In Short

-

Sole Trader: Simple to set up and manage, offering full control and access to all profits. However, you bear personal liability for all business debts and obligations.

-

Partnership: Allows sharing of responsibilities and resources with one or more partners. All partners are jointly liable for the actions and debts of the business.

-

Key Consideration: Choose a structure that aligns with your business goals, risk tolerance, and preference for control versus shared responsibility.

Tips for Businesses

When deciding between a sole trader and partnership structure for your counselling service, assess your capacity to manage responsibilities and risks. If you prefer autonomy and simplicity, a sole trader setup may suit you. If you value collaboration and shared duties, consider a partnership. Seek legal advice to support your choice.

If you are looking to set up a community or welfare counselling service, there are some factors to consider before you establish the business. Choosing a business structure is one of the most crucial decisions you will make in running your business. Therefore, you must be aware of all the business structures available to you before making this decision. Non-employing enterprises (sole traders or partnerships) account for over 70% of all enterprises in the industry, although this has declined marginally in the past five years. This article will explore both types of non-employing enterprises.

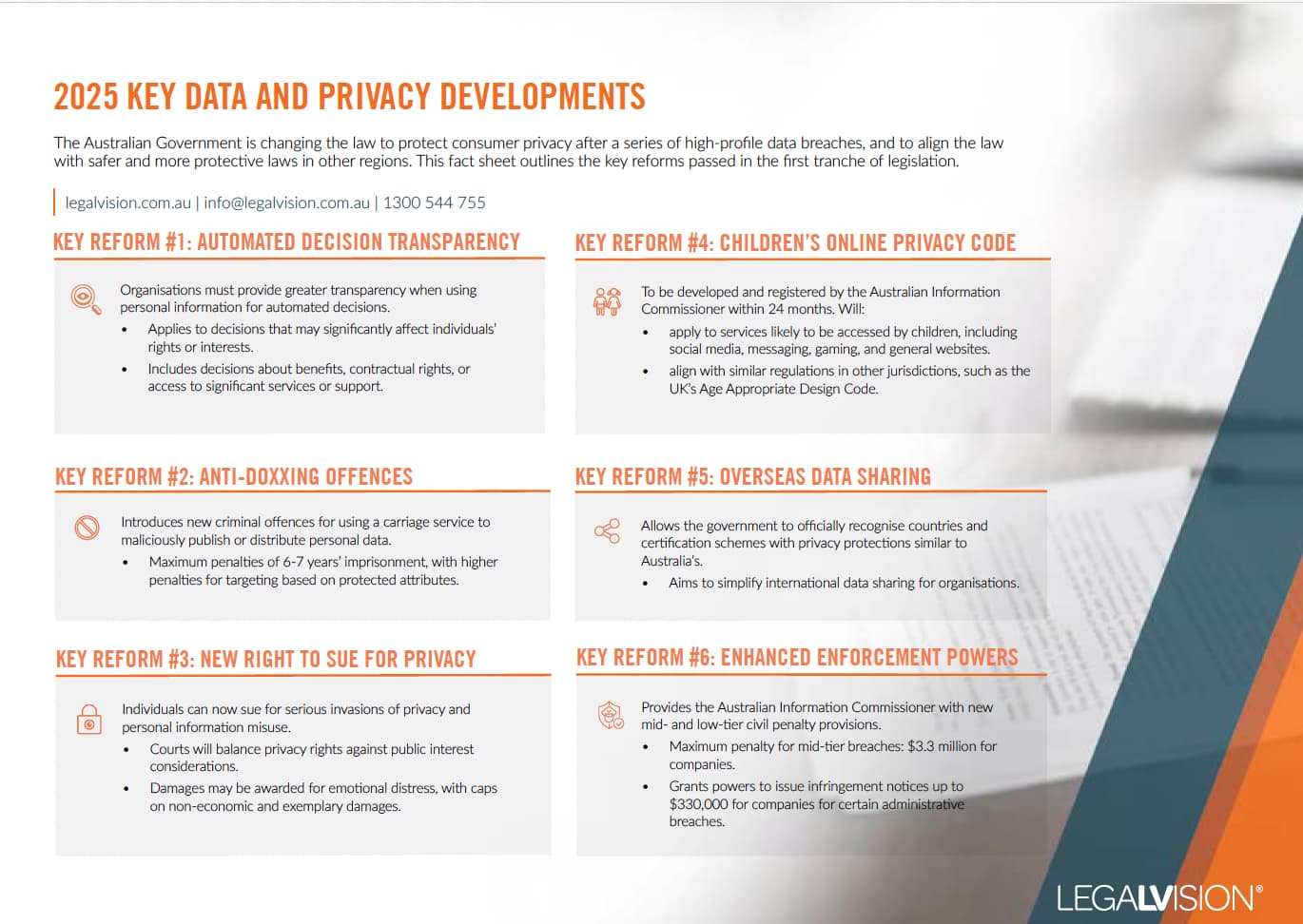

This fact sheet outlines the Australian Government’s strengthened consumer privacy laws in 2025 following major data breaches and their alignment with global standards.

Counselling Services as a Sole Trader

One option available to your counselling business is to become a sole trader. This is by far the most straightforward structure to set up and manage on a day-to-day basis. It means you have access to all profits and complete control of the business.

Many business owners find that they run a business best when they can choose exactly how much or how little capital is required at any given time. Therefore, because a sole trader is indistinguishable from the individual owner in the eyes of the law, this business structure will allow you to spend your profits in any way that you desire.

However, it must be remembered that if you choose a sole trader business structure for your counselling service, you will incur personal liability for any dealings you enter into. Consequently, if you sign a deal that proves to be disastrous for your business, you must pay for it from your finances. Some business owners find this pressure to be overwhelming. Ultimately, deciding if a sole trader business structure is best for your counselling service will be up to you.

Setting up a Counselling Partnership

Another business structure available to your counselling service is that of a partnership. Partnerships require you to go into business with another person or other persons, with whom you share liability for the business.

The advantages of a partnership business structure include its ease of setup. Also, it will allow you to combine your resources and expertise with that of other counsellors, thereby providing you with a significant advantage over someone working as a sole trader. Finally, there is much greater flexibility within a partnership than in other business structures involving two or more people, as profits and investments can be split subject to the agreement of all partners.

However, when you enter into a partnership agreement, all partners agree to be financially liable for the actions of each other’s partners within the course of conducting business. Consequently, it is imperative that you only enter into a partnership with people whom you trust to have your best interests at heart.

Continue reading this article below the formLegal Considerations for Counselling Services

Regardless of whether you choose to operate as a sole trader or in a partnership, there are several legal aspects that counsellors must consider when establishing their practice. Firstly, ensure compliance with the Health Practitioner Regulation National Law, which governs the registration and accreditation of health practitioners in Australia. While counsellors are not currently required to be registered under this law, adhering to its principles can enhance your professional standing.

Privacy Laws

Privacy laws are particularly crucial in the counselling field. Familiarise yourself with the Privacy Act 1988 (Cth) and the Australian Privacy Principles, which outline your obligations regarding the collection, use, and disclosure of clients’ personal information. Implement robust data protection measures and develop clear privacy policies for your practice.

Client Agreements

Consider drafting a comprehensive client agreement that outlines your services, fees, cancellation policies, and confidentiality obligations. This can help prevent misunderstandings and provide legal protection. A well-drafted partnership agreement is essential for partnerships, covering aspects such as profit sharing, decision-making processes, dispute resolution, and exit strategies.

Indemnity Insurance

Professional indemnity insurance is vital for counsellors, protecting you against claims of negligence or breach of duty. Research insurance options tailored to mental health professionals and ensure adequate coverage for your specific practice.

Workplace Health and Safety Laws

If you operate from a physical location, be aware of your obligations under workplace health and safety laws. Implement appropriate safety measures and risk management strategies to protect yourself and your clients. For those offering telehealth services, consider the legal implications of providing counselling across state or international borders. Each jurisdiction may have different regulations governing the provision of mental health services.

Recent Changes

Lastly, stay informed about any changes to laws or regulations affecting the counselling industry. Joining professional associations can help you stay up-to-date with legal requirements and best practices. Regular consultations with a legal professional can ensure ongoing compliance and protection for your counselling business.

Key Takeaways

The advocacy and counselling services industry is booming. If you are looking to start your counselling service or expand your already existing counselling service, you should begin to consider which business structure will work best for you. A partnership business structure will allow you to pool resources with multiple counsellors. Alternatively, running a sole trader business will give you complete control over your counselling business.

If you have any questions about setting up a new business, our experienced business lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

What are the risks associated with being a sole trader?

As a sole trader, you are personally liable for all business debts and obligations. This means that personal assets, such as your home or savings, could be at risk if the business incurs debt or legal issues.

What should be considered before entering into a partnership?

It’s crucial to choose partners you trust, as each partner is jointly and severally liable for the actions of the others. Establishing an explicit partnership agreement outlining roles, responsibilities, profit sharing, and dispute resolution mechanisms is essential to prevent conflicts and ensure smooth operation.

We appreciate your feedback – your submission has been successfully received.