As an NDIS service provider, it is essential to be aware of the differences between the types of NDIS participants. This ensures that you are providing them services appropriately and protecting yourself and the business simultaneously. Generally, there are legal considerations that will apply regardless of the type of NDIS participant you work with. However, only a registered NDIS provider will be able to provide services to NDIS-managed participants. This article discusses what it means to be working with self-managed NDIS participants and the important considerations you must factor in.

Types of NDIS Participants

| Type of NDIS participant | Description |

| Self Managed | A participant manages their own NDIS funding. This gives a participant the flexibility and choice to decide what support they would like to have. |

| Plan Managed | A participant works with a service provider, also known as a plan manager, to manage their NDIS funding. The plan management provider assists the participant by purchasing supports on behalf of the participant from either registered or unregistered providers. |

| NDIS Managed | A participant works with a service provider, also known as a plan manager, to manage their NDIS funding. The plan management provider assists the participant by purchasing support on behalf of the participant from either registered or unregistered providers. |

The NDIS provides further guidance on the ways to manage funds, which a participant can consider.

Working With Self-Managed NDIS Participants

Drawing Up a Service Agreement

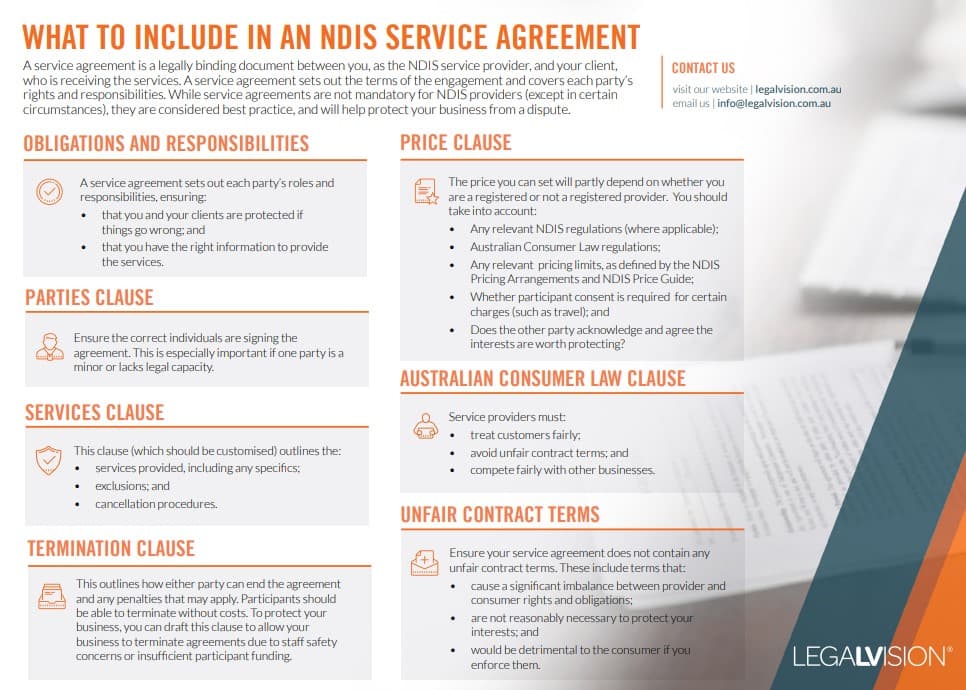

While it is only mandatory to have a written service agreement where you provide Specialist Disability Accommodation support, it is recommended that a service agreement is in place between you and the self-managed participant.

This is especially useful when dealing with self-managed participants, as it provides clarity and certainty for both parties in the supports and services that will be provided to them. In addition, you can specify how much the participant will have to pay in exchange for the supports and services.

Some other key terms that the service agreement will help capture include:

- the expectations of the participants and you as a service provider; and

- the rights of participants under the Australian Consumer Law.

The service agreement can also outline essential processes, such as what happens in the event that a participant is unhappy and would like to make a complaint. This allows you, as the service provider, to outline your complaint process. Conversely, it also enables you to ensure participants treat you and your staff fairly by placing obligations on them when you are providing services and support to them.

Invoicing and Payment

Self-managed participants will be responsible for requesting invoices from service providers and processing payments through the NDIS participant portal. When working with a self-managed participant, it is important to:

- keep a clear record of invoices you issue;

- issue invoices on a regular basis; and

- follow up with unpaid invoices consistently

This is important to mitigate the risk of non-payment by the participant due to their oversight. It is recommended that you work closely with the participant to ensure that any billing issues can be promptly resolved.

It is also vital to ensure you keep a clear record of invoices you issue, as the self-managed participant will be personally responsible for any payment audits required. This allows you to assist the participant in an audit if necessary. Likewise, it also safeguards you should any issues arise during an audit.

Authority of Individual Executing Legal Documents

It is essential to confirm the authority of the individual executing any legal documents. Suppose the self-managed participant is nominating an authorised representative to sign on their behalf. In that case, you should ensure you list the details of the authorised representative clearly in the service agreement.

This eliminates ambiguity when executing documents, as the appropriate person must sign off on requests or agree items between the parties. Likewise, this safeguards you as the provider and ensures the correct parties have entered into the agreements.

This fact sheet will help you to identify the key terms you must include in your NDIS service agreement.

Key Takeaways

As an NDIS service provider, it is essential to be aware of the different needs of each participant you work with. This will help you plan as a provider in providing the services and supports they need while adequately safeguarding yourself as a business as well. Keeping these considerations in mind will help put you in a better position to work with self-managed participants and provide the appropriate care to them.

If you require advice on the NDIS services you intend to provide, our experienced NDIS lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.