Unlike a company where ownership is separated into shares of the company owned by the Shareholders, in a partnership, the partners jointly own the business. Therefore, there is no separate legal entity like a Company in which the partners can hold a specific share.

What is a Partnership?

A partnership is a legal relationship between generally two to 20 people who enter into the relationship with the purpose of operating a business. In a partnership:

- partners jointly own the business and are entitled to a percentage of it assets and revenue;

- there is no separate legal entity (unlike a company) in which partners can hold shares;

- partners have personal liability for the business’s debts; and

- a Partnership Agreement typically outlines each partner’s rights.

Key Features of Partnerships

- Setup: Relatively cheap and easy compared to forming a company.

- Liability: Partners have unlimited personal liability for business debts.

- Management: Partners generally share control and management of the business.

- Maximum Partners: Partnerships are limited to 20 partners in Australia.

What is a Partnership Agreement?

A partnership agreement is a contract between the partners in a business, outlining each partner’s duties and responsibilities. These include duties to each other and duties to the business itself. A partnership agreement will govern important matters that arise in your business, including how to make decisions and resolve disputes amongst partners, how new partners can be added and what happens with retiring partners.

Once you have written your agreement, each partner must sign the document, making it legally binding and enforceable.

There are default provisions in each state and territory’s relevant legislation that apply when no written partnership agreement is in place. Therefore, drafting a written partnership agreement ensures this legislation does not control how you run your business.

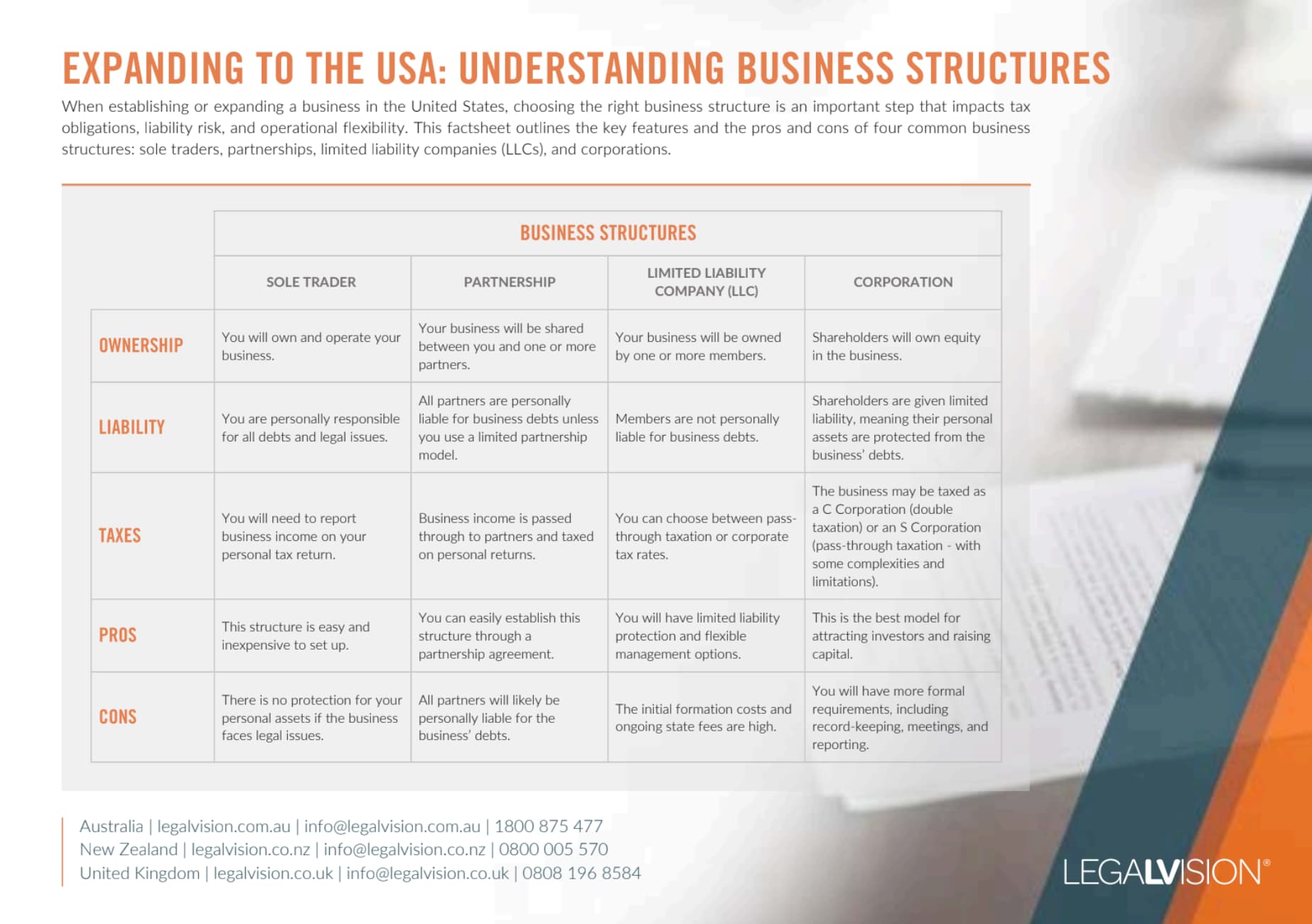

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

What is the Difference Between a Partner and a Shareholder?

Additional people or entities join a partnership by becoming partners, typically in accordance with a Partnership Agreement. However, partnerships generally have a maximum of 20 partners. Becoming a partner carries more responsibility, particularly due to the personal liability of each partner. As the number of partners increases, the complexity and risk associated with decision-making increases.

The role of a shareholder in a company is to have ownership in the company and to make critical business decisions required by the Corporations Act 2001, the company’s constitution and/or the company’s shareholders agreement. Shareholders do not generally have a say in the day-to-day management of the business, unlike partners. Although shareholders own the company, the company is a separate legal entity, and the company’s assets belong to the company itself. Additionally, the company limits shareholders’ liability to the amount unpaid on their shares, so it does not hold them personally responsible for the company’s debts.

Partners vs. Shareholders: Key Differences

| Aspect | Partners | Shareholders |

| Ownership | Direct ownership of business assets | Ownership of shares in the company |

| Liability | Personal liability | Limited to amount unpaid on shares |

| Management | Typically involved in day-to-day management | Generally not involved in daily operations |

| Business Structure | Partnership | Company |

| Legal Entity | Not a separate legal entity | Company is a separate legal entity |

| Maximum Number | 20 partners | No set limit on shareholders |

What is the Best Business Structure for Shareholders?

If you want to structure your business with the ability to take on shareholders, a partnership is not the right structure for you. You may wish to consider incorporating a proprietary limited company. This will allow you to have multiple shareholders who have ownership of the company and appoint directors to manage the day-to-day operations of the company. You will have the flexibility to take on investors, and shareholders can leave without dissolving the business. The company will protect shareholders by limiting their liability regarding the company’s debts, unlike partners in a partnership who have unlimited liability.

On the other hand, if you and your partners decide you want the benefits of a shareholder structure, you can convert your partnership to a company. This process, known as a restructure and involves:

- speaking with tax advisors to determine if there are any considerations in restructuring your business;

- registering a company with ASIC;

- transferring partnership assets to the company; and

- issuing shares to former partners based on their partnership interests.

Determining the best business structure for your business is an important decision that is unique to your circumstances. If you are starting a new business, our experienced business lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

A partnership can have different types of partners with varying rights and responsibilities, but it cannot have shareholders. Partners typically share ownership, management, and liability for the business. However, a partnership agreement can be used to define specific roles, profit-sharing arrangements, and decision-making powers among different types of partners.

Yes, a partnership can be converted into a company. This process involves registering a company, transferring partnership assets, and issuing shares to former partners based on their partnership interests. It’s advisable to consult with a tax advisor to understand any implications before proceeding with the restructure.

We appreciate your feedback – your submission has been successfully received.