In Short

-

A trust is considered a “foreign trust” for income tax purposes if the trustee is not an Australian tax resident or if the central management and control of the trust is outside Australia.

-

For unit trusts, it is a resident trust if any of its property is situated in Australia and if the central management and control is in Australia.

-

Foreign trusts may face additional tax consequences, including ineligibility for certain capital gains tax discounts and potential tax obligations in other jurisdictions.

Tips for Businesses

Before establishing or restructuring a trust, consult with legal and tax professionals to ensure compliance with Australian tax laws and to understand the implications of the trust’s residency status. Proper structuring can help avoid unexpected tax consequences and compliance issues.

A trust is a legal arrangement where one party (the trustee) holds and manages assets for another party (the beneficiary), providing a tool for wealth protection, tax planning, and estate management. In Australia, families commonly use trusts to pass wealth between generations, business owners use them to protect assets from creditors, and investors use them to distribute income among family members in tax-effective ways. While trusts are a popular structure for passive investment vehicles and operating businesses, you must consider whether your trust could be classified as a “foreign trust,” as this can trigger tax consequences. This article explains when a trust may be considered a “foreign trust” and what that means from a tax perspective.

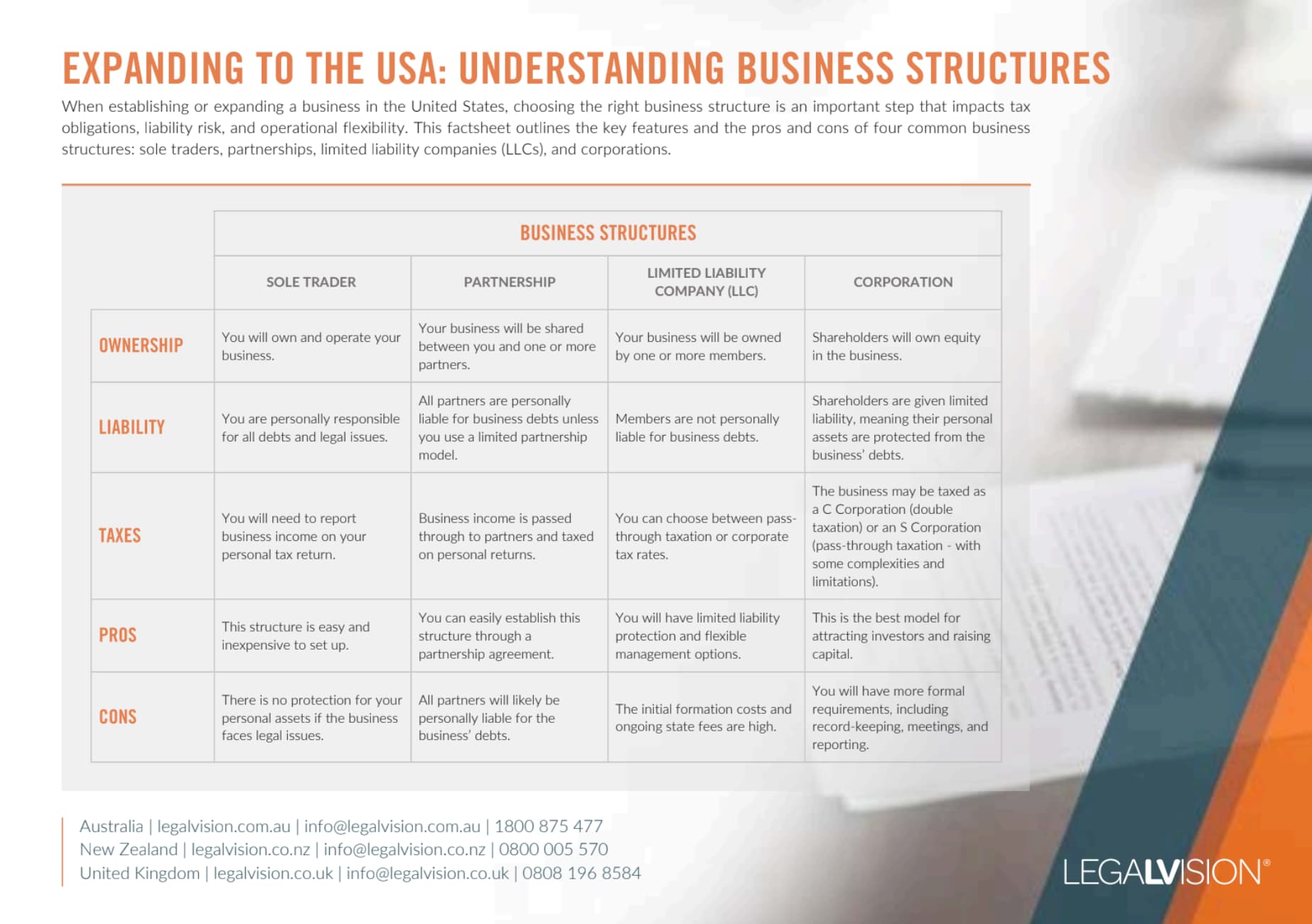

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

Income Tax at the Federal Level

While the main tax consequences of a trust being a foreign trust sit at the state/territory tax level, it is still also important to consider the federal tax implications.

When is a Trust a Foreign Trust for Income Tax Purposes?

For income tax purposes, whether a trust is a foreign trust depends on the type of trust you have. Relevantly:

- for a trust that is not a unit trust, it will be a resident trust (and therefore not a foreign trust) if, at any time during the financial year, the trustee of the trust is an Australian tax resident or the central management and control of the trust is located in Australia; and

- for a unit trust, that trust will be a resident trust (and therefore not a foreign trust) if you can answer “yes” to one or more of the questions in column 1 and one or more of the questions in column 2.

| Column 1 | Column 2 |

| Is any of the trust property situated in Australia? | Is the central management and control of the trust in Australia? |

| Does the trust conduct business in Australia? | Do Australian tax residents hold more than 50% of the beneficial interests in the income or property of the trust? |

What Are the Tax Implications?

Foreign trusts are generally not entitled to the same capital gains tax (CGT) discounts that resident trusts can be entitled to. Furthermore, a beneficiary who receives income from a foreign trust will need to seek advice on whether they will be required to pay tax in Australia on that trust distribution, as well as their income tax obligations in the country where the trust is resident.

Stamp Duty and Land Tax at a State and Territory Level

When is a Trust a Foreign Trust for Stamp Duty and Land Tax Purposes?

The trustee of a trust is considered a “foreign person” if any potential beneficiary is an individual not ordinarily resident in Australia, a foreign corporation or a foreign government. This is the case even if the trustee never actually makes a distribution to that foreign beneficiary.

The definition of “foreign person” is broad and includes the following:

- individual not ordinarily resident in Australia (except for Australian citizens);

- companies, where a foreign person(s) hold a substantial interest in that company;

- trustee of a trust if the trustee is a foreign person or company, or if more than one trustee, if a substantial number of trustees would be considered foreign;

- foreign governments;

- foreign government investors; and

- general partners of limited partnerships.

It is essential to consult the laws governing foreign persons in the state or territory where the trust has its governing law clause, as the rules vary by jurisdiction.

What Are the Tax Implications?

A trust will incur additional tax consequences if it is deemed a foreign person and acquires an interest in land. An example of holding an interest in land is if the trust owns an investment property that it rents out.

The tax consequences of a foreign trust acquiring land are:

- Surcharge purchaser duty: additional stamp duty payable upon the acquisition of residential-related land.

- Foreign owner surcharge: additional land tax payable each land tax year for residential-related land.

Each state and territory is different, so it is essential to obtain advice in the jurisdiction where the trust is established and the state/territory in which the land is being acquired (if this differs from the governing law of the trust).

How Can This Tax Risk Be Mitigated?

The state and territory revenue offices have accepted that discretionary trust deeds can be amended to exclude foreign beneficiaries. If this amendment is made correctly, the discretionary trust would not be considered a foreign trust.

Each state and territory is different, so it is essential to seek advice in the jurisdiction that governs the trust deed. Generally speaking, foreign persons can be excluded by including a clause in the trust deed that has the effect of:

- no beneficiary or potential beneficiary of the trust is a ‘foreign person’; and

- the terms of the trust must not be capable of amendment that would result in a foreign person being a potential beneficiary (i.e. the exclusion of foreign beneficiaries must be an irrevocable exclusion).

Key Takeaways

The distinction between foreign and non-foreign trusts carries significant tax implications. It can significantly affect a trustee’s tax exposure. Trust structures remain one of Australia’s most effective legal tools. They help pass wealth between generations, protect assets from creditors, and distribute income tax-effectively. However, the foreign trust rules add complexity. This is especially true if you plan to hold land through the trust.

Whether your trust operates as a passive investment vehicle or an active trading entity, you must understand its foreign status. Properly managing this can help avoid unexpected tax consequences and compliance issues. Given the financial impact, seeking professional advice before establishing or restructuring a trust is essential.

If you have any questions concerning tax, our experienced tax lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

When is a trust considered a foreign trust for tax purposes?

A trust is a foreign trust for income tax purposes if the trustee is not an Australian tax resident. It is also a foreign trust if the trust’s central management and control is not in Australia. For unit trusts, the trust is considered foreign if it meets specific criteria. These criteria include property location, business operations, or beneficiary residency.

What are the tax implications of a foreign trust owning land?

If a foreign trust acquires land, it may incur additional tax consequences, including surcharge purchaser duty (additional stamp duty) and foreign owner surcharge (additional land tax). These taxes apply to residential-related land, and the rules vary by state or territory, so professional advice is essential.

We appreciate your feedback – your submission has been successfully received.