Intentionally misrepresenting your employees as independent contractors can lead to significant penalties for your business. The distinction between employees and contractors can be confusing but can be manipulated to afford employers fewer obligations. The Fair Work Act protects employees from being misrepresented. This article will discuss what sham contracting is, sham contracting arrangement penalties, and some penalty examples from court cases.

What is Sham Contracting?

In simple terms, sham contracting is when an employer misrepresents what should be an employment relationship as an independent contracting arrangement. Employers may do this to avoid providing their employees with entitlements. These employee entitlements include:

- superannuation contributions;

- tax contributions;

- leave entitlements; and

- ongoing salary payments.

The Fair Work Act 2009 has sham contracting provisions that protect employees against sham contracting. Under these provisions: you are prohibited from:

- misrepresenting an employment relationship as an independent contracting arrangement;

- dismissing or threatening to dismiss an employee who performs particular work because you want to engage the individual as a contractor to perform the same, or substantially the same work; and

- making false statements to persuade or influence an individual to be hired as a contractor but do the same work as an employee.

In summary, you are legally not allowed to:

- tell an employee that they are a contractor when they are, for all intents and purposes, an employee;

- make a false statement to convince an employee to do the same work as an employee but be classified as a contractor; and

- dismiss an employee and then rehire them as an independent contractor to perform the same or substantially the same work.

What is the Difference Between a Contractor and an Employee?

A contractor is a business entity that you engage to provide your business with a service. As contractors run their own business, they:

- submit invoices for work they have completed;

- are responsible for their own taxation obligations;

- are generally not entitled to superannuation contributions, although there are some exceptions to this;

- have a high degree of control over their work;

- bear their own commercial and financial risk; and

- are usually engaged for a specific project.

In contrast, employees are:

- paid a wage;

- have their income tax deducted by their employer;

- are paid superannuation contributions;

- perform work under the direction and control of their employer; and

- receive unpaid and paid leave entitlements.

What Are the Penalties for Sham Contracting Arrangements?

The penalties for sham contracting arrangements include the imposition of financial penalties. The maximum penalty is $18,780 for individuals and $93,900 for corporations per contravention.

You may also be liable for additional penalties if you breach your taxation and superannuation obligations by engaging in sham contracting. For example, if you did not make the required tax deductions from your workers and failed to send the required deductions to the Australian Taxation Office, you may face a PayG withholding penalty. Additionally, if you did not make the required superannuation contributions for your workers, you may face a superannuation guarantee charge.

Additionally, Fair Work can apply to the courts to grant an injunction or interim injunction for employers who dismiss or threaten to dismiss an employee to engage that employee as a contractor. Ultimately, the injunction would prevent the dismissal or remedy the effects of the dismissal. For example, you may have to reinstate the dismissed employee or compensate them.

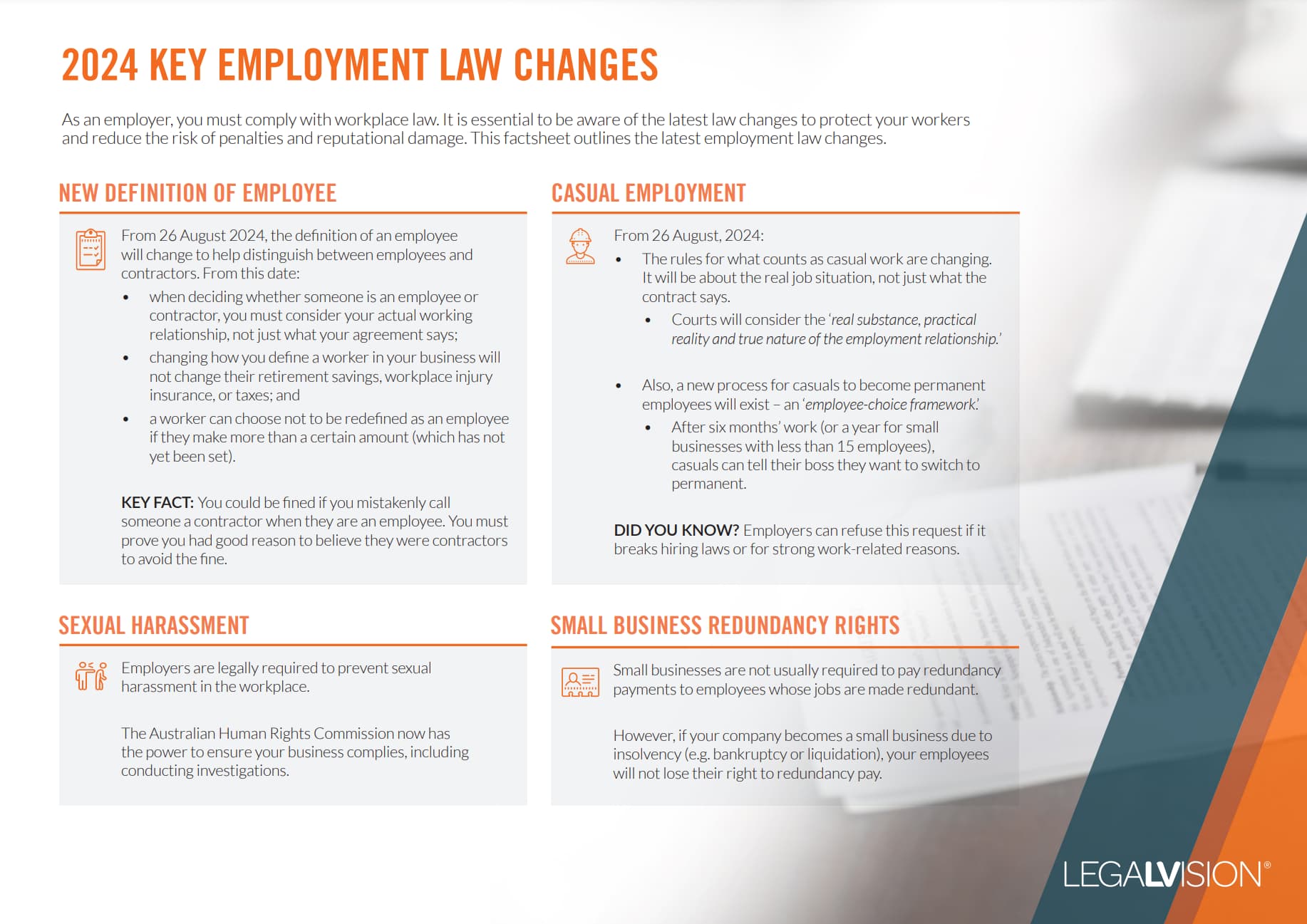

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Examples of Penalties:

Fair Work Ombudsman v Australian Sales and Promotions Pty Ltd (2016)

The Federal Circuit Court awarded penalties of up to $124,000 against both the company Australian Sales and Promotions (ASP) and the director.

The director and ASP breached sham contracting provisions by classifying a backpacker on a working holiday visa as a contractor, despite knowing that they should be an employee.

As a result, the worker was underpaid $7853 in their basic employment entitlements. ASP required the work to get an ABN and invoice another company to receive payment for their work. In addition, ASP required the worker to get public liability insurance.

Ultimately, the worker had never operated a business before and was acting under the direction of ASP. They paid him on a commission basis instead of a minimum hourly rate and casual loading.

Fair Work Ombudsman v Quest South Perth Holdings [2015] HCA 45

This case involved Quest dismissing two employees and rehiring them as independent contractors. The employers used a third party called Contracting Solutions to contract the workers. The workers wore Quest uniforms and completed the same work under the direction of Quest.

The High Court held that Quest breached the sham contracting provisions since the workers were misled about their employment status and ultimately deprived them of their employee entitlements. The company was penalised $54,450, and the company’s former manager was penalised $4,290.

How Can I Protect My Business From Engaging in Sham Contracting?

It is vital that you have a comprehensive written agreement that reflects a genuine contracting arrangement in place to minimise the risk of sham contracting. Previously courts have considered the totality of the relationship between parties to determine if a worker is an employee or a contractor. However, in recent decisions, the High Court changed this approach and stated that the terms of the written agreement are the paramount consideration when determining if a worker is an employee or a contractor.

Key Takeaways

Sham contracting arrangements are illegal, and as a result, there are penalties that the court can enforce on you if you do not comply with the provisions. Employers that breach sham contracting provisions can pay up to $93,900 in penalties per contravention for the company. Additionally, the court can give injunctions to prevent you from dismissing employees who are rehired as contractors or refuse to be rehired in this manner.

If you need assistance in ensuring that you distinguish your workers correctly, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.