In Short

-

Choose the Right Structure: Establishing your consulting firm as a proprietary limited company (Pty Ltd) can protect your family trust by separating business liabilities from personal assets.

-

Implement Asset Protection Strategies: Maintain clear boundaries between business and personal assets, ensure thorough documentation of transactions, and secure appropriate insurance coverage.

-

Seek Professional Advice: Regularly consult with legal and financial advisors to ensure your business structure and practices effectively safeguard your family’s wealth.

Tips for Businesses

When starting a consulting firm, carefully select a business structure that offers liability protection for your personal assets and family trust. Regularly review your asset protection strategies with professionals to adapt to any changes in your business or personal circumstances.

Protecting your personal assets and family trust is paramount when launching a consulting firm. The structure you choose for your business can significantly impact your liability exposure and the safety of your family’s wealth. This article explores key strategies for safeguarding your family trust while establishing a successful consulting venture.

Understanding Family Trusts and Business Liability

A family trust, also known as a discretionary trust, is a popular wealth management tool in Australia. It allows for the tax-efficient distribution of income among family members. However, when a trustee or beneficiary of a family trust engages in business activities, they may inadvertently expose their assets to business liabilities.

Consulting firms, by nature, face various risks, including professional negligence claims, contractual disputes, and operational liabilities. Without proper structuring, these risks could potentially reach beyond the business and impact your family trust.

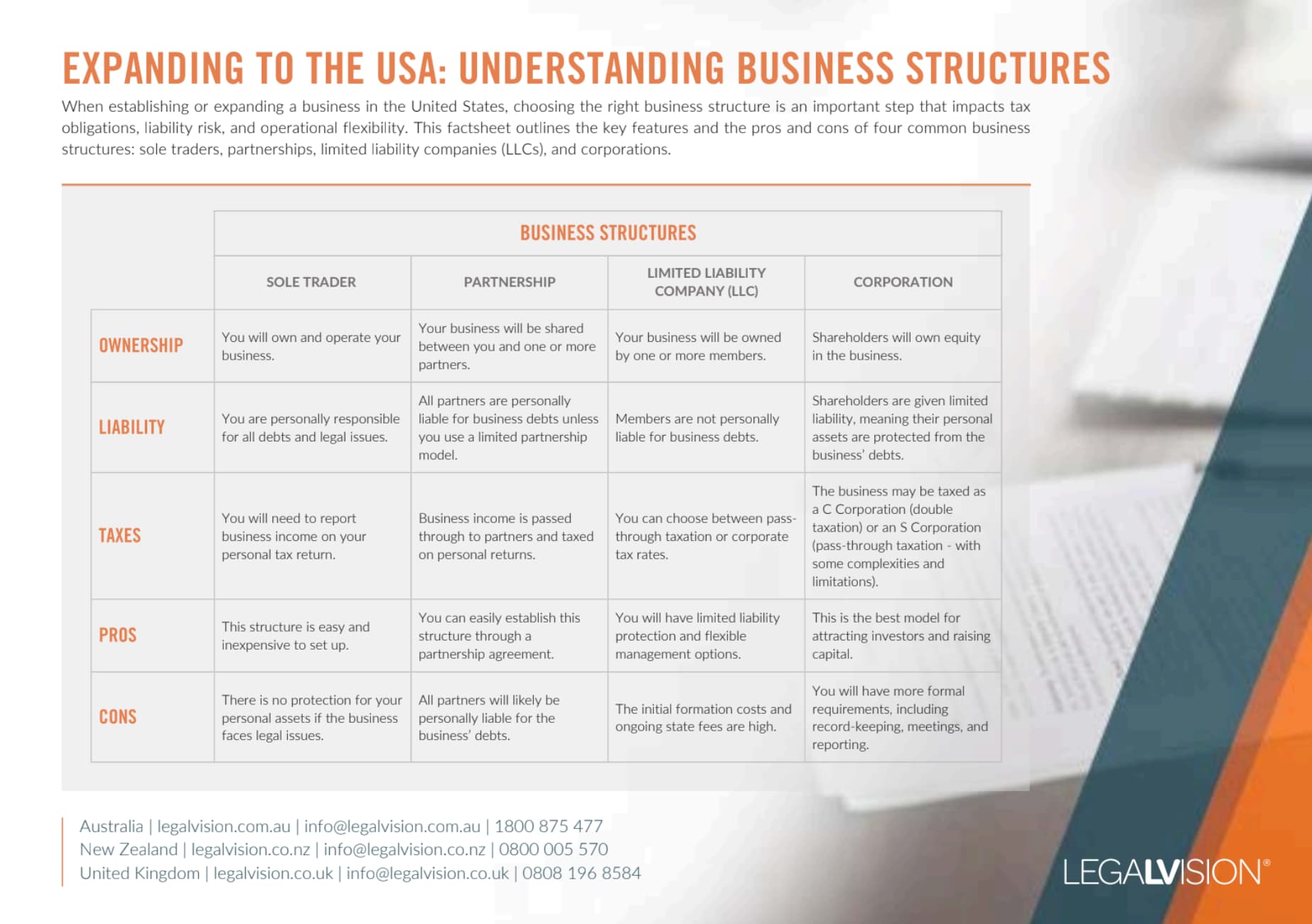

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

Choosing the Right Business Structure

1. Company Structure

Incorporating your consulting firm as a proprietary limited company (Pty Ltd) is often the most effective way to protect your family trust. A company is a separate legal entity, which means it can enter into contracts, sue and be sued in its own name. Your family trust would then own the shares in this new company. This separation creates a liability shield between the business and your personal assets, including those held in the family trust.

However, it’s crucial to note that directors can still be personally liable in certain circumstances, such as insolvent trading or breaches of director duties.

2. Trust Structure

While it may seem logical to operate your consulting firm through your existing family trust, this approach can be risky where the family trust owns other assets (such as property). It potentially exposes all trust assets to business liabilities. If you decide to use a trust structure, consider establishing a separate trust solely for the consulting business, distinct from your family trust. This allows for a simple structure but is inflexible as new equity holders outside the family cannot participate. Additionally, there are no fixed distributions, which are at the trustee’s discretion.

3. Partnership of Trusts

For multi-owner consulting firms, a partnership of trusts can offer asset protection and tax benefits. Each partner operates through their trust, which can then distribute income to beneficiaries in a tax-effective manner.

4. Dual Structure: Company and Trust

A sophisticated approach involves creating both a company and a trust for your consulting firm. The company operates the business, while the trust holds the shares in the company. This structure combines a company’s asset protection with a trust’s tax flexibility.

Continue reading this article below the formAsset Protection Strategies

Regardless of the chosen structure, implementing additional asset protection strategies is crucial:

1. Keep Assets Separate

Maintain clear separation between business and personal assets. Avoid using family trust assets as security for business loans or mixing business and personal funds.

2. Proper Documentation

Ensure all business transactions, especially those between the consulting firm and the family trust, are appropriately documented and conducted at arm’s length.

3. Insurance

Obtain comprehensive professional indemnity and public liability insurance for your consulting firm. Consider key person insurance and management liability cover.

4. Personal Asset Holding Structures

Hold significant personal assets in protected structures. For instance, a non-trading spouse could own a family home or a separate property trust.

5. Loan Accounts

If the family trust lends money to the consulting business, ensure the loan is appropriately documented and secured.

6. Regular Reviews

Periodically review your business and personal structures with your legal and financial advisors to ensure they remain appropriate as your circumstances change.

Legal Considerations

1. Trust Deed Review

Have your family trust deed reviewed by a legal professional. Ensure it includes clauses that protect trust assets from business liabilities and allow for the exclusion of at-risk beneficiaries.

2. Trustee Company

Consider appointing a corporate trustee for your family trust instead of individual trustees. This adds an extra layer of protection for individual family members.

3. Shareholder Agreements

A well-drafted shareholder agreement is essential if your consulting firm has multiple owners. It should cover issues like decision-making processes, dispute resolution, and exit strategies.

4. Employment Contracts

Robust employment contracts and policies can help mitigate risks associated with employees and contractors. These documents should ensure that IP transfers to the company or trust and that there are adequate non-solicitation clauses to prevent workers from poaching customers or other workers if they leave.

5. Client Agreements

Develop comprehensive client agreements that clearly define the scope of your services, limitations of liability, and dispute resolution processes. As mentioned above, this should consider IP ownership, the scope of work, the ability to issue refunds, the timing of payments, and access required to client materials.

Tax Implications

The structure you choose will have significant tax implications. Consider:

- company tax rate vs individual marginal tax rates

- access to small business tax concessions

- capital gains tax implications

- franking credits and dividend strategies

- superannuation contributions

Consult a tax professional to optimise your asset protection and tax efficiency structure.

Key Takeaways

Launching a consulting firm while protecting your family trust requires careful planning and expert advice. While a company structure often provides the best protection, the optimal solution depends on your specific circumstances, risk profile, and long-term objectives.

Remember, no structure provides absolute protection. The key is to create multiple layers of protection through clever structuring, comprehensive insurance, and sound business practices.

Before making any decisions, consult with legal, tax, and financial professionals who can provide tailored advice based on your unique situation. With the proper structure and strategies, you can confidently pursue your consulting venture, knowing that your family’s wealth is well-protected.

If you have any questions about your business structure, our experienced business lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Why is my family trust at risk when starting a consulting business?

If your consulting business is not structured correctly, its liabilities—such as debts, lawsuits, or disputes—could affect your family trust’s assets. Proper structuring helps keep your personal wealth separate from business risks.

What is the safest business structure to protect my family trust?

A company structure (Pty Ltd) is often the safest option. Your family trust can own shares in the company, keeping business liabilities separate from personal assets. Other options include using a separate trust or a partnership of trusts for added protection and tax benefits.

We appreciate your feedback – your submission has been successfully received.