In Short

-

A holding company allows you to manage multiple businesses, protect assets, and separate risk.

-

It can offer tax benefits by offsetting profits and losses across subsidiaries.

-

Setting up requires clear governance, compliance, and planning to balance efficiency with added complexity.

Tips for Businesses

Use a holding company to centralise control and safeguard key assets, but be mindful of costs and compliance obligations. Seek legal and tax advice to structure subsidiaries properly, allocate resources effectively, and maximise both protection and growth opportunities.

The growth of your business can be both exciting and complex. A holding company framework offers an effective way to manage multiple businesses in one corporate group. The use of a holding company in your business structure can provide legal protection, operational clarity and financial efficiency. This article outlines the best practices and key considerations for managing such a structure effectively.

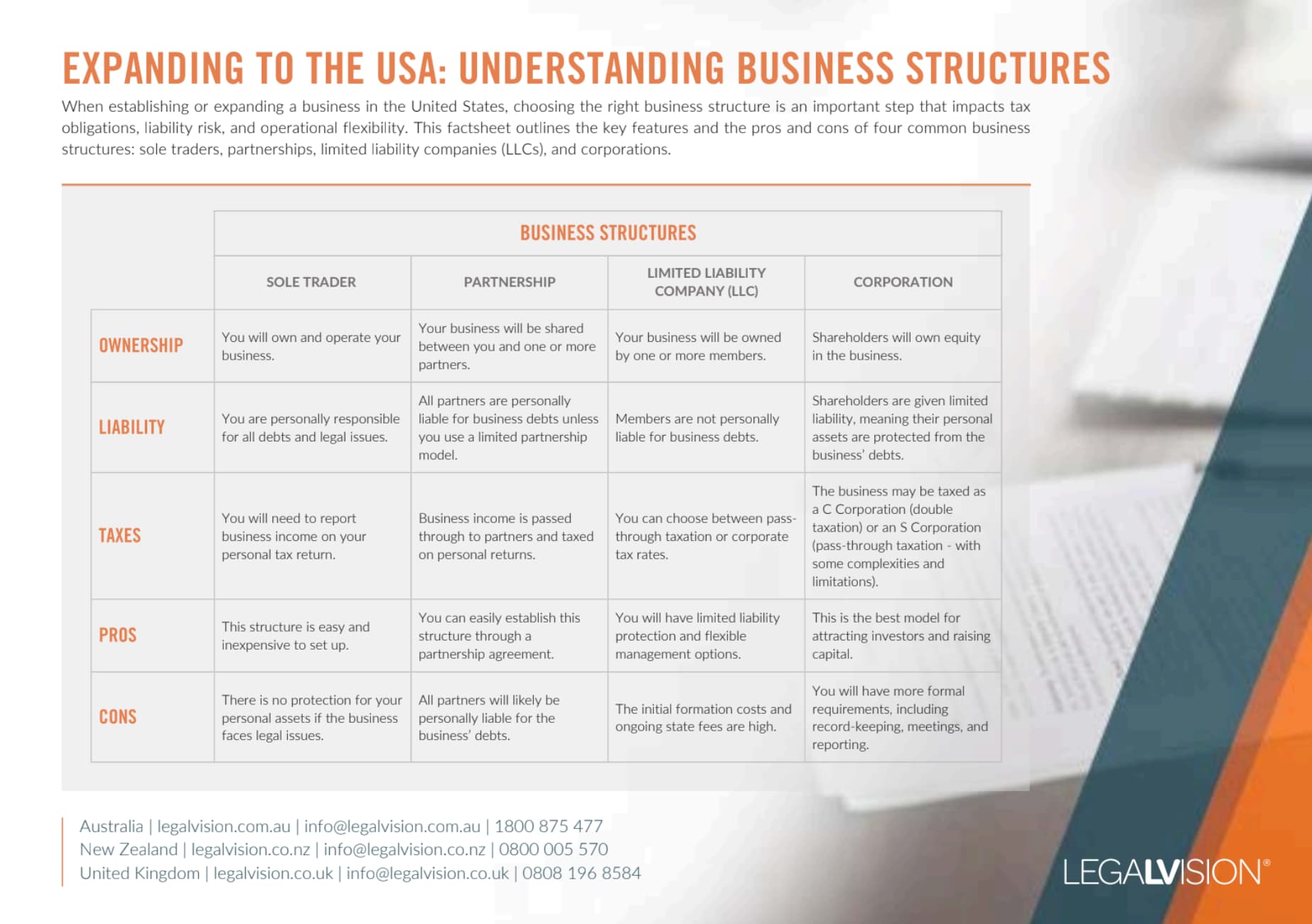

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

What is a Holding Company?

Generally, a holding company is set up for the sole purpose of holding shares in one or more subsidiaries. It does not typically engage in day-to-day operations but rather oversees strategic direction, major financial decisions, and compliance across the corporate group.

In practice, the holding company usually holds the majority of the shares in a subsidiary, giving it control over the subsidiary’s internal management and decision-making processes. The holding company also holds the subsidiary’s assets to provide further protection. This structure can be very strategic as it allows you to isolate risk, streamline management, and explore potential tax benefits.

Why Should I Set Up A Holding Company?

Risk protection

Business assets of the subsidiary companies can be held under the holding company to separate them from the liabilities of the subsidiaries. Each subsidiary is responsible for its own debts, which helps prevent creditors from accessing the business assets in the event of debt recovery or legal claims.

Additionally, a holding company can be used to protect intellectual property such as trademarks, logos and software from the subsidiary company’s trading risks. Generally, existing IP owned by the subsidiaries can be assigned to the Holding company. This is subsequently licensed back to the operating company to use in day-to-day operations. Overall, this maintains the separation of ownership.

Tax Liability Reduction

A holding company can be set up to reduce the amount of tax that the group as a whole has to pay. Additionally, wholly owned subsidiaries under a holding company may form a tax-consolidated group, which can offset the profit from one subsidiary with the losses of another, resulting in a smaller tax liability overall.

Another potential benefit of implementing a holding company in your business structure is that the entity may be eligible for small business CGT concessions if a subsidiary company is sold.

Business Structure Flexibility

As mentioned above, the key business assets of all subsidiaries can be consolidated into the holding company, enabling the corporate group to invest in other business ventures or exit from ventures without compromising the core assets and overall business value.

When subsidiary companies are set up or acquired, the holding company will typically hold 100% of the shares in the subsidiaries. This allows for centralised management and control of the corporate group.

Additionally, implementing a holding company in your business structure can improve the financial transparency of the business. Ultimately, making the corporate group appear more attractive to investors.

Continue reading this article below the formHow to Set Up a Holding Company Structure

In order to set up a holding company for your corporate group, you will need to:

- Form the Holding Company: Establish a new company that will serve as the holding entity. In Australia, this typically involves registering a company with ASIC and obtaining an ABN.

- Create or Acquire Subsidiaries: The holding company then acquires shares in existing businesses or sets up new companies as subsidiaries.

- Transfer Assets or Operations: Depending on your structure, you may need to transfer assets, intellectual property, or employees to the appropriate subsidiary. This step should be carefully managed with legal and tax advice.

- Set Up Governance Structures: Determine how decisions will be made across the group, and appoint directors for each entity.

Key Considerations

While the holding company structure offers numerous benefits, it can also present some challenges, such as:

- Legal compliance: Each entity still has reporting and governance obligations.

- Costs: Running multiple companies involves accounting, legal, and compliance fees.

- Director duties: Directors must ensure they are acting in the best interest of each company, not just the group overall.

- Complexity in Management: Coordinating activities across multiple entities can be complex.

- Resource Allocation: Balancing resource distribution between subsidiaries requires careful planning. Implementing a group-wide resource planning system can aid in efficient allocation.

Key Takeaways

A holding company structure can be a powerful tool for managing multiple businesses efficiently. With proper planning, this structure can support long-term growth, mitigate risk, and simplify complex business arrangements.

If you need further advice regarding setting up a holding company for your business, our experienced business lawyers can help you determine the best option for you as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

What is the main purpose of a holding company?

A holding company exists to own shares in subsidiary companies. It centralises control, protects assets, and allows for risk separation and strategic oversight.

Do I need a holding company to run multiple businesses?

No. You can run multiple businesses without one, but a holding company provides extra protection, tax efficiencies, and flexibility, which many business owners find valuable.

We appreciate your feedback – your submission has been successfully received.