In Short

- A branch is part of your Australian company, while a subsidiary is a separate legal entity incorporated overseas.

- Branches expose the Australian parent to full liability, whereas subsidiaries generally limit risk to the foreign entity.

- Tax, compliance and operational flexibility differ significantly and should align with your global strategy.

Tips for Businesses

Before expanding overseas, clarify whether your priority is speed and central control or risk protection and local flexibility. Review tax residency, transfer pricing and withholding tax implications early. Consider local compliance requirements and customer expectations in the target market, and seek legal and tax advice before choosing between a branch or subsidiary structure.

When Australian businesses expand internationally, one of the most critical decisions is choosing the appropriate legal structure for operating in a foreign market. The choice between establishing a branch or a subsidiary can significantly affect your:

- legal standing;

- tax obligations;

- risk exposure; and

- operational flexibility.

This article outlines the distinctions between these two options, which is crucial to making an informed decision that aligns with your global strategy.

Branch vs. Subsidiary: An Overview

A branch is an extension of your Australian company into a foreign market. It is not a separate legal entity but operates as part of the parent company. As a result, the branch’s operations, liabilities, and profits are directly tied to your Australian entity. This structure is often favoured by companies that want to maintain centralised control and avoid the complexities of incorporating a new entity. Another reason may be that you want to test the market in a foreign jurisdiction without the complexities or costs of setting up a new and separate entity.

On the other hand, a subsidiary is a standalone legal entity that is incorporated under the laws of a foreign country. Even if the Australian parent company owns the subsidiary, the subsidiary is treated as an independent business with its own obligations and liabilities. Subsidiaries offer more operational autonomy and a clear separation between the parent company and the foreign entity, making them a popular choice for businesses looking to limit risks or adapt their operations to local market conditions.

Legal and Compliance Obligations

Establishing a branch would generally require registering your Australian company in the foreign jurisdiction, which often involves working with local regulators. This could be for:

- registering for sales tax in that jurisdiction; and

- registering for employment tax obligations (if employment staff are in that jurisdiction).

For subsidiaries, the process involves incorporating a new company in a foreign country. This includes:

- selecting a business name (which must comply with local naming conventions);

- drafting incorporation documents; and

- appointing directors (who may need to include local residents, depending on the jurisdiction).

Unlike branches, subsidiaries are governed by the local corporate laws of the host country. However, because a subsidiary is a separate legal entity, its obligations and liabilities are confined to the company itself, which reduces the risk to the parent company.

Continue reading this article below the formCall 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Taxation Considerations

Taxation is another area where the differences between branches and subsidiaries are significant. A branch is generally taxed pursuant to local corporate tax laws in the foreign jurisdiction on the actual profits derived within the foreign market. For Australian entities, it is important to seek transfer pricing expert advice in determining the correct amount of actual income and actual expenses attributed to the branch.

By contrast, a subsidiary is taxed as a local business in the foreign country. It is subject to the host country’s corporate tax rates. Although there would still be transfer pricing considerations in relation to cross-border intercompany dealings, its profits are separate from the Australian parent company’s income. If the subsidiary remits profits back to Australia, withholding taxes may apply, depending on the local laws and any tax treaties in place. It is also important to determine the tax residency of the subsidiary.

If the subsidiary is considered to be an Australian tax resident, it would be taxed in Australia on its worldwide income. It is encouraged to speak with tax professionals on the tax residency of the subsidiary and options to mitigate the potential risk of double taxation.

Liability and Risk Management

Liability is a critical consideration when choosing between a branch and a subsidiary. As a branch is not a separate legal entity, the Australian parent company is fully responsible for the following:

- all debts;

- obligations; and

- legal claims arising from the branch’s operations.

This direct exposure to liability can pose significant risks, particularly in jurisdictions with high levels of regulatory oversight or legal uncertainty.

In contrast, a subsidiary’s liabilities are typically limited to the assets of the subsidiary itself. This means that if the subsidiary incurs debts or faces legal claims, the Australian parent company’s assets are generally protected. The separation of liabilities makes subsidiaries a safer choice for businesses entering unfamiliar or high-risk markets.

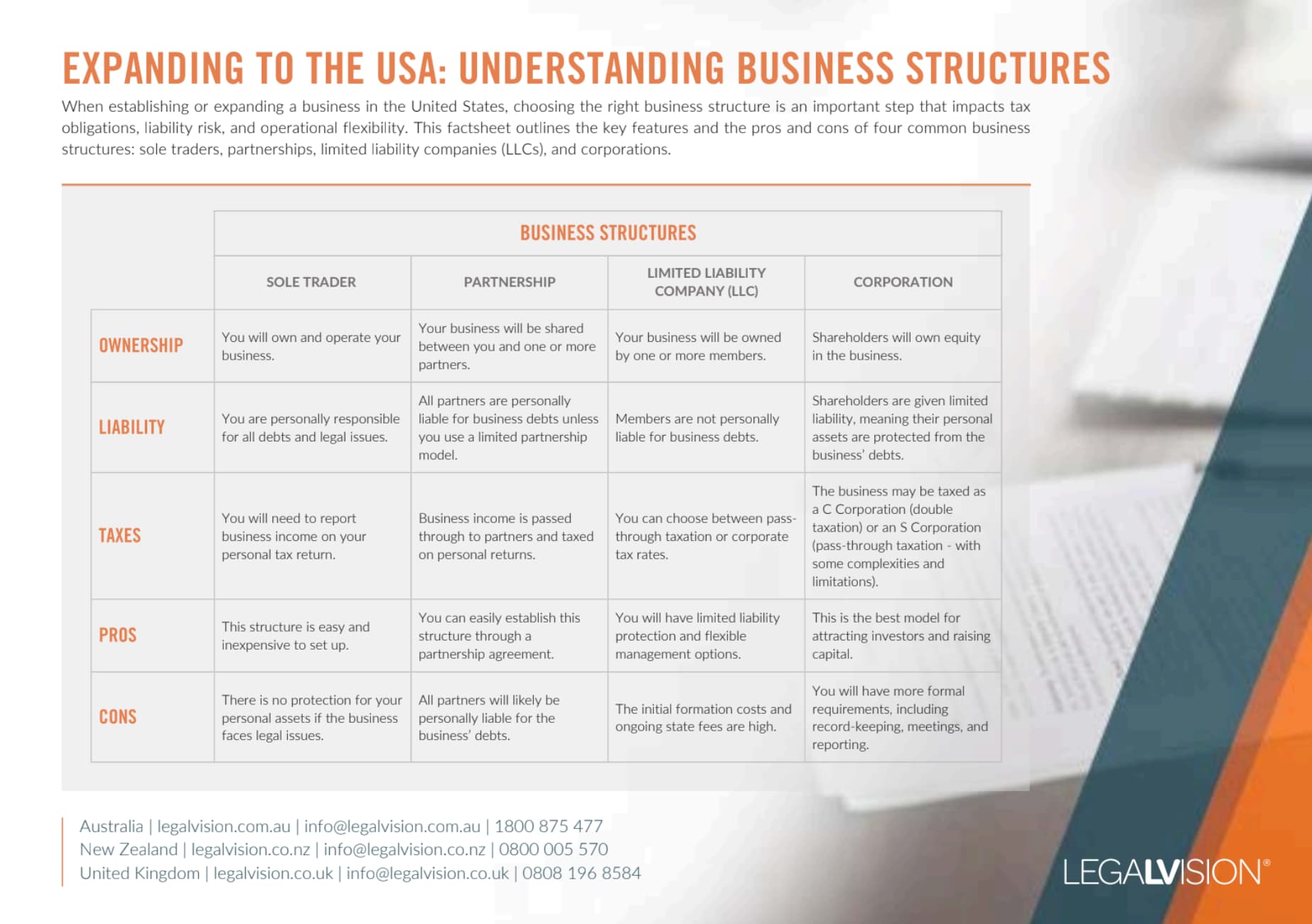

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

Operational Flexibility and Control

Branches offer a high degree of integration with the parent company, allowing for centralised decision-making and streamlined processes. This structure is particularly beneficial when

- your goal is to maintain consistency across markets; or

- if the foreign operation is an extension of your existing business activities; or

- if it is during the initial phase of market research in the new foreign market.

However, the centralised nature of a branch can also limit its ability to respond quickly to local market conditions. As decisions often require approval from the parent company, branches may struggle to compete in fast-moving or highly localised markets.

On the other hand, subsidiaries provide greater operational autonomy. Local management teams can make decisions tailored to the host country’s market, allowing for more agility and responsiveness. This independence is particularly valuable in markets with the following:

- unique cultural;

- regulatory; or

- consumer demands that differ from Australia.

Key Takeaways

When expanding overseas, Australian businesses must carefully choose between a branch and a subsidiary. A branch is an extension of the parent company, taxed on locally sourced income, and exposes the parent to full liability for the branch’s obligations. Being an independent legal entity, a subsidiary offers greater liability protection, operates under local laws, and is taxed as a separate business. While branches offer centralised control, subsidiaries provide operational flexibility and localised decision-making. The choice depends on:

- your business goals;

- risk tolerance; and

- the specific requirements of the target market.

LegalVision provides ongoing legal support for subsidiaries and branches through our fixed-fee legal membership. Our experienced lawyers help businesses manage tax structure, contracts, employment law, disputes, intellectual property and more, with unlimited access to specialist lawyers for a fixed monthly fee. To learn more about LegalVision’s legal membership, call 1300 544 755 or visit our membership page.

Frequently Asked Questions

A branch is part of the Australian parent company, while a subsidiary is a separate legal entity incorporated overseas.

A subsidiary generally offers better protection, as liabilities are usually limited to the subsidiary rather than the parent company.

We appreciate your feedback – your submission has been successfully received.