As the fintech landscape continues to evolve, companies offering innovative financial products must navigate regulatory frameworks to ensure compliance. In Australia, one crucial aspect that fintech businesses need to be aware of is the regulation surrounding holding cash or other assets in custody or trust. While offering these services can be beneficial for clients and lucrative for your business, it is essential to understand that such activities may trigger licensing requirements under Australian law. This article explores when you require an Australian Financial Services Licence when holding cash or assets on trust.

When Do You Need An Australian Financial Services Licence?

In Australia, the Australian Securities and Investments Commission (ASIC) regulates the provision of financial services. Under the Corporations Act 2001, any person or entity that carries on a business of providing financial services must hold an Australian Financial Services Licence (AFSL), unless exempt. The definition of ‘financial services’ is broad and includes, among other things, providing a custodial or depository service.

What is a Custodial or Depository Service?

A business provides a custodial or depository service if it holds:

- a financial product for a client or their nominee; or

- a beneficial interest in a financial product for a client or their nominee.

Accordingly, whether your business is providing a custodial or depository service depends entirely on two key issues. Firstly, whether your business holds anything on trust or custody. Secondly, if yes, whether it is a financial product you hold on trust or custody. If so, you will be providing a custodial or depository service.

Under the Corporations Act 2001, a ‘financial product’ is a facility through which a person makes a financial investment, manages financial risk or makes non-cash payments. This broad definition includes:

- shares;

- options;

- securities;

- debentures;

- bonds;

- units in unit trusts;

- interests in a managed investment scheme;

- margin lending products;

- non-cash payment facilities;

- bank deposit accounts; and

- any product with similar functions to any of the above.

Are There Any Exemptions?

The following activities, however, are not custodial or depository services:

- providing services to a related company;

- operating a clearing and settlement facility;

- operating a registered scheme;

- operating certain foreign passport funds; and

- operating certain superannuation or deposit funds.

What Are Some Examples?

Let us explore some key examples.

Asset Management Companies

An asset manager holds and manages investment portfolios on behalf of individuals, institutional investors, or other entities. This is likely a financial service. Accordingly, the asset manager would need to hold an AFSL.

Online Brokerage Platforms

Some online brokerage platforms hold client funds and the financial products purchased with those client funds in escrow. Both the funds and the financial products are released upon completion of the transaction. The holding of financial products (and not the holding of funds) is likely a financial service, and the online brokerage platform would need to hold an AFSL.

Cold Storage

Some crypto businesses hold certain crypto assets of their users in cold storage. Suppose these crypto assets are financial products. For example, they are a facility through which someone can make a financial investment. In that case, the crypto business would need to hold an AFSL.

Online Marketplace

An online marketplace allows buyers and sellers of physical products, such as artwork and collectibles, to connect. The marketplace holds funds in Australian dollars in escrow until the buyer receives the physical product. As the funds are in Australian dollars, it is not considered a financial product and the online marketplace is not considered to be providing a custodial or depository service.

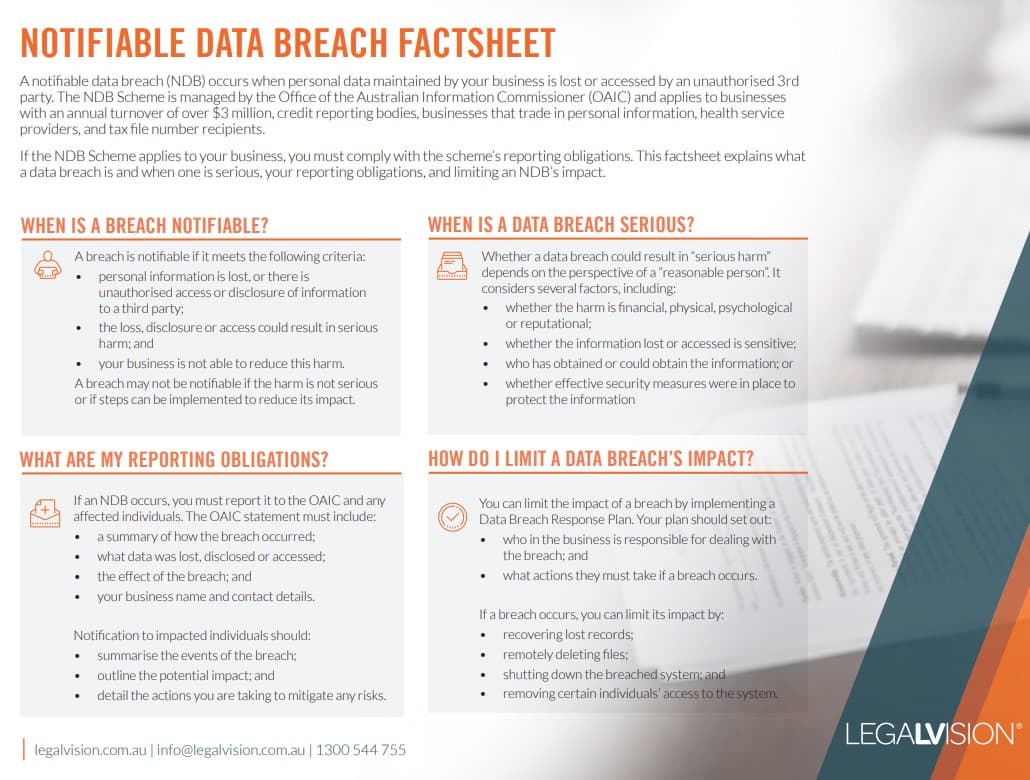

This factsheet explains what a data breach is and when one is serious, your reporting obligations, and limiting an NDB’s impact.

Key Takeaways

Understanding the financial regulatory landscape is paramount for businesses that hold cash or other assets in custody or trust. If what you hold on custody or trust is a financial product, you will be classified as providing custodial or depository services. Accordingly, you must hold an Australian Financial Services Licence (AFSL) or be authorised under another entity’s AFSL. Such services involve holding shares, options, securities or beneficial interests in them for clients.

In navigating these complexities, seeking legal guidance from experts like LegalVision can provide clarity and ensure compliance with regulatory requirements. Our experienced FinReg lawyers offer tailored advice and support to help fintech businesses thrive in the Australian market.

If you need assistance with your financial regulatory needs, our experienced fintech lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.