In Short

- Australian businesses may need to collect U.S. sales tax if they have a physical or economic presence in a state.

- Sales tax rates and rules vary significantly across the U.S., with over 12,000 tax jurisdictions.

- Some goods and services may be exempt from sales tax, but businesses are generally responsible for collecting and remitting taxes where required.

Tips for Businesses

Before selling to U.S. customers, assess whether your business activities create a nexus. Understand the specific sales tax laws in each state you operate in, and consult tax professionals to manage multi-jurisdictional compliance.

For any business, navigating the tax landscape can be a challenging exercise, and the United States is no exception. There are over 12,000 tax jurisdictions in the U.S., comprising states and local counties that have implemented a tax on transactions occurring within their borders, known as ‘sales tax’ or ‘transaction privilege tax’, which as the name suggests is a tax for the privilege of doing business in that particular state or local county. In this article, we explore what sales tax is, when it applies, and how Australian businesses may be required to collect and remit sales taxes on their transactions with U.S. customers.

What is Sales Tax?

Sales tax is known as a ‘consumption tax’, meaning that it is only collected once at the time the end consumer purchases the relevant goods or services. This is different to value-added taxes such as GST, which are charged at each stage of supply, although businesses can often claim credits. There is no nationwide sales tax, so businesses need to be aware of each state and local county’s requirements.

Sales tax is generally a percentage of the price, and added on top at the time of purchase. The seller is then responsible for paying the collected sales tax to the appropriate state or local authority. However, complexities arise for businesses that operate in multiple locations, as the tax rate can change, and the types of goods or services covered are often different. For example, some states do not tax software sales, while others do.

When is Sales Tax Applicable?

A business has an obligation to collect and remit sales tax in a particular area, if it has either a physical nexus or an economic nexus with that area.

A physical nexus means that the business has a physical connection with that area, such as:

- land, offices or facilities in that area;

- employees working in that area;

- in-person business activities occurring in that area; or

- equipment or inventory stored or warehoused in that area.

An economic nexus means that although the business does not have a physical nexus with a particular area, it has a level of economic activity in that area, such as earning more than $100,000 or completing more than 200 transactions in any given year. The economic nexus test emerged in 2018 following the Supreme Court’s decision in South Dakota v Wayfair. This case recognised the emergence of the digital economy, and levelled the sales tax playing field between local and remote sellers.

Continue reading this article below the formAre Some Goods or Services Exempt From Sales Tax?

Although specific exemptions vary by area, many of the following are typically exempt from sales tax:

- groceries;

- prescription medications;

- educational and healthcare services; and

- professional services (like legal and accounting services).

Over half of the states impose sales tax on the sale of digital products and downloads. Some of these states offer a reduced rate or discount on the applicable sales tax rate, such as Texas, which only taxes 80% of the total charge for certain software and digital services sales.

There may also be times where sales to certain organisations do not require the seller to collect sales tax. This includes sales to non-profits, churches, educational institutions, and government agencies.

For businesses who supply to distributors or wholesalers, you should obtain a ‘resale certificate’ from them to confirm that they are not an end consumer and that you do not have an obligation to collect sales tax on your transactions with them.

Do Australian Businesses Need to Pay Sales Tax?

An Australian business will be required to pay sales tax on its sales to U.S. customers if it has either a physical or economic nexus with somewhere in the United States. Businesses should examine their activities for any physical connections first, such as offices, employees and inventory, before assessing whether they have met any of the economic thresholds. Providers such as Avalara and TaxJar help with sales tax compliance. They are worth considering due to the sheer number of tax jurisdictions in the United States, and these providers can handle the reporting and filing obligations.

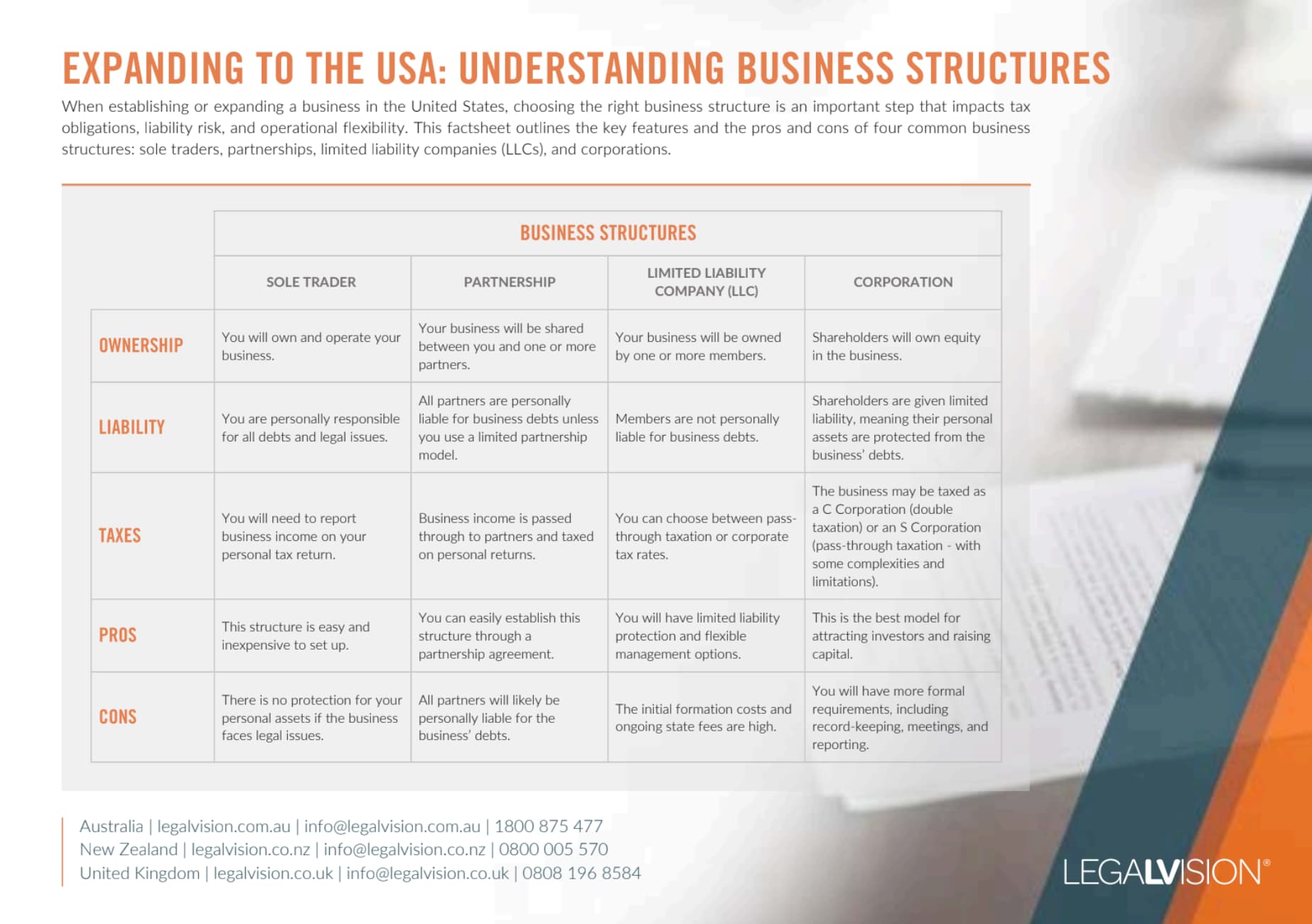

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

Key Takeaways

Sales tax is a tax on end consumer sales of certain goods or services. A business generally has an obligation to collect and remit sales tax to the relevant state or local county authority if:

- the business has a physical presence in that state or local county (such as property, staff, or inventory); or

- the business carries out a certain level of business in that state or local county (such as more than $100,000 or 200 transactions made in a given year, although some areas impose a higher threshold),

which means even remote sellers located in Australia may have obligations.

If you want to learn more about operating your business in the United States, call us today on 1300 544 755 or send us an enquiry.

Frequently Asked Questions

Yes. If your business has a physical presence (such as U.S.-based property, employees, or inventory) or meets an economic threshold (such as more than USD $100,000 in sales or over 200 transactions in a state), then you must collect and remit sales tax, even if your business operates from Australia.

No. Each state sets its own rules. Many states exempt items like groceries, prescription medicines, and professional services. However, most states tax digital products, and some apply reduced rates. If you sell to resellers or exempt organisations, make sure you get the right certificate so you do not charge sales tax when you should not.

We appreciate your feedback – your submission has been successfully received.