In Short

- Engaging contractors may classify them as employees for payroll tax purposes, potentially increasing your tax liability.

- Certain contractors might be deemed employees for superannuation, requiring you to make contributions on their behalf.

- Understand the GST status of your services and ensure correct income tax reporting to avoid penalties.

Tips for Businesses

Consult with a tax professional to navigate the complexities of payroll tax, superannuation, and GST obligations. Implement clear contracts and maintain thorough records to support your tax positions and ensure compliance.

On this page

- Payroll Tax

- Relevant Contract vs Tenancy Contracts

- Health Service Marketplaces

- Exemptions for Bulk Billing

- Pay As You Go (PAYG) Withholding and Superannuation

- Extended Meaning of “Employee” for Superannuation Purposes

- Income Tax and Goods and Services Tax (GST)

- Key Takeaways

- Frequently Asked Questions

Starting a health service, such as a general practice or allied health service, can be exciting. However, setting up such services can be complex because businesses must comply with additional regulations. In addition, health services need to be particularly wary of the tax implications of operating such services, especially as there have been a number of cases recently which show that health services are a particular focus area for revenue authorities. This article will explain the tax considerations health services should be aware of when starting.

Payroll Tax

Payroll tax is a state and territory tax that a business must pay to their local revenue office if the wages they pay to employees are over the payroll tax threshold in that state or territory. With the exception of Western Australia, each state and territory has “relevant contract” provisions in its payroll tax legislation. The broad effects of the relevant contract provisions are that where a business engages a contractor to provide services:

- the business may deem the contractor an “employee” of the business;

- the business deems itself the contractor’s “employer”; and

- the business considers any payments it makes to the contractor as “wages” for payroll tax purposes and includes them in its taxable wages for the relevant reporting period.

In the past few years, state and territory revenue offices have aggressively applied the relevant contract provisions in the medical industry. The courts ruled that doctors were employees of medical centres. The courts also classified payments from medical centres to doctors as wages. Despite the medical centres arguing that they were providing services to patients and not to the doctors, the courts disagreed and ruled that:

- seeing patients directly connected the doctors’ work to the medical centre’s business, making the doctors also provide services to the medical centre. Therefore, a relevant contract existed; and

- the amounts paid by the medical centre were considered wages, even though the doctors were otherwise entitled to receive the money paid to them by Medicare.

While the cases considered medical centres specifically, guidance from the revenue offices indicates that the principles would apply equally to any business providing medical services. This includes dentists, psychologists and other allied health professionals.

Relevant Contract vs Tenancy Contracts

The payroll tax implications for a health service depend on whether the arrangement between the service provider and the practice is a relevant contract or a tenancy contract. The difference is broadly:

- Relevant Contract: The practice generally engages the service provider to see patients on behalf of the practice. The practice usually maintains a high degree of control over how the service provider services the patients. The practice considers the patients as its own and views the service provider as providing services in and for the business of the practice, rather than viewing them as running their own business.

- Tenancy Contract: Sometimes known as a facilities and services agreement, involves a service provider leasing or licencing a space within a practice for the service provider to operate their practice. In this case, the service provider does not provide services to the practice. The service provider considers all patients to be its own patients, and the practice cannot control how the service provider operates its business.

A genuine tenancy contract would not be considered a “relevant contract” and would not be subject to payroll tax. However, the revenue authority would consider the agreement’s substance over its form, meaning the parties cannot call the arrangement a “tenancy contract” to escape payroll tax if the arrangement is that of a relevant contract in practice. In particular, patients of the service provider should pay the service provider directly, not the health service. The medical centre cases ruled that when a medical practice pays a doctor under a relevant contract, it treats the payment as “wages,” even if Medicare owes the money to the doctor.

Continue reading this article below the formHealth Service Marketplaces

While the recent cases and guidance from the state and territory revenue offices all considered payroll tax for brick-and-mortar medical practices, you can argue that these principles could apply to online marketplaces if those marketplaces facilitate medical services (Relevant Marketplace).

A recent NSW payroll tax case examined whether contracts between Uber and drivers using the Uber platform (the Drivers) constitute “relevant contracts” for payroll tax purposes, and if so, whether Uber’s payroll tax liability extended to payroll tax on amounts Uber paid to Drivers. In this case, the court originally held that the Drivers were providing services to riders, not Uber, and therefore, Uber’s payments were not “wages” for payroll tax purposes. In coming to its conclusion, the court focused heavily on the terms of the written contract between Uber and the Drivers.

Recent Updates

The Commissioner of State Revenue (Commissioner) appealed this case to the New South Wales Court of Appeal (NSWCOA). In August 2025, the NSWCOA overturned the original decision, concluding that the drivers were providing services to Uber as well as to the riders. This was in part because “transportation of riders to their destination (the driving service) is not merely of assistance to Uber in some indirect or collateral way. It clearly generates a financial benefit for Uber in the form of a service fee, and is the foundation of Uber’s business insofar as it concerns ridesharing.” This means that for payroll tax purposes:

- Uber is a deemed employer;

- the drivers are deemed employees; and

- the amounts paid or payable by Uber to the drivers are deemed wages.

While this case did not concern a Relevant Marketplace, it is the first payroll tax case to consider a gig economy platform. It is therefore likely that these implications will shape the structure of Relevant Marketplaces. As of the date of this article, Uber has not yet appealed the NSWCOA’s decision to the High Court, but it is likely to do so.

Exemptions for Bulk Billing

In response to the uncertainty created by the payroll tax cases for medical practices and stakeholder lobbying, the New South Wales, Victorian and South Australian Governments have introduced relief for medical practices that offer bulk billing. As of the date of this article, the other states and territories have yet to introduce equivalent measures.

New South Wales

Medical centres in New South Wales will receive the following payroll tax relief:

- for unpaid payroll tax liabilities that accrued before 4 September 2024, an exemption from payroll tax; and

- from 4 September 2024, a rebate for payroll tax arising from wages paid to contractor general practitioners (GPs) if the medical centre meets the following bulk billing thresholds:

- at least 80% of services if the medical centre is in metropolitan Sydney; or

- at least 70% of services if the medical centre is located elsewhere.

The government has legislated the above measures, which took effect as of the date of this article.

Victoria

The Victorian Government has announced that medical centres in Victoria will receive the following payroll tax relief:

- for unpaid payroll tax liabilities for wages paid to contractor GPs that accrued before 30 June 2024, an exemption from payroll tax;

- for medical centres that have not yet received payroll tax advice but have started paying payroll tax on wages paid to their contractor GPs from 1 July 2024, a further 12-month exemption on these payments through to 30 June 2025; and

- an exemption from payroll tax for payments made to contractor GPs and employee GPs for providing bulk-billed consultations from 1 July 2025.

At the time of writing, lawmakers have not legislated the above, nor have they released draft legislation.

South Australia

The South Australian Government has announced that medical centres in South Australia will receive an exemption from payroll tax on the wages of GPs (contractors and employees) related to bulk-billed services from 1 July 2024. The exemption will calculate the proportion of bulk-billed items compared to the total number of billed items by GPs. This percentage deduction will reduce the medical practice’s total annual GP wages bill.

The government planned to table the legislation for the above exemption as part of South Australia’s 2024-25 Budget on 6 June 2024.

As of the date of this article, the legislation has not been released or enacted.

Pay As You Go (PAYG) Withholding and Superannuation

If your health service has workers, you must consider whether those workers are employees for PAYG withholding and superannuation purposes. These workers are employees, whether they are casual, permanent, or fixed-term. They are also employees for PAYG withholding and superannuation purposes.

This means that you must withhold amounts from payments to them under the PAYG system and make minimum superannuation contributions to the workers’ nominated superannuation fund.

If any of your workers are sole trader contractors, you must consider whether they should be classified as a common law employee or genuine contractor for tax purposes. The broad factors that the ATO, a court and a tribunal would consider in addressing this question are:

- the degree of control the health service has over the worker;

- how integrated the worker is into the health service’s business;

- whether the worker is engaged to achieve a specific result;

- which party bears the ultimate risk of carrying out the work;

- whether the work can be delegated/subcontracted;

- which party is responsible for providing the tools, equipment, etc., required to complete the work;

- which party is responsible for business expenses while completing the work;

- whether the worker is subject to any restraints and exclusivity arrangements;

- whether the worker is entitled to common law employment entitlements (e.g. annual/sick leave); and

- whether the worker needs to wear a uniform.

Extended Meaning of “Employee” for Superannuation Purposes

Contractors who provide services to your health service may still have a right to superannuation, even if they are not classified as common law employees. This is because the term “employee” has an extended meaning for superannuation purposes. It broadly examines whether the health service engages the contractor principally for their skills and labour. To determine if this extended meaning is met, the ATO, a court, or a tribunal will examine whether the contractor is hired to deliver a specific result and whether the contractor is allowed to delegate the work to another person.

Income Tax and Goods and Services Tax (GST)

There can be income tax implications if your health service intends to act as a “payment agent” for any service providers. This payment agent arrangement may arise if, for example, your health service entity collects amounts payable to the service provider (either from patients directly or from Medicare), keeps a percentage (usually a service fee) and passes the rest on to the service provider.

The income tax implications of this arrangement mean that the total amount received by the health service may be treated as the health service’s income. In reality, 100% of the amount should be considered the service provider’s income, while the percentage retained by the health service should be treated as its income. This can be especially risky for the health service where the patient receives an invoice from the health service, which contains the health service’s, and not the service provider’s, ABN.

The above can also cause complications from a GST perspective. Issues that can arise are whether the health service correctly charges GST on any “service fee” and correctly reports in its business activity statements.

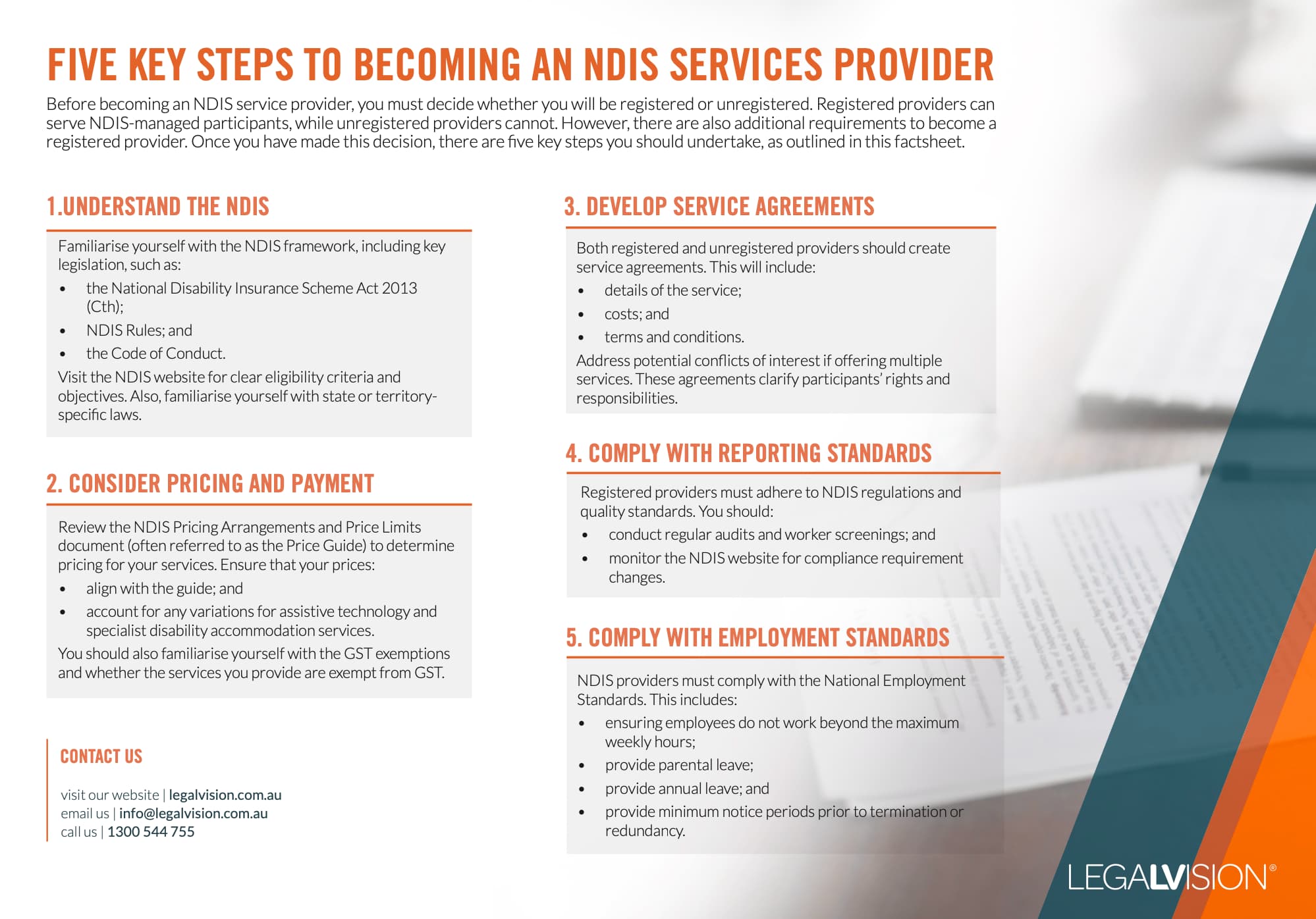

Understand five key steps you should know to become an NDIS service provider with this free LegalVision factsheet.

Key Takeaways

Starting a health service can be an exciting experience. However, a health service operator needs to know the regulatory landscape when operating a business in this space. Relevantly, there are many tax considerations when establishing a health service, with payroll tax, in particular, being a key focus area for health services. Other taxes relevant to health services include superannuation, PAYG withholding, income tax, and GST. Each of these needs specific consideration to determine how they apply to the particular health service.

If you are planning to start a health services business, want to avoid paying more tax than necessary and make sure you meet your obligations, our experienced tax lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Revenue offices often classify contractors, such as doctors, as employees for payroll tax purposes if their work is integral to the practice’s business. They may treat payments to these contractors as wages, which creates payroll tax obligations.

Health services should ensure tenancy contracts clearly state that providers operate independently and patients pay the provider directly. Labelling arrangements closely resembling relevant contracts as tenancy agreements will not remove payroll tax obligations.

We appreciate your feedback – your submission has been successfully received.