In Short

- If your NDIS services are unpaid, the first step is to contact the participant or their plan manager to resolve the issue.

- Keep a record of all communications and ensure your invoices are clear and accurate.

- If the matter is unresolved, escalate it by lodging a formal complaint with the NDIS Quality and Safeguards Commission.

Tips for Businesses

Ensure you have a clear payment process in place for NDIS services, including regular follow-ups on overdue payments. It’s also helpful to have a written agreement with participants outlining payment terms to avoid misunderstandings. Seek professional advice if you’re unsure of your rights or need help escalating unpaid service issues.

As a service provider under the National Disability Insurance Scheme (NDIS), timely payments are crucial for your business. You may be an individual therapist or a large organisation offering multiple services. If clients do not pay your invoices on time, they can harm your cash flow and reduce your ability to deliver high-quality services to participants. Payment issues can arise for various reasons, including administrative errors, miscommunication, or funding problems. It is essential for service providers to seek payment for services rendered under the NDIS when plan managers or participants do not make payment. This article helps you understand what steps to take if a client has not paid you for your NDIS services.

Understanding the NDIS Payment Process

Before addressing solutions, it is essential to understand how payments typically flow in the NDIS. The process involves several key stakeholders:

| NDIS Participants | Self-managed NDIS participants approve and pay invoices themselves. Participants who are plan-managed can also approve invoices or instruct the plan manager to withhold payment if they dispute the services provided. |

| Plan Managers | If a participant is plan-managed, their plan manager handles payments for them. The plan manager pays providers on behalf of participants and assists with budgeting and financial reporting. |

| National Disability Insurance Agency (NDIA) | For agency-managed participants, the NDIA processes payments directly. |

| Service Providers | That is you – responsible for delivering services and submitting accurate documentation and invoices. |

Steps to Take When You Have Not Been Paid

1. What Does My Agreement Say?

Before addressing payment issues, you must review the client service agreement. This is a contract that sets out the payment terms, as well as your rights and obligations as a service provider and those of the NDIS Participant.

- verify the details in your service agreement – who is the other party liable for costs?;

- confirm that your invoice was accurate and properly submitted; and

- if an individual participant signed the agreement and it states they are liable for all costs, you may be able to recover funds directly from them. however, sometimes this may not be the best course of action, as many participants are vulnerable individuals with limited assets and require continual support services.

If you do not have an agreement in place, you should draft a contract to set out the parties’ rights and obligations. The agreement usually includes payment terms and accounts for contingencies. You can book a consultation with our NDIS Regulatory and Compliance team, who can provide you with NDIS-related assistance.

2. Contact the Other Party

Review Your Provision of Services

Before you seek payment of your invoices, you should review your records and confirm that the services you have provided to the participant are in line with their plan, and that you have not exceeded the scope of the services. If you have incurred excess costs by overservicing, that will make it more difficult to secure payment.

| If the participant is self-managed: | If you have your records in order, contact the participant to: + discuss the unpaid invoice; + confirm that you provided the service and they have no issues with it; and + check if there are any issues with their NDIS plan or funding. |

| If the participant is plan-managed: | If the participant manages their plan through a plan manager, contact the plan manager or support coordinator (with the participant’s consent) to: + ask about the payment status; + confirm they received your invoice and the participant’s funding status; and + if there’s an overspend, the plan manager may submit a manual claim for NDIA assessment, however this does not always guarantee payment. As a provider, it is your responsibility to ensure that you provide services in line with the participant’s plan. |

| If the Participant is NDIA-Managed: | The NDIA may block invoices for NDIA-managed clients if they audit a provider or question an invoice. They may also block invoices if a service booking or invoice does not match the funded amounts or funding periods. If you are not getting paid, or if you know the services you provide will exceed the funding, you must contact the participant and the NDIA. When a participant is underfunded, high-risk, or cannot have services stopped without breaching the code of conduct, you should: + promptly contact the NDIA to seek approval to continue services; + if a support coordinator is involved, they should also be informed. It is worth involving a Support Coordinator as they can often help resolve complex issues by liaising between you, the participant, and other stakeholders. They might also be able to identify and address underlying problems in the participant’s plan; and + encourage the participant to promptly lodge an unscheduled review of the participant’s plan. This is also called a section 48 or s48 review. |

3. Contact the NDIA and NDIS

If the above steps do not resolve the issue, you can also contact the provider enquiry line on 1300 311 6750, or lodge a request through the my NDIS provider portal if you are a registered provider. They may be able to assist if you:

- provide detailed information about the unpaid invoice and steps you have taken; and

- ask for guidance on next steps.

Do I Need to Provide Ongoing Services to the Participant?

While pursuing payment, you will need to make decisions about ongoing service provision. It is difficult to cease providing services to a participant, especially if they are vulnerable, receiving essential services, or unresponsive and difficult to deal with. We recommend that you:

- maintain open communication with the participant and any decision maker if there is a plan nominee or guardian about the payment issue, and the fact that you will need to cease providing services if your invoices remain unpaid; and

- as a last resort, you may need to suspend services.

However, ensure you do this in line with your service agreement and NDIS guidelines, particularly since NDIS participants often receive essential services. This often requires providing formal notice to the participant, and linking them to other support services, organisations, or hospitals. This ensures that there is a smooth transition so that the participant keeps receiving the necessary support.

What are My Other Options?

In addition to the above steps, there are other options to address payment issues you may wish to consider. These include:

- initiating private recovery actions against the participant or their nominee, provided you have a service agreement in place and your services were validly provided under the agreement;

- selling the debt to debt collectors; and

- checking insurance policies to determine if they cover non-payment, which could take care of legal costs.

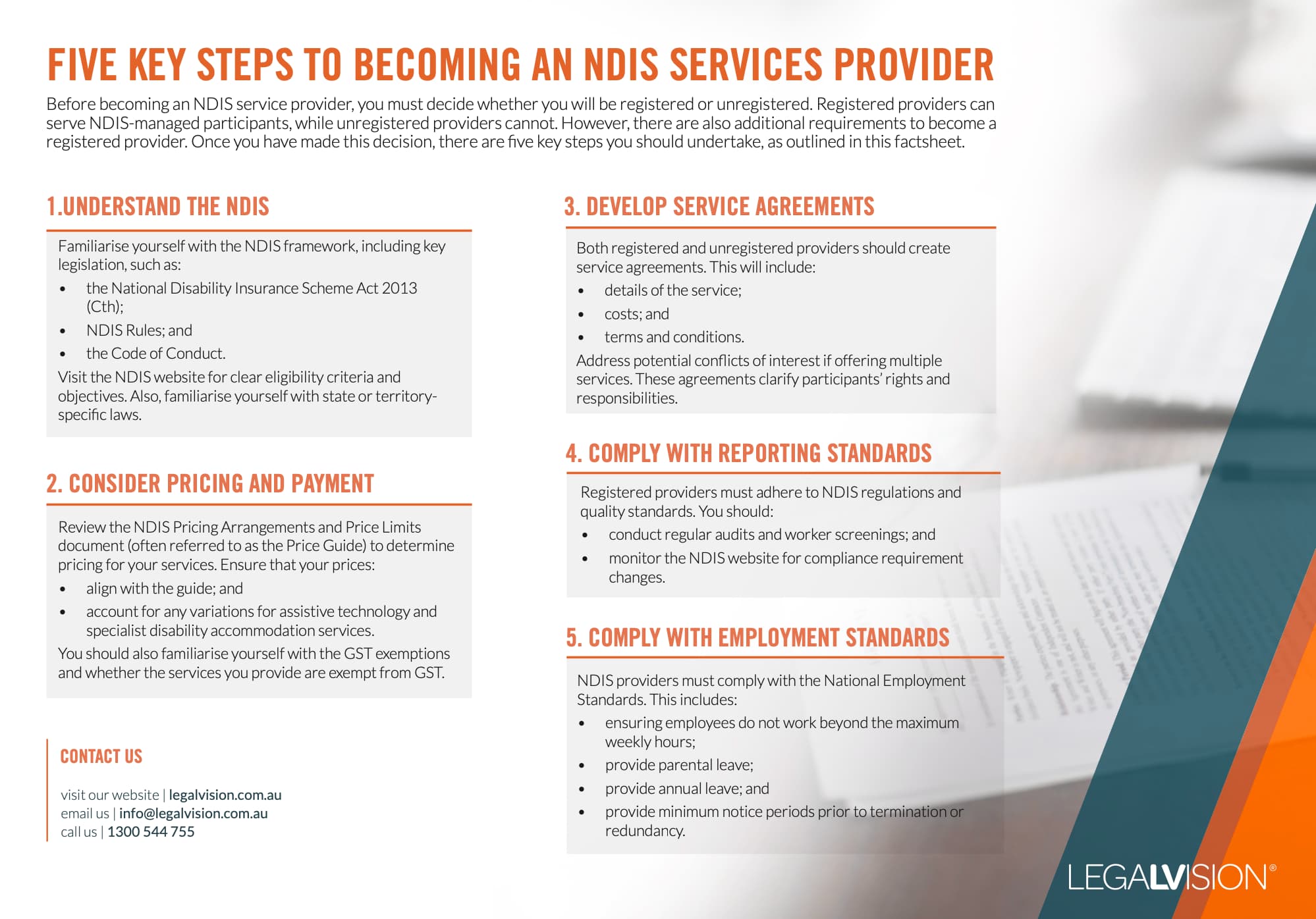

Understand five key steps you should know to become an NDIS service provider with this free LegalVision factsheet.

Prevention: Best Practices to Avoid Payment Issues

Establishing Clear Service Agreements with Participants

Most importantly, prevention is always better than cure. Avoiding payment issues in the first place is always ideal, and below are some best practices to mitigate these risks.

This includes understanding the participant’s plan and required support, as well as having a clear service agreement in place. There may also be ancillary or additional agreements that should be in place, depending on the particular supports being provided. For these reasons, it is important to enlist lawyers who have a detailed understanding of the NDIS regime and legal framework, who can assist with the drafting of your agreements.

Ongoing Management

It is also helpful to:

- ensure accurate and timely invoicing;

- maintain regular communication with participants and plan managers; and

- understand the nuances of different plan management types

Key Takeaways

Navigating payment issues in the NDIS can be challenging, but a systematic approach can help resolve most problems. Remember to:

- keep detailed records;

- ensure you are aware of the funding amounts and funding periods in a participant’s plan;

- communicate clearly with all stakeholders and ensure that you have consent in place allowing you to discuss with stakeholders;

- escalate issues appropriately; and

- stay informed about NDIS processes and changes

By following these steps you can often resolve payment issues while continuing to provide valuable services to NDIS participants. While payment issues can frustrate you, you can resolve most of them through open communication and persistence. Navigating the complexities of the NDIS requires careful documentation, clear communication, and a commitment to resolving disputes in the participant’s best interest. By implementing effective internal management strategies and understanding the legal framework, you can minimise the risk of non-payment and ensure better support for those in need.

If a client has not paid you and you need help, our experienced debt recovery lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Review your service agreement to confirm payment terms and responsibilities. Check your records and invoices for accuracy. Contact the participant, plan manager, or NDIA, depending on the participant’s funding arrangement. Escalate the matter to the NDIA provider enquiry line or portal if necessary to resolve outstanding payments.

You can stop services, but only after giving proper notice under your service agreement and NDIS guidelines. Maintain open communication, inform the participant or their guardian, and help them access alternative support to ensure continuity of care before suspending or ceasing essential services to vulnerable participants.

We appreciate your feedback – your submission has been successfully received.