In Short

-

Start-up tax concessions for employee share option plans (ESOPs) may not apply if certain criteria aren’t met.

-

Alternative incentive plans include Tax Deferred Plans, Phantom Share Plans, and Premium Priced Option Plans.

-

Carefully assess your company’s structure and objectives to select the most suitable employee incentive scheme.

Tips for Businesses

If your company no longer qualifies for start-up tax concessions, consider implementing alternative employee incentive plans. Options like Tax Deferred Plans, Phantom Share Plans, and Premium Priced Option Plans can effectively motivate and retain staff. It’s essential to align these plans with your company’s goals and consult with tax professionals to ensure compliance and optimal tax treatment.

The start-up concession employee share option plan (ESOP) is a popular way for startups, often low on cash, to incentivise key employees, as it provides those startups with a cash-free way of paying premium talent when there are not enough funds to pay market salaries.

If the concessional tax treatment is available to the employee/s that receive equity (whether options or shares) under the ESOP, the employee would

- not be taxed up front on receipt of the equity (which ordinarily would be the market value of the equity) ;

- if issued options, only be taxed on the sale of any resulting shares, with the tax treatment being governed by the capital gains tax (CGT) rules; and

- will be taken to have acquired those resulting shares on the date the options are granted, not the date they exercise the options. This is relevant for the timing of specific CGT discounts.

Failing to meet any start-up concession criteria makes the concessional treatment unavailable to the employee. This article discusses common situations where the start-up concession is unmet and explains popular alternatives to a start-up concession ESOP.

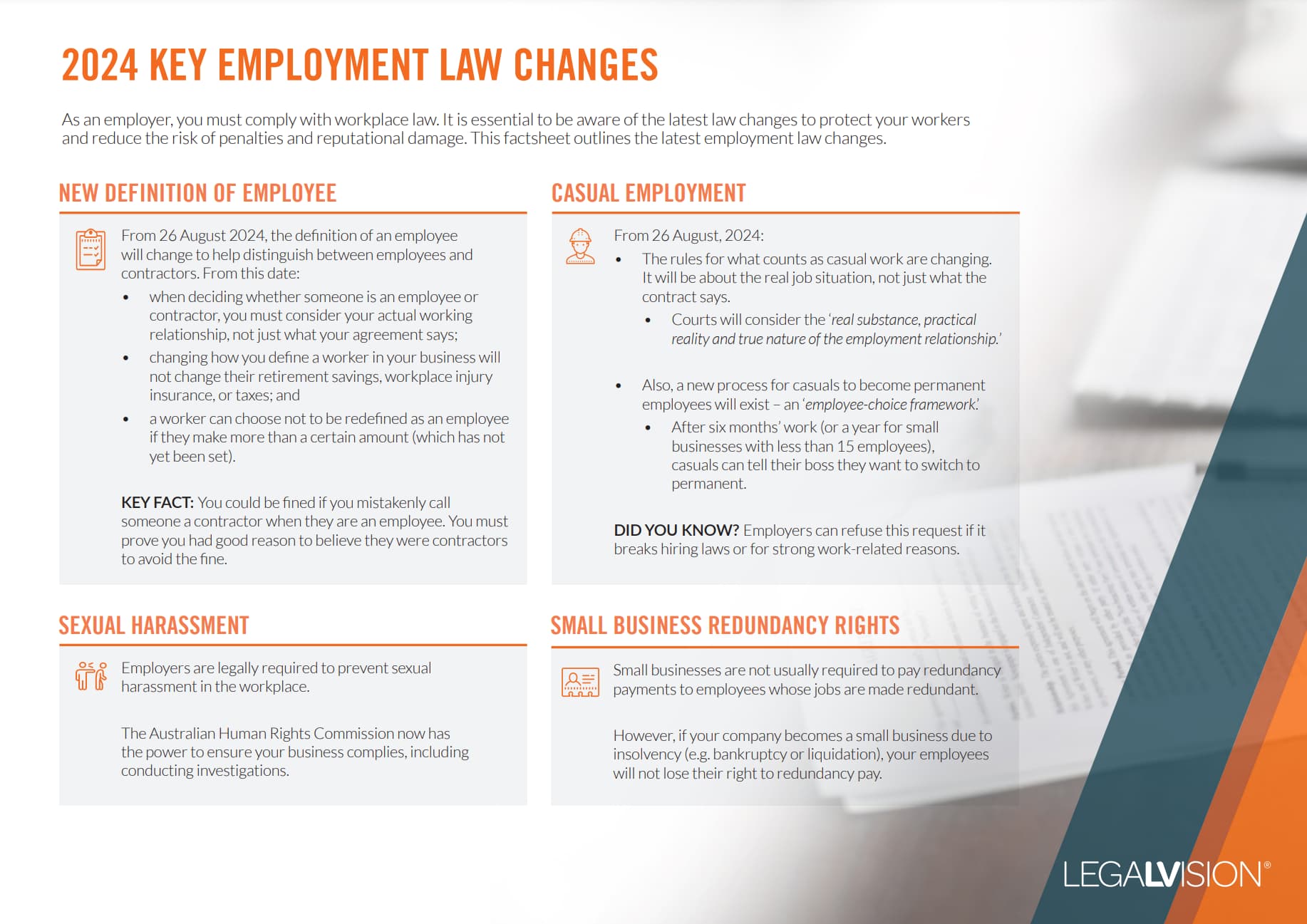

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Why might the start-up concession not be available?

The most common situations where the start-up concession is not available are as follows:

- a company in the corporate group is older than 10 years; and/or

- the employee will hold a beneficial interest in more than 10% of the shares in the company or in a position to control more than 10% of the votes at a general company meeting. This 10% limit considers the options as if they had been converted into shares.

In addition to the above, the start-up concession will not be available where (amongst other things):

- any member of the corporate group is listed for quotation on any approved stock exchange;

- the company granting the options has an aggregated turnover of more than $50 million in the financial year prior to the grant of options; and/or

- the recipient of the options is not an employee, contractor or director of a company in the corporate group at the date of the grant.

Is the Employee Receiving a Discount?

When service providers receive equity for their services, the “employee share scheme” rules apply. The employee must include the “discount” in their assessable income. Typically, the difference between the market value and the price paid for the equity (options or shares). This position is changed if a deferral concession applies.

Continue reading this article below the formTax Deferred Plan

A tax-deferred plan (TDP) works similarly to the start-up concession ESOP in granting options or shares to an employee. Under a TDP, an employee will not have to pay any tax upfront. Instead, the tax is deferred to the “deferred taxing point”. The deferred taxing point is generally the earlier of:

- when there is no real risk that the employee will forfeit their interest and they are no longer restricted from disposing of those interests under the plan; and

- 15 years.

Other key differences between a TDP and a start-up concession ESOP are:

- the amount of income assessable to the employee at the deferred taxing point is generally the market value of the options minus anything the employee paid to acquire them; and

- when the employee exercises the option to convert the option into a share, the timer for when the employee acquires that share restarts. This may impact the availability of specific CGT discounts.

Phantom Share Plan

A phantom share plan (PSP) involves a company granting “phantom shares” to eligible service providers. Phantom shares are essentially contractual rights that mimic receiving an actual share in the company. A PSP can be set up to meet the company’s objectives, but for example, an employee may receive:

- a phantom dividend when the company pays out dividends to actual shareholders; and/or

- payment on an exit event; and/or

- another opportunity to redeem the phantom shares for cash.

However, this means that the tax treatment for the employee would be broadly similar to a cash bonus scheme. This could possibly impact the employee’s cash position. Relevantly:

- any payments made to an employee under a PSP would be taxed as income, not capital;

- a phantom dividend would not be frankable; and

- If the company pays a phantom shareholder at an exit event, the phantom shareholder will not be entitled to any CGT discounts.

Indeterminate Rights Scheme

Under an indeterminate rights scheme (IRS), the company grants rights without specifying their form. Later, the company decides whether these rights convert into cash or shares.

The employee is not taxed upfront upon receipt of the indeterminate rights. The tax outcome for the employee will differ depending on whether the indeterminate rights manifest into cash or shares:

- Manifests into Cash: The company treats the cash payment like a bonus, meaning it must pay superannuation and withhold PAYG tax.

- Manifests Into a Right to Receive Shares: The employee receives rights to shares on the date the indeterminate rights are granted. They may need to amend their tax return to include any discount received to acquire the rights.

When drafting an IRS, special care should be taken to ensure that the right is genuinely “indeterminate” when granted. If it is not truly indeterminate, this could have adverse tax consequences.

Premium priced option plan

A premium-priced option plan (PPOP) grants employees the option to acquire shares later. The key difference is the “premium” exercise price, often more than double the market value. By paying this premium, the option’s market value may be reduced to nil. Ultimately, this means the employee avoids upfront tax, depending on the exercise period.

Limited Recourse Loan Plan

A limited recourse loan plan (LRLP) allows the employee to acquire shares at market value through a loan. The company’s recourse is limited to the shares acquired if the employee fails to repay the loan. LRLPs usually involve the acquisition of shares rather than options. This is generally because of the added complexity that can arise when options are exercised. Broadly:

- when an option is exercised, that option ceases to exist, and a new asset (being the share) is issued. Issues can arise if the LRLP documents don’t address the company’s recourse after an option is exercised. For example, if the documents only account for recourse against the options, not the resulting shares, it may create uncertainty about the company’s approach; and

- for the same reason above, issues can arise with the availability of the general 50% CGT discount. However, this is mainly where exercising options can only happen on an exit event. This is because when the options are exercised and shares are issued, the general 50% CGT discount timer restarts.

Other Considerations

Other key considerations with an LRLP are:

- Repayment of Loan: The loan advanced under the LRLP is a debt by law, meaning the employee will need to repay it. A company forgiving a debt owed to it by a shareholder can trigger Division 7A, so care would need to be taken if this is considered.

- Process On Exit: If the employee experiences a “leaver event” and the company chooses to buy back their shares, the company will need to undertake a share buyback. This can be an administratively burdensome process.

- Fringe Benefits Tax: An employer advancing a loan to an employee can trigger a fringe benefits tax for the employer.

- Financial Assistance Whitewash: a company providing financial assistance (such as a loan) to someone to acquire shares in that company may have to undertake a financial assistance whitewash, which is also an administratively burdensome process.

Key Takeaways

An ESOP is a popular way for startups to incentivise key employees. If the start-up concession is unavailable due to unmet criteria, an ESOP may not be the most tax-efficient option. In this case, the company should consider alternative plans that could better suit the company’s needs, such as:

- a tax-deferred plan (TDP);

- phantom share plan (PSP); or

- premium-priced option plan (PPOP).

If you have any questions regarding incentives and tax concessions, our experienced taxation lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Why might the start-up concession not be available?

The start-up concession may not apply if:

- the company is older than 10 years;

- the employee holds more than 10% of shares; or

- if other specific criteria are not met.

What is a limited recourse loan plan (LRLP)?

An LRLP lets employees acquire shares at market value through a loan. If the loan isn’t repaid, the shares are the only recourse.

We appreciate your feedback – your submission has been successfully received.