In Short

- Providers may engage others as subcontractors, managed service providers or through brokerage and labour hire arrangements.

- Such engagements can affect payroll tax, PAYG withholding and superannuation obligations.

- Providers must assess their tax duties based on the nature of each engagement.

Tips for Businesses

When engaging other providers, carefully evaluate the tax implications of each arrangement. Understand how different engagement types affect your payroll tax, PAYG withholding and superannuation responsibilities. Consult a tax professional to ensure compliance and optimise your tax position.

There may be times when a provider of aged care or NDIS services (a provider) may need to seek the services of another provider. The need for additional staff to service clients, support services like client management and administrative assistance, or a specific client requiring a service offered by the second provider can all drive the need for the second provider. When a service provider enlists the assistance of another, the tax implications can change. This article will explain these potential tax implications and when they may arise.

Summary of Engagements With Other Providers

The following table outlines when an aged care or NDIS service provider engages with another provider.

| Arrangement | Description |

| Subcontractor | A provider may engage another provider (the subcontractor) to deliver staff and services directly to their clients. However, the provider remains legally responsible for all obligations under the aged care or NDIS legislation, even though the subcontractor performs the services. |

| Managed services | The provider offers client management services to another provider, such as: staff rostering;client onboarding;client invoicing; and other administrative support. However, they will not directly provide services to the second provider’s clients. |

| Brokerage and labour hire | A provider facilitates service delivery for a user through another provider. This often involves the provider engaging a second provider to find a worker. The provider then employs or engages that worker, who ultimately supports the provider’s clients. Alternatively, the provider can contract a service to source workers on a labour-hire agreement. |

Payroll Tax Considerations for Providers

Payroll tax is a state and territory-based tax that is imposed by the local revenue authorities. It applies to the amount of “wages” an “employer” pays to its “employees”. For providers, there are specific provisions in the payroll tax legislation that can:

- deem the provider an “employer”;

- deem service providers and sub-contractors, the provider engages and pays as “employees”; and

- deem amounts paid by the provider to its deemed employees as “wages”.

The deeming provisions in relation to providers are broadly outlined below.

| Payroll tax provisions | Overview | Deemed employer | Deemed employee | Deemed wages | Application to providers |

| Relevant contracts | A relevant contract broadly arises when: 1. there is a contract, undertaking or arrangement from one person to another person or entity; or 2. the person provides services for or in relation to the performance of work. | The recipient of the services under the relevant contract. | The provider of the services under the relevant contract. | Payments by the deemed employer to the deemed employee under the relevant contract. | May apply where a provider is engaging any contractor to provide services to them. This is the case whether the contractor is engaged as a sole trader or company. |

| Employment agents | An employment agency contract broadly arises where a person (the employment agent) engages the services of another person (the service provider) for a client of the employment agent. | The employment agent under the employment agency contract. | The service provider under the employment agency contract. | Payments by the employment agent to the service provider. | May apply where the provider is procuring the services of another service provider, such as in subcontractor arrangements. |

While exemptions exist for relevant contract provisions, none apply to employment agency provisions. However, these regulations are inapplicable when a direct employment relationship forms between the service provider and the client, as seen in brokerage arrangements. In contrast, if the client engages the service provider as a contractor, they must assess whether relevant contract provisions apply to that relationship.

Continue reading this article below the formPay as You Go (PAYG) Withholding and Superannuation Considerations for Providers

Common Law Employee

Engaging sole traders as contractors requires the provider to assess their classification as common law employees. This impacts the provider’s obligations under tax and Fair Work regulations.

The contract between the provider and sole traders is a key factor, especially concerning Fair Work obligations. The Australian Tax Office (ATO) may have additional criteria for tax purposes which look beyond the contract. Ultimately, the provider must consider the entire relationship, including:

- how much control it exercises over how the sole trader performs its work; and

- whether the sole trader has been engaged to achieve a result.

If the sole trader is deemed a common law employee of the provider, the provider may have to:

- withhold PAYG amounts on behalf of the sole trader; and

- pay the sole trader superannuation guarantee contributions.

Superannuation – Employee Extended Definition

Engaging a sole trader does not require PAYG withholding if tax authorities do not classify them as common law employees. However, superannuation obligations may arise. The extended definition of “employee” for super purposes can capture sole traders. This is especially the case when the sole trader works under a contract that is principally for their labour. Accordingly, the sole trader is not engaged to achieve a result and cannot delegate or subcontract the work.

In such cases, the provider becomes responsible for paying superannuation guarantee contributions on the sole trader’s behalf.

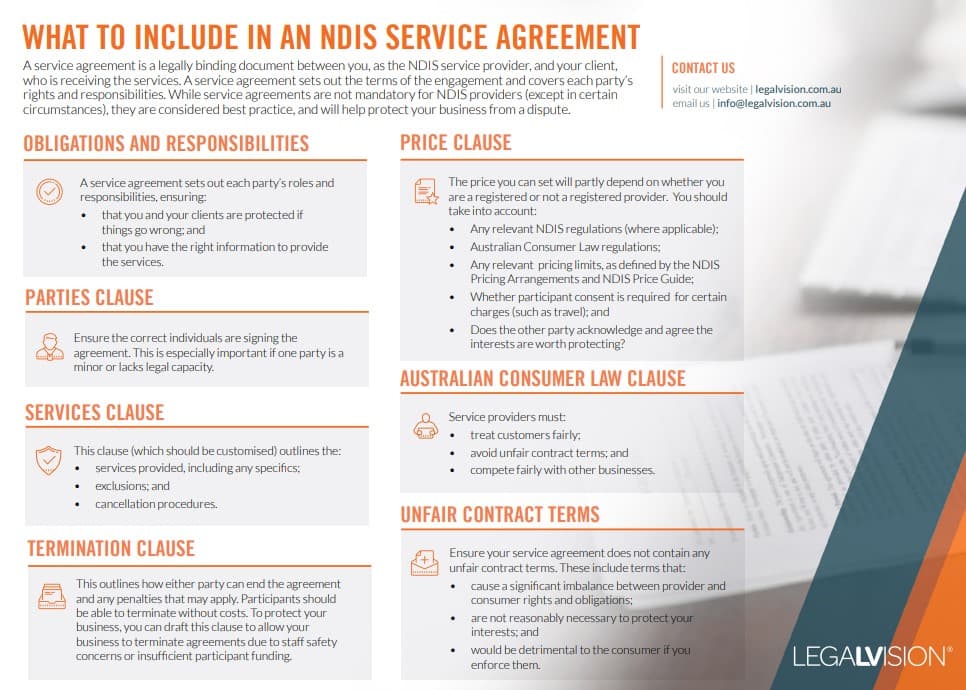

This fact sheet will help you to identify the key terms you must include in your NDIS service agreement.

Non-Sole Trader Contractors

Engaging a contractor who contracts through another entity, like a company or trust, does not automatically classify them as a common law employee for PAYG withholding and superannuation. However, payroll tax authorities may still consider payments made to the contractor under relevant contract or employment agent provisions.

Application to the Providers

Engaging a sole trader as a subcontractor or broker can bring about PAYG withholding and superannuation obligations for the provider. These obligations are not relevant when the provider is the service provider in a managed service arrangement.

Key Takeaways

Engaging another service provider raises several tax considerations for the provider. These depend on the arrangement between the parties, but can broadly include:

- payroll tax;

- PAYG withholding; and

- superannuation obligations.

The contractor’s business structure will further determine whether the provider is responsible for superannuation and PAYG withholding.

If you are a provider and require assistance in understanding your tax obligations, our experienced business tax lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

What tax obligations are relevant when a provider is engaging another provider to provide services?

Broadly, the essential taxes to consider are payroll tax, superannuation and PAYG withholding.

Is payroll tax payable when a provider is engaging contractors?

It can be, depending on the arrangement. There are provisions in the payroll tax legislation that can deem a provider as an employer and the second service provider as the provider’s employee. These are the relevant contract and employment agent provisions.

Are payments by providers to other providers who operate out of companies captured for payroll tax, superannuation and PAYG withholding?

Payments to companies will not trigger PAYG withholding or superannuation obligations for a provider. However, these payments may still be captured for payroll tax purposes.

We appreciate your feedback – your submission has been successfully received.