The Fair Work Act 2009 (Cth) allows certain employees to cash out their annual leave. However, as an employer, you may be wondering if your employees can cash out their sick leave. In most situations, they are not legally able to do this. However, there is an exception where their registered award or agreement states that sick leave may be cashed out. This includes the:

- Timber Award;

- Black Coal Award; and

- Stevedoring Award.

This article will explore these awards in detail so that you can make an informed decision when faced with cashing out sick leave for your employees.

Cashing Out Sick Leave

Cashing out sick (personal) leave means employees get payment instead of taking time off work. Employees with lots of accumulated sick leave may make these sorts of requests. Your employees may also ask you whether their sick leave will be paid out upon termination of their employment, similarly to how their annual leave would.

If you allow your employees to cash out their sick leave when they are not legally permitted to do so under an award or enterprise agreement, you may be in breach of the Fair Work Act. This applies even if your employee has requested you to cash out their sick leave. However, the awards examined below are exempt from this.

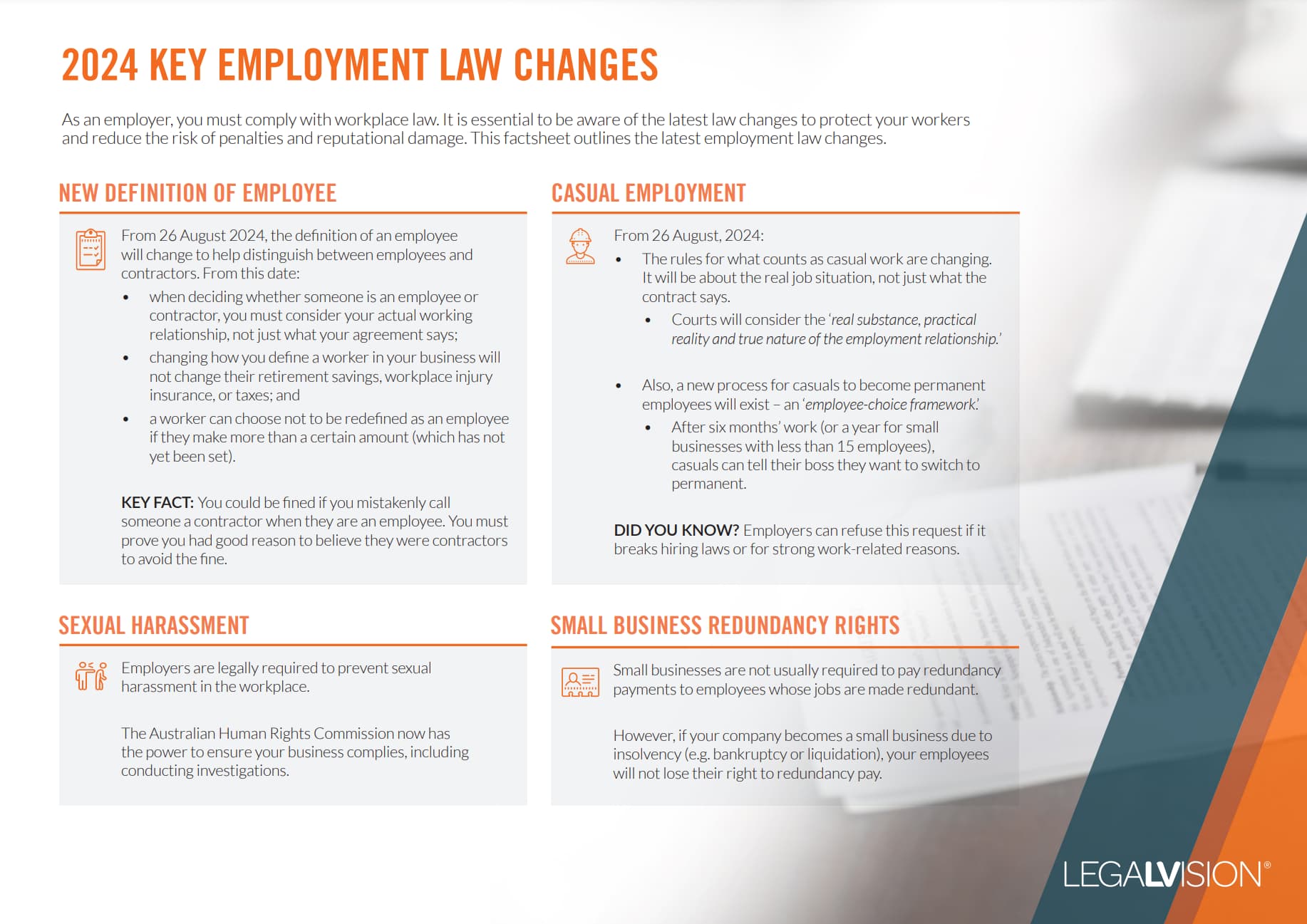

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Timber Award

Under the Timber Award, an employee may request to cash out sick leave instead of taking time off work. This right exists once they have accumulated more than 15 days’ worth of leave.

If the request is approved, you may pay your employee up to:

- 64 hours (if they are in the General Timber Stream); or

- 38 hours (if they are in the Wood and Timber Stream).

The employee must make a written request and can only do so once per year.

However, employees in the Pulp and Paper Stream can only cash out sick leave upon:

- retirement;

- termination of employment after ten years of continuous service; or

- death (as long as they were still an employee of the business).

Call 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Black Coal Award

Under the Black Coal Award, an employee can only cash out sick leave if they have 70 or more hours of untaken sick leave and you have terminated their employment. Termination may occur by:

- redundancy;

- retirement;

- dismissal by you because of sickness; or

- death.

If you terminate an employee while they are on paid sick leave, you must pay them until their either:

- their leave runs out; or

- they return to work.

Stevedoring Award

An employee under this award may elect to cash out sick leave instead of taking time off of work once they have accumulated at least 28 days’ worth of leave. They may choose to be paid all or part of their entitlement in excess of the 28 days. You should pay this amount at their ordinary rate of pay.

You must also pay an employee the total amount of their unused sick leave in the event of their:

- redundancy;

- retirement;

- resignation;

- death; or

- disablement.

Registered Agreement

Some registered agreements may permit employees to cash out their sick leave. A registered agreement is a document between you and your employees regarding employment conditions, which has been approved by and registered with the Fair Work Commission. Examples of registered agreements include:

- enterprise agreements;

- collective agreements; and

- greenfields agreements.

Employee Considerations

An employee should consider whether it is worth cashing out their sick leave before doing so. Accumulated sick leave can provide a safety net that they may use in the event of themselves or one of their family members falling ill or suffering an accident.

However, it is also worth considering that an employee may be entitled to unpaid sick leave if their sick leave has run out.

Employer Considerations

As an employer, you should consider whether allowing employees to cash out their sick leave will result in more employees becoming hesitant to use their sick leave and instead of coming to work while they are sick.

These actions may lower staff performance and make other employees in the workplace sick as well. However, it is also worth considering the financial implications to your business in allowing sick leave to build up, as you will have to pay it out in one lump sum.

Key Takeaways

An employee will only be allowed to cash out sick leave if one of the three awards or a registered agreement that allows for this provision covers them. The awards include the:

- Timber Award;

- Black Coal Award; and

- Stevedoring Award.

Even if the employee is entitled to this payment instead of time off work, there are numerous conditions and issues to consider before doing so. If you have any questions about cashing out sick leave, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.