In Short

-

A sole trader business ends when the owner dies, as it is not a separate legal entity.

-

All business assets and debts become part of the deceased’s estate and are managed by the executor.

-

With proper planning, the business may be sold or passed on under a new structure.

Tips for Businesses

Sole traders should have a valid will, appoint a capable executor, and consider a succession plan. Keep business records organised and up to date. Planning ahead helps avoid confusion, reduces stress for loved ones, and allows the business to be sold or continued more easily after your death.

As a sole trader, you have poured your heart and soul into building your business. But have you considered what would happen if you were to pass away unexpectedly? This article examines the legal implications and processes that arise when a sole trader passes away, offering essential information for business owners and their families.

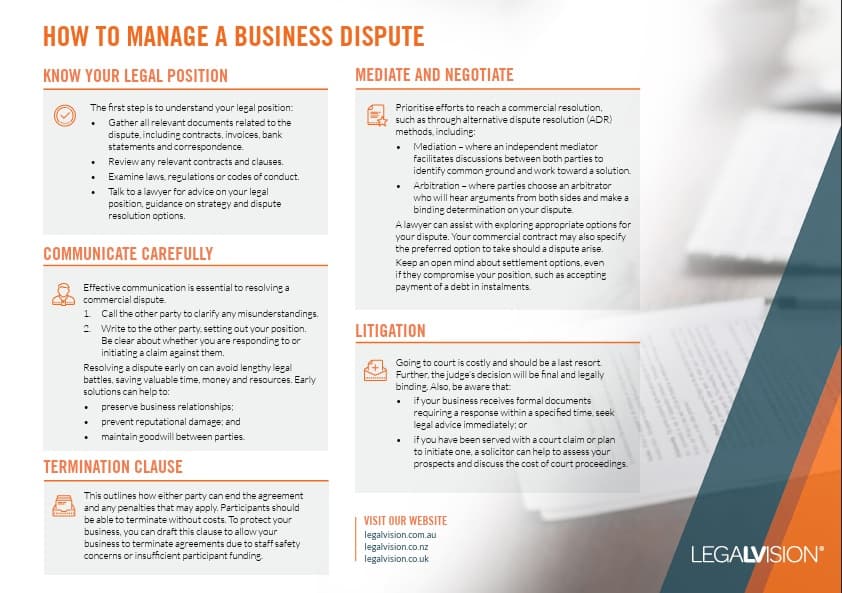

Learn how to manage and resolve your business disputes effectively.

Understanding Sole Trader Structures

Before we dive into the consequences of a sole trader’s death, let us recap what a sole trader structure entails. In Australia, a sole trader is an individual who runs a business under their own name. Unlike companies or partnerships, there is no separate legal entity. The business and the individual are one and the same for legal and tax purposes.

This lack of separation has significant implications when the sole trader passes away, as the business itself doesn’t continue as a distinct legal entity.

What Happens Immediately After a Sole Trader’s Death?

When a sole trader dies, several immediate consequences come into play:

- the business operations cease, as the business is not a separate legal entity and cannot continue to operate in its current form;

- all business assets and liabilities become part of the deceased’s estate;

- any authority to operate bank accounts, make business decisions, or enter into contracts on behalf of the business immediately ceases; and

- the Australian Business Number (ABN) associated with the sole trader becomes inactive, and final tax returns must be lodged.

The Executor’s Role

The executor of the deceased sole trader’s will plays a crucial role in managing the business affairs after death. Their responsibilities include:

- identifying all business assets and liabilities;

- notifying relevant parties, including the Australian Taxation Office (ATO), banks, creditors, debtors, customers, and suppliers;

- managing ongoing obligations, such as fulfilling outstanding contracts;

- finalising tax affairs; and

- distributing assets according to the will or intestacy laws.

Dealing with Business Assets and Liabilities

The treatment of business assets and liabilities is a key concern when a sole trader passes away:

- all business assets, including equipment, inventory, and intellectual property, form part of the deceased’s estate;

- business debts become debts of the estate and must be paid before any distribution to beneficiaries;

- the executor may need to negotiate the termination or transfer of ongoing contracts and leases; and

- business bank accounts are frozen upon notification of death, and the executor will need to work with the bank to access funds for paying outstanding debts and winding up the business.

Can the Business Continue?

While the sole trader structure cannot continue after the owner’s death, there are options for the business to continue operating under a different structure:

- the executor may sell the business as a going concern if it’s viable and there’s market interest;

- if provided for in the will, the business assets could be transferred to beneficiaries who may choose to continue the business under a new structure; and

- if planned in advance, the sole trader may have arrangements in place to convert the business to a company structure upon their death, allowing for a smoother continuation.

Estate Planning Considerations for Sole Traders

Given the complexities involved when a sole trader dies, proper estate planning is crucial:

- have a valid, up-to-date will that clearly outlines your wishes for the business;

- appoint a suitable executor who has the skills and knowledge to manage your business affairs;

- consider developing a succession plan, which might involve gradually transitioning the business to a family member or key employee;

- appoint an enduring power of attorney who can make decisions about your business if you become incapacitated;

- consider taking out life insurance to provide funds for paying off business debts or compensating family members who don’t inherit the business; and

- keep clear records of business operations, contracts, and financial information to assist your executor.

Key Takeaways

The death of a sole trader has significant implications for the business and the deceased’s estate. Without proper planning, it can lead to confusion, financial stress for beneficiaries, and the potential loss of business value. Here are the key points to remember:

- a sole trader business cannot continue operating in its current form after the owner’s death;

- all business assets and liabilities become part of the deceased’s estate;

- the executor plays a crucial role in managing the business affairs and winding up the business;

- there are options for the business to continue under a different structure, but these require advanced planning; and

- proper estate planning is essential for sole traders to ensure a smooth transition of business assets and minimise stress for their loved ones.

It is strongly recommended that sole traders seek professional legal and financial advice to develop a comprehensive estate plan that addresses their unique business circumstances. This foresight can make a world of difference in protecting the legacy you’ve worked so hard to build.

If you need assistance with estate planning for your sole trader business, our experienced business lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

No. A sole trader business cannot legally continue after the owner’s death because the business and individual are the same legal entity.

All business assets and debts become part of the deceased’s estate. The executor must manage and distribute them according to the will or intestacy laws.

We appreciate your feedback – your submission has been successfully received.