When a business owner sells their company, they have two options: a share sale or asset sale. A share sale is where the shareholders sell their shares, giving majority control to the new owner. Conversely, an asset sale is where the company sells their assets such as client lists, trade marks and equipment to the new owner. This article describes the differences between share and asset sales from a tax perspective.

Benefits of a Share Sale

Traditionally, advisers have shown a strong bias towards an asset purchase rather than a share purchase due to possible ‘skeletons’ in the target company. As such, share sales represented a relatively small percentage of total business exits as no one was willing to purchase them.

However, this aversion to purchasing shares appears to be changing, at least in relation to tech-based companies where:

- there are no potential manufacturer or product liability claims; and

- appropriate indemnities and warranties protect purchasers.

The added benefit for vendors in exiting by way of share sale is the potentially significant difference in the after-tax return compared to an underlying asset sale.

Taxation in a Share Sale or Asset Sale

Assuming that the shares are held on capital account, rather than as trading stock or otherwise on revenue account so as to be taxed as ordinary income, the disposal of shares triggers capital gains tax (CGT).

The relevant capital gain is generally the difference between the amount paid for the shares, less the cost base of those shares. However, certain taxpayers, including individuals and trusts (but not companies), may be eligible to apply the 50% CGT discount. This means that they halve the gross capital gain before including it in their assessable income. This can allow individuals making a share sale to pay half as much tax as a company asset sale.

Continue reading this article below the formShare Sale or Asset Sale: An Example

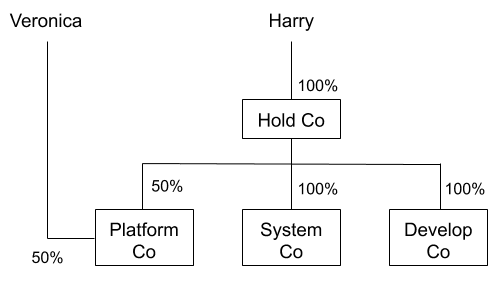

Veronica and Harry are co-founders of Platform Co. Veronica holds her 50% share personally. Conversely, Harry holds his 50% through a holding company that also invests in other startups.

Veronica has held the shares in Platform Co for at least 12 months (one of the conditions for the 50% CGT discount). She then negotiates a share sale to minimise her CGT liability.

Conversely, as Harry holds his shares in Platform Co via Hold Co, and companies are ineligible for the 50% CGT discount, this causes the following difference in the taxable capital gain between a share sale and asset sale:

| Veronica | Harry | |

| Cost base of Platform Co shares | $10,000 | $10,000 |

| Sale proceeds | $2,000,000 | $2,000,000 |

| Gross capital gain | $1,990,000 | $1,990,000 |

| Less 50% CGT discount | $995,000 | N/A |

| Net capital gain | $995,000 | $1,990,000 |

Hold Co’s Tax Payment

Hold Co will pay tax at the prevailing corporate tax rate (either 30% or the applicable small business rate). The amount representing the capital gain at the Hold Co level may be paid out by way of fully franked dividend. Assuming that Harry is already at the top marginal tax rate (currently 45%), he will also pay ‘top-up tax’ on the difference between:

- his personal tax rate; and

- the amount already paid at the company level.

| Veronica | Hold Co/Harry | |

| Net capital gain | $995,000 | $1,990,000 |

| Individual tax on net capital gain (assuming 45% marginal tax rate) | $447,750 | N/A |

| Corporate tax on net capital gain (assuming 30% corporate tax rate) | N/A | $597,000 |

| Dividend income | N/A | $1,990,000 ($1,393,000 in cash and $597,000 in franking credits) |

| Individual tax on dividend income (assuming 45% marginal tax rate) | N/A | $895,500 |

| Franking credit/offset | N/A | $597,000 |

| Individual top-up tax payable | N/A | $298,500 |

| Total tax payable on gross capital gain (excludes levies) | $447,750 | $895,500 |

As you can see, Hold Co and Harry pay twice as much tax as Veronica.

Never Forget the Small Business CGT Concessions

Separate to the general 50% CGT discount, there are small business CGT concessions. This can have a significant influence on the question of share sale or asset sale.

| Concession | Explanation |

| The 15-year exemption | Provides a complete exemption from CGT where, among other things, a business has been operated for at least 15 years |

| 50% active asset reduction | Operates in addition to the general 50% CGT discount where available for a combined 75% reduction in the gross capital gain |

| Small business retirement exemption | Allows eligible taxpayers to reduce their capital gain up to the $500,000 lifetime limit – although individuals under 55 years old are required to contribute the amount sheltered from tax under the retirement exemption to a complying superannuation fund |

| Small business rollover relief | Provides an automatic two-year tax deferral during which time, the taxpayer may acquire a replacement active asset to defer the taxing point further |

Key Takeaways

The type of business exit — either a share sale or asset sale — has a significant impact on the after-tax gain. Business owners should consider negotiating a share sale where appropriate to access the 50% CGT discount. Further, never forget to consider the availability of the small business CGT concessions. These can reduce or even eliminate any CGT on the capital gain altogether.

To achieve the best outcome, speak to your advisers early in the exit process to:

- canvass the various exit options;

- identify the relevant tax outcomes for each exit option; and

- craft an appropriate negotiation strategy with prospective purchasers to deliver the desired result.

If you need further advice on tax implications when you sell your business, call LegalVision’s taxation lawyers on 1300 544 755 or fill out the form on this page.

We appreciate your feedback – your submission has been successfully received.