Franchising presents an exciting opportunity for NDIS home care business owners to expand and develop their business. As the franchisor, it allows you to grant third parties (franchisees) the right to utilise your intellectual property and systems to offer, sell, or distribute goods or services within the NDIS framework. In return for these rights, the franchisee pays fees. While this opportunity is exciting, it is crucial to grasp the legal complexities involved. This article aims to help you understand the key legal aspects you need to consider when franchising your NDIS home care business.

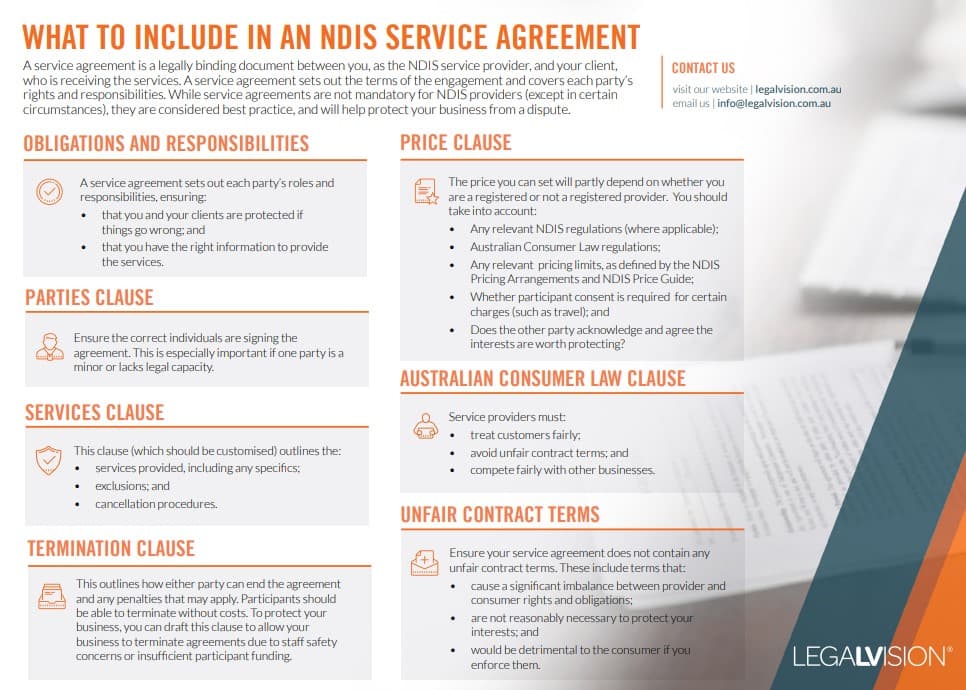

This fact sheet will help you to identify the key terms you must include in your NDIS service agreement.

Franchising Code of Conduct

This mandatory industry code applies to all franchise agreements in Australia. It regulates the franchising sector by outlining specific requirements and standards for both franchisors and franchisees. As a franchisor, you must adhere to the Code’s requirements. A franchisor’s key obligations include the following.

Disclosure

You must provide potential franchisees with a set of prescribed documents to meet your disclosure obligations. The Code requires that you supply a prospective franchisee with specific documents. This includes the Franchise Agreement and Disclosure Document. These must be submitted at least 14 days before whichever of the following occurs first:

- they enter into a franchise agreement; or

- they make any non-refundable payment.

Generally, you must also update the disclosure document within four months after the end of each financial year. You must also provide prospective franchisees with a:

- key facts sheet;

- the franchise agreement; and

- other relevant documents.

As an NDIS home care business, this will include details about your franchise system. Specifically, this may concern operating in the NDIS sector, such as the requirements for NDIS registration and compliance.

Acting in Good Faith

As a franchisor, you must comply with the overarching principles outlined in the Code, particularly that all parties are required to act in good faith. While there is no precise definition, acting in good faith under the Franchising Code means that you and your franchisees should interact:

- honestly;

- reasonably; and

- cooperatively steering clear of arbitrary actions or motives that are irrelevant or ulterior.

Good faith must be upheld by both you and potential franchisees. This encompasses the entire franchise relationship, including:

- pre-agreement negotiations;

- the lifespan of the franchise agreement; and

- any disputes that arise after termination.

Dispute Resolution

Like all professional relationships, disputes may arise between you and your franchisees. The Franchising Code of Conduct (Code) outlines how you and the franchisee should handle complaints and disputes. When disputes occur, the first step is to provide written notification of the dispute to the other party. Both parties should attempt to resolve the matter through their Internal Dispute Resolution (IDR) process. You can initiate external dispute resolution steps if the IDR process is unsuccessful. You can start with Alternative Dispute Resolution (ADR), such as mediation. If ADR fails, the parties may opt to proceed with arbitration or litigation.

Disputes may arise in the NDIS context, as well as over issues such as:

- compliance with NDIS standards;

- pricing arrangements; or

- the provision of support to participants.

Franchise Agreement

The franchise agreement is a legally binding contract between you and the franchisee that formalises your relationship and establishes legal obligations. As an NDIS Home Care business, it is important to customise your franchise agreement to reflect the unique characteristics of the NDIS sector. You should also include the standard terms in franchise agreements across various networks. Key terms to consider for your NDIS franchise are below.

Pricing and Payment

The pricing and payment structure is a vital aspect of any franchise agreement, especially in the NDIS sector, where specific regulations are in place. This section of the agreement should clearly outline all financial obligations between you and your franchisees. It must encompass both industry standards and NDIS-specific regulation requirements.

Franchise agreements typically include various fees, such as:

- initial franchise fees;

- ongoing royalty fees (often a percentage of gross sales); and

- marketing or advertising fees.

Your agreement should clearly outline these details. Ensure the levels set are reasonable and considerate of industry standards and the specific context of the NDIS sector. NDIS, unlike many other industries, has distinct price arrangements and limits. These dictate the maximum fees you and your franchisees can charge for certain services. It is essential to familiarise yourself with the pricing guide and ensure that all franchisees adhere to it. You must ensure they only charge the prices that align with the guide.

When drafting a franchise agreement, you must consider the fees and charges prohibited by the Franchising Code of Conduct. The Code specifically prohibits you from requiring the franchisee to pay any part of your costs for legal services, including:

- preparing;

- negotiating;

- executing; or

- extending the franchise agreement.

The Code also prevents you from charging potential franchisees for your costs associated with:

- preparing the disclosure document; or

- for your legal expenses related to dispute resolution.

However, the Code does provide an important exception. You can pass on certain legal costs to the franchisee if they relate specifically to the franchise agreement. This exception allows for a fixed payment, which must be made before the franchisee starts their business. To comply with the Code, this payment must meet three crucial criteria:

- the amount must be clearly specified in the franchise agreement;

- the agreement must explicitly state that this payment covers your legal costs for preparing, negotiating, or executing the agreement; and

- the agreement must clearly indicate that this amount does not include any future legal costs that may arise after signing. This refers to aspects such as preparing, negotiating, or executing various documents.

By following these guidelines, you can legitimately recover some of your legal expenses while staying compliant with the Franchising Code of Conduct.

Training and Support

You must provide detailed information about the initial and ongoing training and support you will offer franchisees. Specify the format, duration, and frequency of training sessions and any additional resources or materials you will provide. The NDIS Quality and Safeguards Commission offers a range of resources. You can use this to assist you and your franchisees in:

- better supporting individuals with disabilities; and

- understanding your obligations under the NDIS Code of Conduct

Reporting and Auditing

As a registered provider offering services, you and your franchisees are required to meet specific obligations. This includes regularly conducting audits and performing worker screenings. Additionally, setting up a transparent system that allows franchisees to report their performance and compliance consistently is essential. This ensures they adhere to NDIS standards while also identifying opportunities for enhancement.

By clearly and thoroughly addressing these factors, you can establish a solid framework for your franchisees to thrive in the NDIS sector.

Continue reading this article below the formNDIS Compliance

As an NDIS home care franchisor, ensuring your franchisees obtain and maintain their NDIS registration is critical. You and your franchisees must comply with all relevant laws as well as the NDIS Practice Standards and Code of Conduct. These set out expectations for service quality to promote safe and ethical service. This is particularly important given recent laws that hold franchisors liable for breaches committed by their franchisees.

You should provide support to your franchisees to assist them in understanding and complying with the relevant regulations. Some ways you can do so include:

- providing templates and guidance for policies, procedures, and work practices;

- offering training and workshops on NDIS compliance obligations and best practices;

- establishing systems for monitoring and reporting on compliance issues; and

- clearly defining responsibilities for compliance in your franchise agreement.

Non-compliance with the legal and NDIS requirements can have significant ramifications for your franchise. Therefore, prioritising compliance across your franchise network is essential.

Key Takeaways

Franchising your NDIS Home Care Business presents an exciting chance to expand and develop your operations. However, as the franchisor, it is essential to recognise the legal responsibilities that pertain to your business and your franchisees and ensure adherence to these legal requirements.

For advice regarding NDIS services or franchising requirements and obligations, our experienced franchise lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

What are the disclosure obligations for franchisors?

Franchisors must provide potential franchisees with a set of prescribed documents, including the Franchise Agreement and Disclosure Document, at least 14 days before the franchise agreement is signed or a non-refundable payment is made. Disclosure documents should be updated within four months after the end of each financial year.

What does acting in good faith mean under the Franchising Code?

Acting in good faith requires both the franchisor and franchisee to interact honestly, reasonably, and cooperatively, avoiding arbitrary or ulterior motives throughout the relationship, including during pre-agreement negotiations, the franchise agreement’s lifespan, and any disputes.

We appreciate your feedback – your submission has been successfully received.