In Short

-

A company structure offers limited liability but comes with specific governance and legal obligations. Consider whether it suits your business needs before proceeding.

-

Choose a name, set up internal governance, get consents from key individuals and complete the application with ASIC.

-

Open a business bank account, set up accounting systems, obtain necessary licenses and meet ASIC reporting requirements.

Tips for Businesses

Setting up a company requires careful planning and compliance with legal requirements. Start by choosing a suitable structure and name, establish internal governance, and complete the registration process with ASIC. Once registered, focus on keeping accurate financial records, maintaining compliance and understanding your responsibilities as a company director.

Starting your own business is always a big decision. It can be all the more nerve-wracking when you decide to structure your business as a company. The paperwork necessary to start a company can sometimes be daunting. If you would like to start a company, this article discusses how you can determine if it is the right structure for you and how you can do it.

Is a Company Structure Good For You?

Before you begin the process of starting a company, you need to be sure that its structure suits your individual needs. There are many ways to structure a business: a partnership, as a sole trader or via a trust. No one structure is necessarily better than another. Their different characteristics mean that certain structures often suit the needs of a business owner better than others.

Types of Companies

There are different types of companies, but the most popular kind of company is one limited by shares. These can be either proprietary or public.

A company limited by shares is attractive because it offers shareholders limited liability. Their liability for any company debts is limited to the extent of any unpaid shareholdings. This is so popular because it means that the company’s creditors cannot access shareholders’ personal assets to satisfy debts.

Shareholders and Directors

The two principal actors in a company are the shareholders and the directors. The shareholders contribute capital. In a proprietary limited company, shareholders typically have limited involvement in the company’s daily operations. The process for appointing directors in these companies can vary and is usually outlined in the company’s constitution or shareholders’ agreement.

Conversely, company directors are responsible for managing the company. They have responsibilities to shareholders, and the Corporations Act 2001 (Cth) (Corporations Act) imposes duties upon them (directors’ duties). Regulators view breaches of these duties seriously.

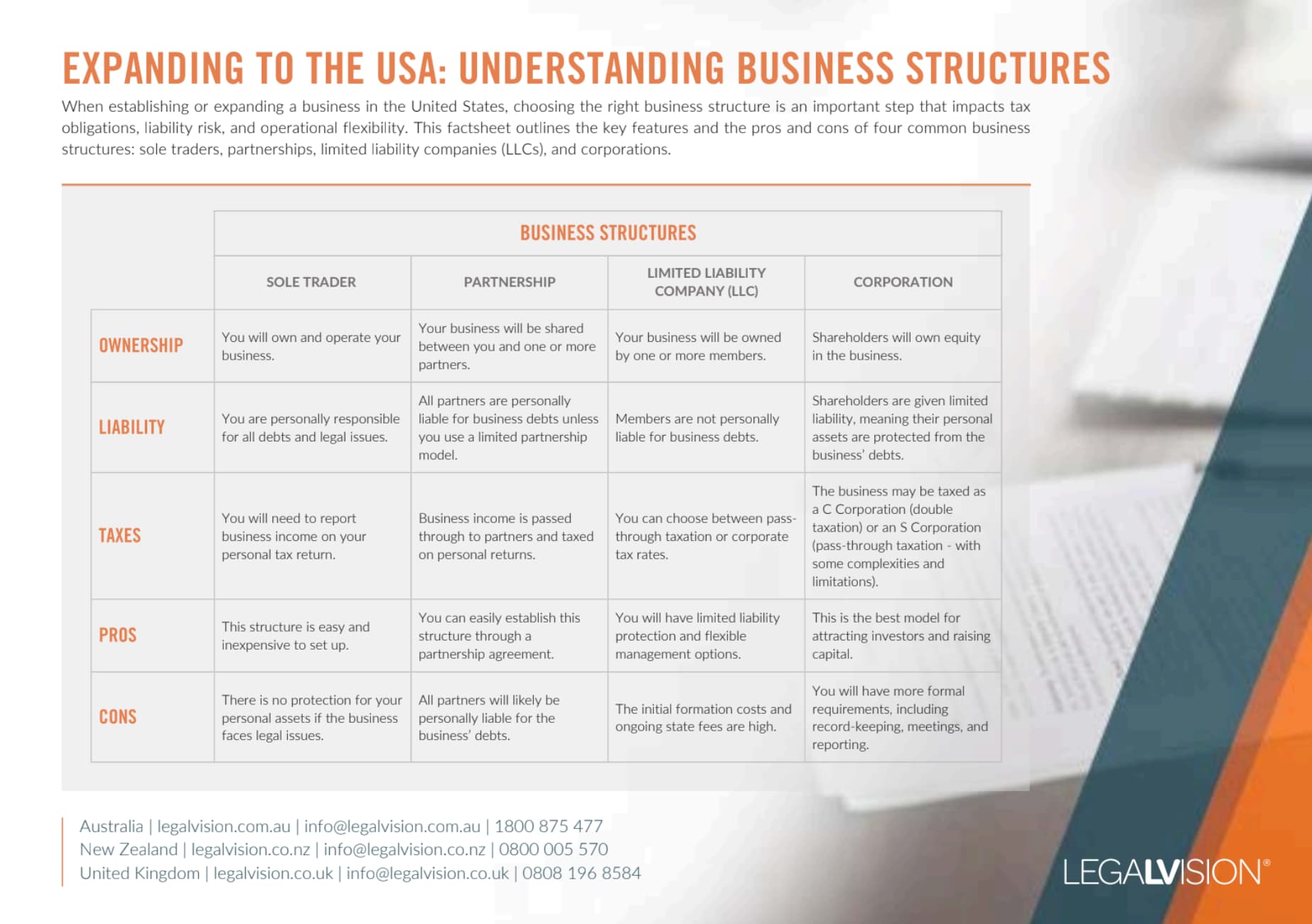

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

Choosing a Company Name

The first step in setting up a company is choosing a name. Your name will need to detail your legal status. For example, if your business is a proprietary company, your name must include Pty at the end. The website for the Australian Securities and Investment Commission (‘ASIC’) has a list of approved abbreviations.

If you wish your company name to be the same as a registered business name that you own, you can only do so in particular circumstances. For example, if the business name holder is an individual, a company can only use that name if that same person is a proposed director or member of the company.

Regulations prohibit the use of some words in a name unless you have official permission (such as building society). You also cannot incorrectly suggest a link to:

- government;

- royalty; or

- an ex-servicemen’s organisation.

Of course, you need not choose a name immediately. ASIC issues all companies with an ACN to identify them. However, it is advisable to reserve your name when you decide on one to prevent another company from using it. You pay a fee and ASIC reserves the name for two months.

Continue reading this article below the formCall 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Internal Governance

The next step is deciding on internal governance. Internal governance is the set of rules that guide your company. You can use the Replaceable Rules (which are provided in the Corporations Act), a company constitution or a mixture of both. However, if your company is proprietary with one member and one director, and they are the same person, it cannot use the Replaceable Rules. There are specific requirements for these companies.

Furthermore, you must also get the consent of all directors, secretaries and shareholders for them to act in those positions. You will need all these permissions before registering your company, so be sure to keep a written record of all of them in a safe place. Additionally, you will need to set up a register of members.

Application to ASIC

You can now register your company. The correct form to use is on the ASIC website. You could also employ a business service provider.

Once ASIC receives your application, they will register your company, give it an ACN and issue a certificate of registration. You must display the certificate wherever you conduct business.

Post-Registration Requirements

After successfully registering your company, there are several important steps you need to take:

- Open a Business Bank Account: Separating your personal and business finances is crucial for maintaining proper financial records, simplifying tax reporting and protecting your personal assets. It also adds credibility to your business when dealing with customers and suppliers.

- Set Up Accounting Systems: Accurate and up-to-date financial records are necessary for making meeting tax obligations and complying with ASIC requirements. Good accounting practices help track cash flow, manage expenses and identify growth opportunities.

- Get Necessary Licenses and Permits: Operating without required licenses or permits can lead to fines and, in some cases, business closure.

- Register for GST if Turnover Exceeds $75,000: GST registration is legally required for businesses that exceed the threshold. It allows you to claim GST credits on business purchases and ensures compliance with Australian tax laws. Failure to register can result in penalties.

- Maintain Company Records: Proper record-keeping is a legal requirement and essential for good corporate governance. This includes financial statements and share registers. Additionally, organised records make audits and legal processes easier.

- Comply with ASIC Reporting Requirements: Companies must submit annual reviews and financial reports to ASIC. Staying compliant maintains your company’s good standing and ensures transparency and accountability.

- Understand Directors’ Duties: Company directors have legal obligations under the Corporations Act. Knowing these duties helps prevent breaches that could lead to personal liability and ensures management is in the best interests of shareholders and stakeholders.

Remember that running a company comes with ongoing legal and financial obligations. These post-registration requirements are not just bureaucratic hurdles but essential steps in building a strong foundation for your business. They help ensure legal compliance, financial stability and good corporate governance. While it may seem overwhelming at first, addressing these requirements diligently from the start can save you time, money, and potential legal issues in the long run.

Key Takeaways

Starting a company can be daunting, but understanding the process helps. First, determine if a company structure suits your business needs. The most common type is a proprietary limited company, offering limited liability for shareholders. Key steps include choosing a name, setting up internal governance, and registering with ASIC. Post-registration, it’s vital to open a separate business bank account, maintain accurate financial records, and comply with ASIC reporting requirements. Directors must understand their legal duties to avoid personal liability. Taking these steps early helps ensure compliance, financial stability, and effective governance, setting your business up for long-term success.

If you setting up a business, our experienced business structuring lawyers can assist you as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

A company structure offers limited liability, meaning shareholders’ personal assets are protected if the company incurs debts. It also provides a formal governance framework, which can add credibility and professionalism. Additionally, a company can continue operating independently of its owners, making transferring ownership or attracting investors easier.

No, GST registration is only legally required if your company’s turnover exceeds $75,000 per year. However, voluntary registration is possible, allowing you to claim GST credits on business purchases.

We appreciate your feedback – your submission has been successfully received.