In NSW, the NSW Industrial Relations agency regulates retail trading hours for businesses, including public holidays. The regulation of trading hours aims to prevent unfair advantages by restricting trading hours on certain holidays and attempts to ensure that employees can take time off during these holidays. Unless your business is exempt, you cannot trade on:

- Christmas day;

- Boxing day;

- ANZAC day before 1 pm;

- Good Friday; and

- Easter Sunday.

This article outlines the exemptions that may apply to your business, allowing you to trade on restricted trading days.

Exemptions to Trade on Restricted Days

As a business owner, you may request an exemption so that your business can trade on restricted days by applying to the NSW Industrial Relations Agency. Your application will only be approved if it is in the public interest to do so. Additionally, the agency will consider if there are any other exceptional circumstances and:

- the nature of your shop and the kind of goods that you sell;

- if there is a special need for your shop to be open on the particular restricted days;

- if there will be any potential effects of the exemption upon local businesses in the area; and

- if there will be any effects on the employees required to work on the restricted days.

What Types of Business Are Exempt?

Your business may be exempt if it classifies as a:

- pet shop;

- nursery;

- newsagency;

- bazaar;

- book store;

- chemist shop;

- florist;

- seafood shop;

- fruit and vegetable shop;

- music store;

- restaurant;

- cafe;

- souvenir shop;

- shop that is near a venue used for physical recreation;

- take-away food and drink store;

- tobacconist;

- vehicle service centre; or

- petrol station.

If your business does not receive an exemption, there is a conditional exemption for all businesses only on Boxing Day, where the shop is staffed exclusively by employees who have freely elected to work on that day. Therefore, on the presumption that your business can be staffed by employees who voluntarily work on Boxing Day, no express exemption is required.

Exemptions to Small Shops

If your business is a small shop, you may also be exempt from the requirements to suspend trading on restricted days. Your business may classify as a small shop if it:

- is owned by a maximum of two people or one corporation; and

- has a maximum of four regular employees.

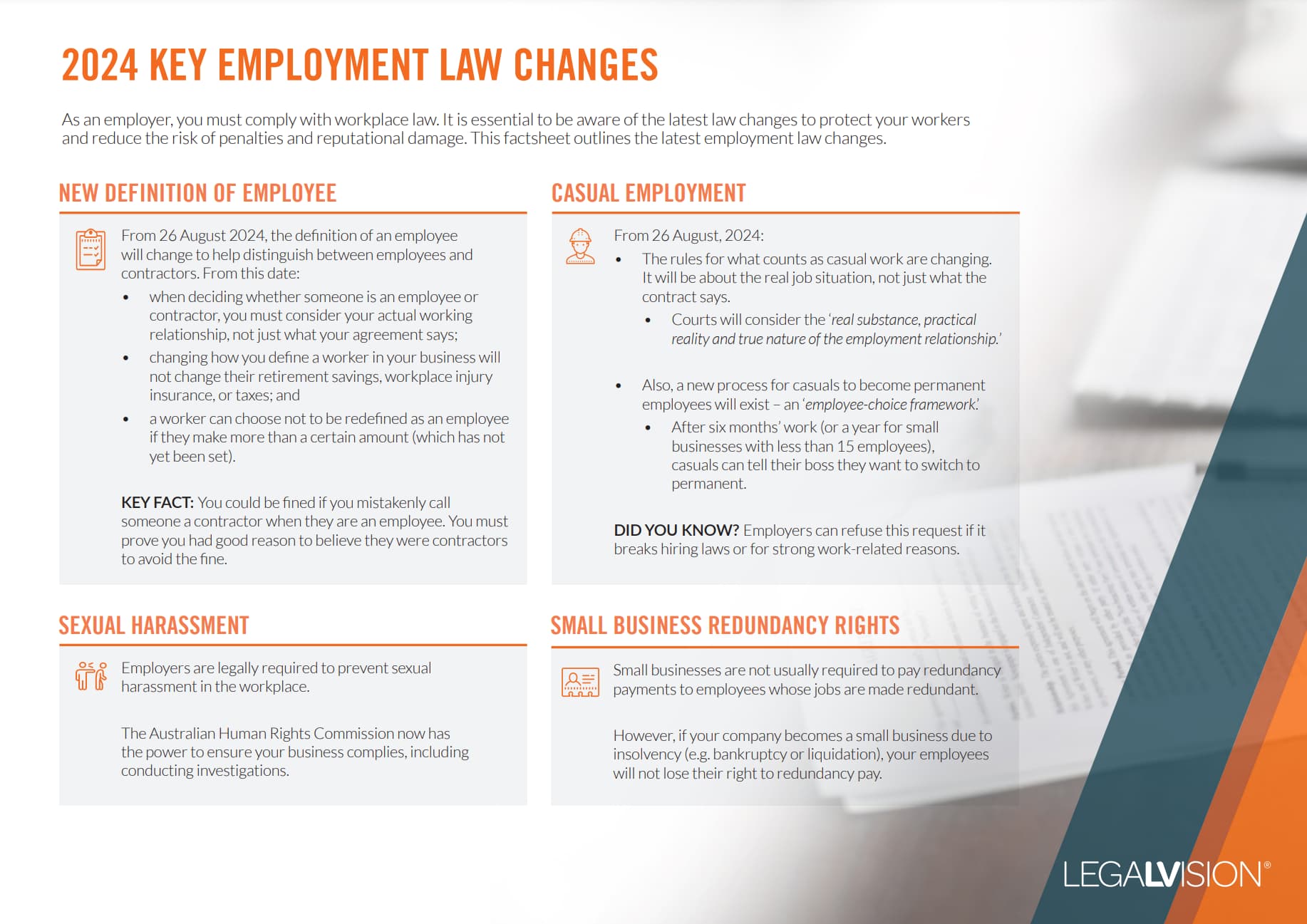

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Call 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Voluntary Employee Arrangements

Where your business has obtained an exemption, you must mutually agree with your employee in order for them to work. You must make this agreement without any:

- coercion;

- harassment;

- threats; or

- intimidation.

You cannot require your employee to attend work on a restricted trading day simply because you had rostered them to work on that day. Additionally, if the employee originally agrees to work on a restricted trading day and then withdraws their consent, you cannot lawfully force them to work or take action against them.

If you require an employee to work on restricted trading days, you may face penalties. If you force an employee to work under duress, the employer may be fined up to $11,000 per employee.

Additionally, landlords cannot force retailers to be open on a restricted trading day. If you are a landlord, you may face a fine of up to $22,000 for forcing a retailer to stay open.

Key Takeaways

You should always ensure that your business complies with laws surrounding when you are legally able to trade. It is crucial that, unless your business is exempt, you do not trade on specific public holidays. If you force an employee to work these days, even where you obtain an exemption, you may receive an $11,000 fine per employee.

If you have any questions about your responsibilities as an employer, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.