In Short

- Determine if your contractors are deemed employees under common law or relevant contract provisions, as this affects payroll tax obligations.

- Each Australian state and territory has specific payroll tax laws and exemptions; Western Australia, for example, does not apply the ‘relevant contract’ concept.

- Engaging contractors through labour-hire arrangements may trigger payroll tax liabilities under employment agency contract provisions.

Tips for Businesses

Regularly review your contractor agreements to ensure compliance with state-specific payroll tax laws. Consult with legal professionals to accurately classify workers and understand applicable exemptions, thereby minimising potential tax liabilities.

If your business engages contractors, knowing when payments to them may be subject to payroll tax in each state and territory is essential. Each Australian state and territory has its payroll tax legislation, with many jurisdictions (except for Western Australia (WA)) employing the “relevant contract” concept to assess whether contractor payments should be treated as taxable wages. Further, each state and territory has “employment agency contract” provisions that can apply when engaging contractors in labour-hire-type arrangements. This article explains the concept of relevant contracts, looks at common exemptions and WA’s unique approach, and explains the employment agency contract rules.

Common Law Employee

Payroll tax is generally payable on wages paid or payable to an “employee”. The term “employee” is not defined in payroll tax legislation, which means it takes its ordinary, common-law meaning.

The following factors are generally what the state or territory revenue office would consider when deciding if a contractor is an employee:

- the degree of control the engaging entity has over the worker;

- how integrated the worker is into the engaging entity’s business;

- whether the worker is engaged to achieve a specific result;

- which party bears the ultimate risk of carrying out the work;

- whether the work can be delegated/subcontracted;

- which party is responsible for providing the tools, equipment etc., required to complete the work;

- which party is responsible for business expenses while completing the work;

- whether the worker is subject to any restraints and/or exclusivity arrangements;

- whether the worker is entitled to common law employment entitlements (e.g. annual/sick leave); and

- whether the worker needs to wear a uniform.

Relevant Contracts in NSW, VIC, QLD, SA, TAS, NT and ACT

In these states and territories, the concept of a “relevant contract” applies to determine payroll tax obligations for contractor arrangements. A relevant contract exists when:

- there is a contract, undertaking or arrangement from one person to another person or entity; and

- the person provides services for or in relation to work performance unless an exemption applies.

If the relationship fulfils the relevant contract test, the person providing the services is deemed an employee for payroll tax purposes. Likewise, the entity that receives the services from the person is deemed their employer.

Common Exemptions

Several common exemptions can reduce or eliminate payroll tax liability for contractor payments. Recognising these exemptions can help you manage payroll tax obligations effectively. Each state and territory is different, so you must seek advice in the relevant states or territories. However, common exemptions include the following:

- Provision of Goods with Services: many states and territories offer an exemption where a contractor’s services are ancillary to them providing goods under their contract. For instance, if a contractor provides materials or goods integral to their service, payments may be exempt from payroll tax. This exemption is particularly relevant in fields where contractors provide labour and materials, such as construction or manufacturing.

- Services Performed by 2 or More People: a standard exemption applies when you engage two or more workers to provide the services under the contractor arrangement. Each worker must generally constitute a significant portion of the total work required under the contract.

- Short-term Engagements (Limited Days): in most states, contractors engaged for fewer than 90 days within a financial year may be exempt from payroll tax. This exemption can reduce your payroll tax obligations when hiring contractors for seasonal, temporary, or highly specialised work that does not extend over a prolonged period.

- Services Outside Core Business Operations: Contractors engaged in specialised tasks outside your business’s core functions where the contractor conducts a business of providing such services to the general public may qualify for an exemption. A typical example of this exemption includes specialised technical work that falls outside your business’s daily operations, such as that of an electrician, a plumber, or a painter.

Some states and territories (such as VIC, QLD and SA) also specifically exclude certain classes of contracts from the operation of the contractor provisions. The excluded contracts are mainly owner-driver contracts, insurance sales agent contracts, and door-to-door sales agent contracts.

WA’s Distinct Approach

Western Australia does not have the relevant contract provisions. However, payments to contractors could still be considered taxable wages in Western Australia if the contractor is considered an employee at common law.

Relevant Contracts in the Medical Industry

The relevant contract provisions have recently been applied aggressively in the medical industry. In these cases, the revenue offices successfully argued that doctors were employees of medical centres for payroll tax purposes. This created significant uncertainty within this space. If you operate in this space, advice should be sought. You can read more about this here.

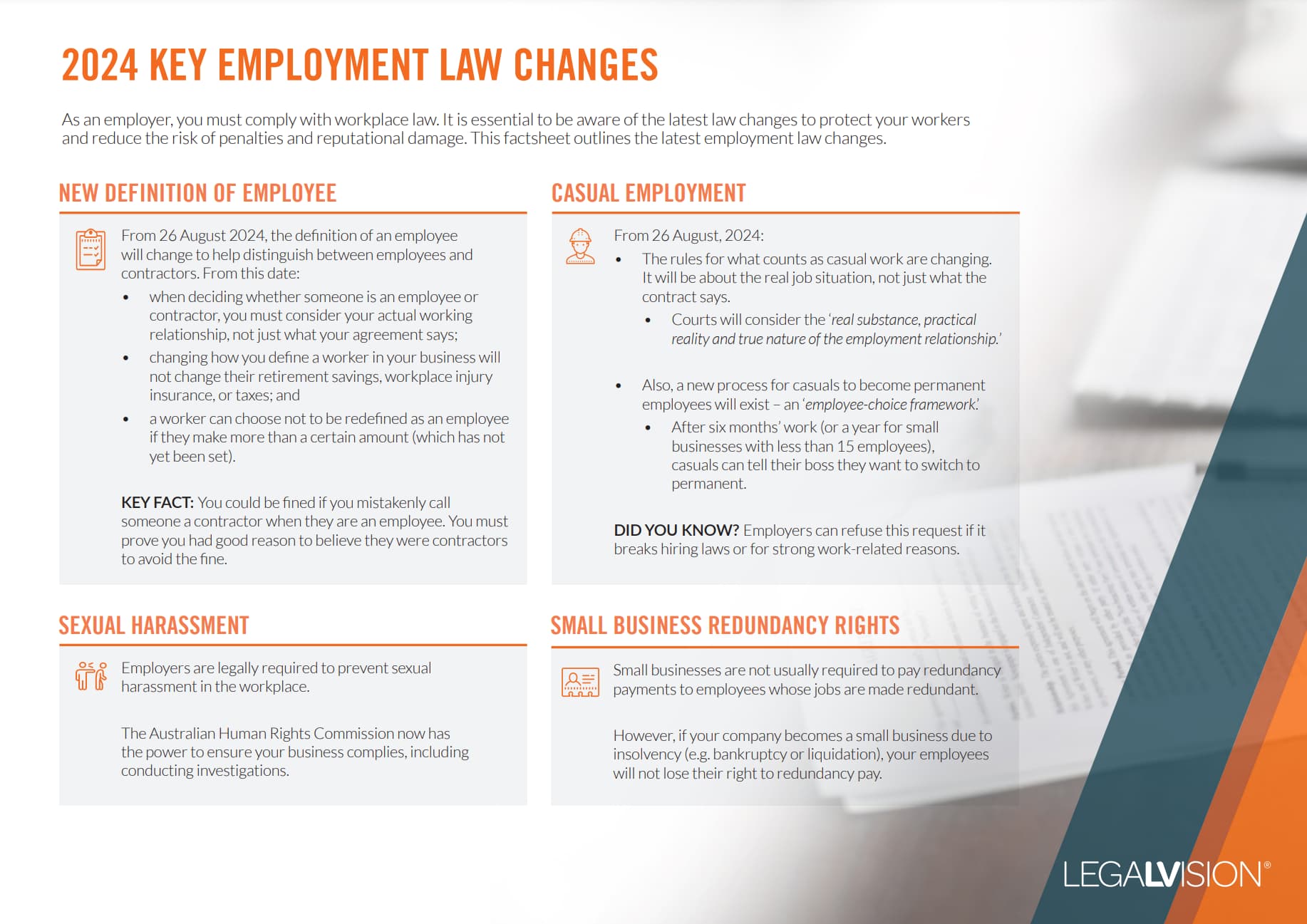

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Employment Agency Contracts

An employment agency contract exists when one party (the employment agent) procures a worker (the service provider) to provide services to the employment agent’s client. The most common example of this is labour-hire arrangements. However, the revenue offices have broadly applied the employment agency contract rules in various contexts.

Unlike the relevant contract provisions:

- there are very limited exemptions which generally only apply where the client of the employment agent is a government body or not-for-profit organisation (however, not all jurisdictions have these exemptions); and

- all states and territories have employment agency contract provisions.

Key Takeaways

Australian employers must determine if contractor payments are subject to payroll tax. First, assess if the contractor is an employee under common law. If not, most states and territories use the “relevant contract” concept. This can classify contractor payments as taxable wages even when they are not employees under common law. Specific exemptions exist for providing goods with services, short-term engagements, or contractors offering services to the public. In WA, payments to contractors are taxable only if they are common-law employees. Additionally, all states and territories apply “employment agency contract” provisions. This can classify contractors in labour-hire arrangements as employees for payroll tax purposes.

Review each contractor arrangement and seek advice from payroll tax experts to ensure accurate classification. This helps your business meet payroll tax obligations and minimise liabilities across jurisdictions.

If you are uncertain about your legal obligations surrounding payroll tax or other employment issues, our experienced taxation lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Contractor payments may attract payroll tax if the contractor is deemed an employee under common law. Alternatively, if the arrangement qualifies as a relevant contract under state and territory laws. In labour-hire arrangements, the employment agency contract provisions may also apply.

A relevant contract is a business arrangement where services are provided under a contract or agreement. Moreover, the person providing the service is deemed an employee for payroll tax purposes unless an exemption applies.

We appreciate your feedback – your submission has been successfully received.