise agreement during the 14-day disclosure period. The New Regulations clarify that the franchisor must not sign a franchise agreement during this consideration period.

This aims to prevent confusion about when the franchise agreement was “entered into”. It applies if the franchisee signs within 14 days after receiving all required documents and information.

Provision of Updated Financial Documents

The New Regulations require that franchisors provide updated solvency statements, financial reports or audit reports if these documents are created:

- after a disclosure document (and relevant financial annexures) are provided to a franchisee; and

- before the franchisee signs the new franchise agreement.

A franchisor will need to provide an updated disclosure document unless requested not to do so. For example, this could include providing the most recent financial reports.

Disclosure of Fair Work Proceedings

Franchisors must now disclose certain legal proceedings commenced by a public agency for breaches of the Fair Work Act where:

- a franchisee committed the offence (such as non-compliance with the National Employment Standards, engaging in sham contracting or underpayment); and

- the franchisor (or its directors) should have known the offence did or would occur.

This can also capture actions taken against holding companies, and is referred to as vicarious liability. They must also report judgments for certain breaches of the Fair Work Act.

Disclosure of Former Franchisee Details

Under the previous version of the Code, a former franchisee could request their personal details be removed from a franchisor’s disclosure document. This request remains under the New Regulations. Franchisors must now notify a former franchisee at least 14 days before the disclosure document is issued. They must also inform the former franchisee that they can request to have their details removed.

Franchisors can be penalised for including a former franchisee’s details without their consent or proper notice. They can also be penalised for trying to influence whether a request is made or not.

Changes to 7-Day Termination Provisions

The current Code allows franchisors to include provisions for terminating a franchise agreement with seven days’ notice. This is permitted only in particular circumstances involving misconduct or serious offences.

Expansion of 7-Day Termination

These circumstances have expanded to include:

- serious contraventions of the Fair Work legislation (for employees) by a franchisee (such as where they knowingly or recklessly breached the law); and

- certain contraventions of migration laws, including convictions,

provided that a Court has confirmed the contravention occurred in the relevant proceedings.

The Fair Work Act allows employees to take legal action if their rights are violated. This includes seeking financial penalties or injunctions against their employer in cases involving workplace protections.

Partial Removal of Rapid Alternative Dispute Resolution

Under the old version of the Code, franchisees could apply for urgent Alternative Dispute Resolution (ADR) after receiving a 7-day termination notice. This would prevent a franchisor from terminating due to that issued notice for 28 days after the termination was disputed. The rapid appointment of an ADR practitioner will no longer be available for objective terminations, such as:

- a franchisee losing a necessary licence (as decided by a regulatory body);

- the franchisee becoming bankrupt, insolvent under administration, in liquidation or deregistered (according to ASIC); or

- a Court convicting a franchisee of a serious offence (including for certain contraventions of the Fair Work Act or the Migration Act).

A franchisee can only request an urgent alternative dispute resolution process for certain terminations that involve a subjective opinion about the conduct, such as:

- abandoning the franchise relationship;

- engaging in fraudulent activity; or

- operations that endanger public health or safety.

Understand the latest regulatory developments to help franchisors stay compliant. Download our free factsheet today.

Increased Ombudsman Disclosure for ADR

Failure to Engage in ADR Process

The Australian Small Business and Family Enterprise Ombudsman (ASBFEO or the Ombudsman) currently facilitates ADR processes. They commonly introduce franchisors and franchisees to potential mediators and conciliators and report on the success rate of attempted ADR.

Under the New Regulations, the ASBFEO will be able to publicly name franchisors who:

- do not meaningfully engage in an ADR process; or

- improperly withdraw from an ADR process.

The New Regulations do not allow the ASBFEO to disclose specific outcomes of any ADR process due to confidentiality.

Increased Penalties

Many obligations in the Code are proposed to have a penalty of 600 penalty units. This change aligns with updates made in 2021 to provisions that previously had no applicable penalties.

Some of these provisions include:

- failing to obtain a written statement from the franchisee or transferee confirming they had a reasonable opportunity to understand the disclosure document and the Code;

- prohibiting general releases from liability or waivers in franchise agreements;

- failing to discuss disclosed significant capital expenditure with a franchisee;

- banning the requirement for franchisees to initiate legal proceedings or ADR processes outside their own jurisdiction; and

- ensuring personal details of former franchisees who requested removal are redacted from the disclosure document, in compliance with Australian privacy laws.

The penalty units are the maximum penalty a Court can impose for each offence.

Application of New Regulations

The New Regulations generally apply to:

- franchise agreements entered into, transferred, renewed or extended on or after 1 April 2025; and

- conduct relating to such new agreements, including the relevant transfer, renewal or extension of those new agreements (where it takes place on or after 1 April 2025).

Franchise agreements made before 31 March 2025, and related actions, will follow the version of the Code that was in place when the agreements were signed. This will continue until the agreements end, are terminated, transferred, renewed, or extended. However, the New Regulations will apply to any transfer, renewal, or extension of these older agreements if it happens on or after 1 April 2025.

Refusal to Engage in Alternative Dispute Resolution

The Ombudsman may publish details of a franchisor’s refusal to take part in ADR after 1 April 2025 if the franchise agreement was entered into, transferred, renewed or extended from 1 January 2015 onwards (when the original Code was initially implemented).

All parties involved in a dispute should remain aware of their ongoing obligations to resolve disputes under current and older Codes.

Delayed Compensation and Reasonable Opportunity for Return

Two major new expansions of the Code will only apply for agreements entered into, transferred, renewed or extended from 1 November 2025 onwards. These are:

- the new compensation provisions (for all franchised businesses) where the franchise network leaves Australia, rationalises the network or experiences a change in distribution model; and

- the obligation of franchisors to only enter into a franchise agreement where there is a reasonable opportunity during the term to make a return on any investment required by the franchisor as part of the agreement.

Reporting Requirements for Specific Purpose Funds

A specific purpose fund that is not a marketing or co-operative fund is exempt from the New Regulations to:

- prepare financial statements;

- obtain votes on audits; and

- manage accounts and payments

until 1 November 2025 onwards. This means that franchisors operating such specific purpose funds will not be burdened with extra requirements at short notice.

Disclosure Document Updates for Specific Purpose Funds and Significant Capital Expenditure

Similar to the above, a new Disclosure Document created before 1 November 2025 does not need to include details of:

- all specific purpose funds (unless for a marketing or cooperative fund); and

- significant capital expenditure required during the term of the Franchise Agreement in item 14, if this was not previously mentioned.

Under the old Code, additional information about certain expenditures had to be included, even if they were not significant capital expenditures. The New Regulations do not make major changes but have altered where this information appears in the disclosure document.

Disclosure Documents Provided Pre-1 April 2025

If a disclosure document is given to a franchisee by 31 March 2025 (for franchise agreements to be entered into, transferred, renewed, or extended on or after 1 April 2025), the franchisor does not need to update it immediately on 1 April 2025.

Franchisors planning to disclose under the old Code should complete their formal disclosure to a prospective franchisee before 1 April 2025 to avoid duplication.

A disclosure document updated in 2024 and provided before 1 April 2025 will still be compliant for disclosure purposes until 31 October 2025.

Updates to Pre-1 April 2025 Disclosure Documents

The obligation to update the disclosure document annually within four months of the financial year remains unless:

- only one or less franchise agreements were entered into in the financial year; and

- the franchisor does not intend to enter another franchise in the next financial year.

For following financial years (ending on or after 1 November 2025), the New Regulations apply and the annual updates are required if:

- two or more franchise agreements were entered into during the previous financial year; or

- the franchisor intends to enter into new franchise agreements in that financial year. This is irrespective of how many agreements were entered into during the previous financial year.

Disclosure Documents Provided on or After 1 April 2025

Disclosure documents that are given to franchisees from 1 April 2025 will need to comply with the New Regulations. However, this excludes the certain exceptions for some types of specific purpose funds and significant capital expenditure.

Interaction with Other Industry Codes

The new version of the Code does not generally apply to franchise agreements already subject to an existing industry Code. For example, the Oil Code of Conduct. However, it will still apply to franchise agreements governed by the Food and Grocery Code or the Unit Pricing Code.

The New Regulations also clarify that certain pre-existing business relationships will not be subject to the Code if:

- for at least two years before signing the franchise agreement, the franchisee had been providing similar goods or services;

- sales under the franchise agreement are unlikely to exceed 20% of the gross turnover for those same goods or services within the first year; and

- sales under the franchise agreement do not exceed 20% of franchisee’s gross turnover for three consecutive years.

Key Takeaways

The changes to the Franchising Code of Conduct, effective April 1, 2025, will significantly impact both franchisors and franchisees. These updates aim to increase transparency, improve fairness, and enforce stricter compliance. Some key adjustments include revised disclosure requirements, stricter restraint of trade rules, and expanded protections for franchisees. Franchisors will have to update their agreements to comply, while franchisees should understand how these changes affect their rights and obligations.

If you need help understanding these changes, our experienced franchising lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

The new laws apply to agreements entered, renewed, extended or transferred from 1 April 2025 onwards. They also apply to the renewal, extension or transfer of older franchise agreements.

The New Regulations remove the Key Facts Sheet. This will reduce the compliance burden on franchisors and simplify the process for franchisees from April 2025 onwards. Additional information about significant capital expenditure and specific purpose funds will need to be included in documents updated from 1 November 2025 onwards.

Franchisors’ fixed legal costs must be reasonable and not disingenuous, ensuring fairness in the preparation, negotiation, and execution of franchise agreements. There are additional penalties for requiring a franchisor’s legal costs of a dispute to be paid by a franchisee.

No, the new laws do not mandate a guarantee of profit. The purpose of the new law is to make sure that it is reasonable for a franchisee to recoup their investment during the term of the agreement by having sufficient time to operate the business.

We appreciate your feedback – your submission has been successfully received.