Your business must consider the question of goods and services tax (GST) and whether the goods or services you are providing attract GST. When operating a business, most of your supplies are taxable. This means that GST must be charged. However, some supplies fall into either the GST-free or input-taxed categories. This exempts them from the addition of GST to their prices. Examples of GST-free supplies encompass certain foods, beverages, medicines, and, notably, home care services and disability supports (NDIS). This article outlines the typical GST charging process and its variations for home care services and disability support supplies.

How Is GST Usually Charged?

GST is a tax of 10% charged on the supply of most goods and services sold or consumed in Australia.

A GST-registered business typically incorporates GST into the prices of their goods or services. Additionally, they will claim credits for the GST paid on certain business expenses. These credits are called GST credits or input tax credits.

A business that has not registered for GST does not need to charge GST on the goods or services it supplies. The business is also unable to claim GST credits for GST amounts included in business expenses. Instead, that business could claim 100% of that expense amount as an income tax deduction.

What Is a GST-Free Supply?

In a GST-free supply, the sale price does not include GST. There are supplies of both goods and services which can be GST-free. Common examples include:

- certain medical services and medicines;

- certain foods;

- sales of going concern; and

- certain education-related supplies.

If your business provides GST-free sales, you can still claim credits for the GST included in the expenses related to your supplies.

Is the Supply of Home Care Services GST-Free?

If a business satisfies specific conditions, it may qualify for GST-free status on the supplies it provides. In this circumstance, home care refers to “a package of personal care services and other personal assistance provided to a person who is not being provided with residential care”.

The broadest of these conditions is that the services provided are to one or more aged or disabled people. Additionally, the Quality of Care Principles must explicitly list the kind of service. These services can include:

- daily living assistance;

- meals and refreshments;

- emotional support; and

- recreational therapy.

If the criteria satisfies this, the supply qualifies as GST-free.

The supply of home care may also be considered GST-free if the home care provider receives:

- specific subsidies;

- contributions; or

- funding from the Commonwealth, State or Territory for their services.

Are Disability Supports Provided to NDIS Participants GST-Free?

If a business is providing support to an NDIS participant, it may qualify for GST-free status when it meets specific criteria. Broadly, these are:

- the supply is made to an NDIS participant as that term is defined in NDIS law;

- the participant’s plan is in effect under NDIS law;

- the support is reasonable and necessary under the participant’s plan;

- the supply is made under a written agreement between the supplier and the participant – this written agreement must satisfy certain conditions; and

- the supply must be of a kind that the Disability Services Minister has determined in writing, such as specialist disability accommodation, household tasks, travel arrangements and home modifications.

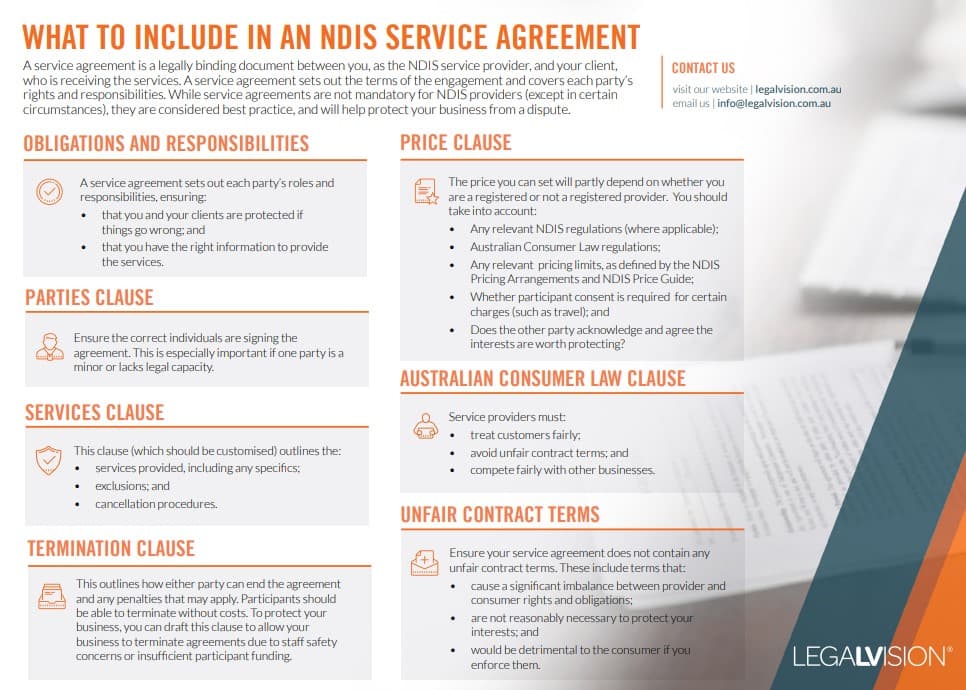

This fact sheet will help you to identify the key terms you must include in your NDIS service agreement.

Who Is Providing the Supply?

The GST law has precise requirements about who is able to provide their goods and services as GST-free.

A typical example of an arrangement in the home care and NDIS support space is an NDIS provider engaging a contractor where that contractor ultimately provides the services to the NDIS participant. In this situation, although the contractor is physically delivering the support, from a legal perspective, the contractor is providing a service to the NDIS provider, not directly to the participant. The NDIS or home care provider is the entity making the “supply” to the participant. Therefore, in this example:

- the NDIS provider would not include GST on its invoice to the participant (provided it has met the relevant conditions) – as the supply is GST-free; and

- the contractor would include GST in its invoice to the NDIS/home care provider (provided it is registered for GST) – as this supply is not GST-free.

Key Takeaways

A business will need to consider its GST obligations when operating, including whether the goods or services it is selling attract GST or not. The Australian government applies GST to the majority of goods and services sold in Australia. However, certain circumstances in aged home care and NDIS support can make specific supplies GST-free. If your business wishes to rely on the GST-free provisions, you must closely consider who you are in the supply chain. Furthermore, it is essential to determine if you are the party making the GST-free supply. In the NDIS and aged care sector, only some links in the supply chain are exempt from GST charges on their specific supplies.

If you need help determining whether your business supplies are GST-free, our experienced tax lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.