In Short

- Understand U.S. franchise laws, including providing a Franchise Disclosure Document to potential franchisees at least 14 days before any agreement or payment.

- Set up a U.S.-based entity, often in Delaware, to simplify legal compliance and operations.

- Register your trademark in the U.S. to protect your brand and meet franchise registration requirements.

Tips for Businesses

Research local consumer preferences and legal requirements before entering the U.S. market. Adapt your franchise model to align with local regulations and cultural expectations. Engage local legal and business experts to navigate complexities and build strong partnerships.

For many franchisors, the prospect of taking your Australian franchise to the United States brings an opportunity to access a large market and drive significant growth. However, with various franchising laws in place nationwide and within each state, it can be a minefield for new franchisors to manage. This article will examine the main legal considerations to consider when expanding your Australian franchise network into the United States.

Overview of U.S. Franchising Laws

In the United States, both federal (nationwide) and state governments regulate franchising. The primary federal law governing franchising is the Federal Trade Commission’s Franchise Rule. This rule requires franchisors to provide a Franchise Disclosure Document (FDD) to potential franchisees at least 14 days before they pay any money or sign an agreement.

However, some of the remaining states require your FDD to be filed (or a notice be filed) before your franchise can be sold in that state (these are the “Filing States”). Others require your FDD to be registered and approved with the local state regulator (these are the “Registration States”). These filings and registrations must be renewed annually.

| Type | States |

| Non-Registration States | Alabama, Alaska, Arizona, Arkansas, Colorado, Delaware, D.C., Georgia, Idaho, Iowa, Kansas, Louisiana, Maine, Massachusetts, Mississippi, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Vermont, West Virginia, Wyoming, and D.C. |

| Filing States | Connecticut, Florida, Kentucky, Michigan, Nebraska, South Dakota, Texas, Utah |

| Registration States | California, Hawaii, Illinois, Indiana, Maryland, Minnesota, New York, North Dakota, Rhode Island, Virginia, Washington, Wisconsin |

What is a Franchise Disclosure Document?

Franchising requires a significant investment from a potential franchisee, so the Federal Trade Commission published the Franchise Rule in 1978 to act as a protective measure for franchisees. It requires franchisors to give potential franchisees a disclosure document that covers matters such as the franchisor’s:

- background and business experience;

- financial position and litigation history;

- fees to grant the franchise, and ongoing costs for the franchisee to own a franchise;

- key contracts; and

- existing franchises and the details of other franchisees (so the potential franchisee can ask questions about running a franchise).

Do I Need a U.S. Trademark?

No, the Franchise Rule does not require a franchisor to have a U.S. federal trademark. However, if a franchisor does not have a U.S. federal trademark, then the franchisor will be faced with more compliance obligations under state law.

For added protection, you might want to consider registering your copyright in relation to key marketing assets (such as logos or packaging), which can be done with the U.S. Copyright Office.

Do I Need a U.S. Company?

No, the Franchise Rule does not require a franchisor to have a U.S. company. However, because payments of royalties from U.S. franchisees to Australian franchisors are subject to a 5% withholding tax (if the double tax agreement between the U.S. and Australia applies, otherwise the rate is 30%), then having a U.S. company can be beneficial to reduce your tax burden and to make it easier to bring lawsuits against franchisees.

While there are many business structures available in the United States, many franchisors who are not looking to set up local offices typically choose a wholly-owned Delaware corporation because it has a lower compliance burden and no state income tax (other than on transactions with other Delaware businesses). It may also simplify the movement of profits back to your Australian company for reinvestment in your franchise network.

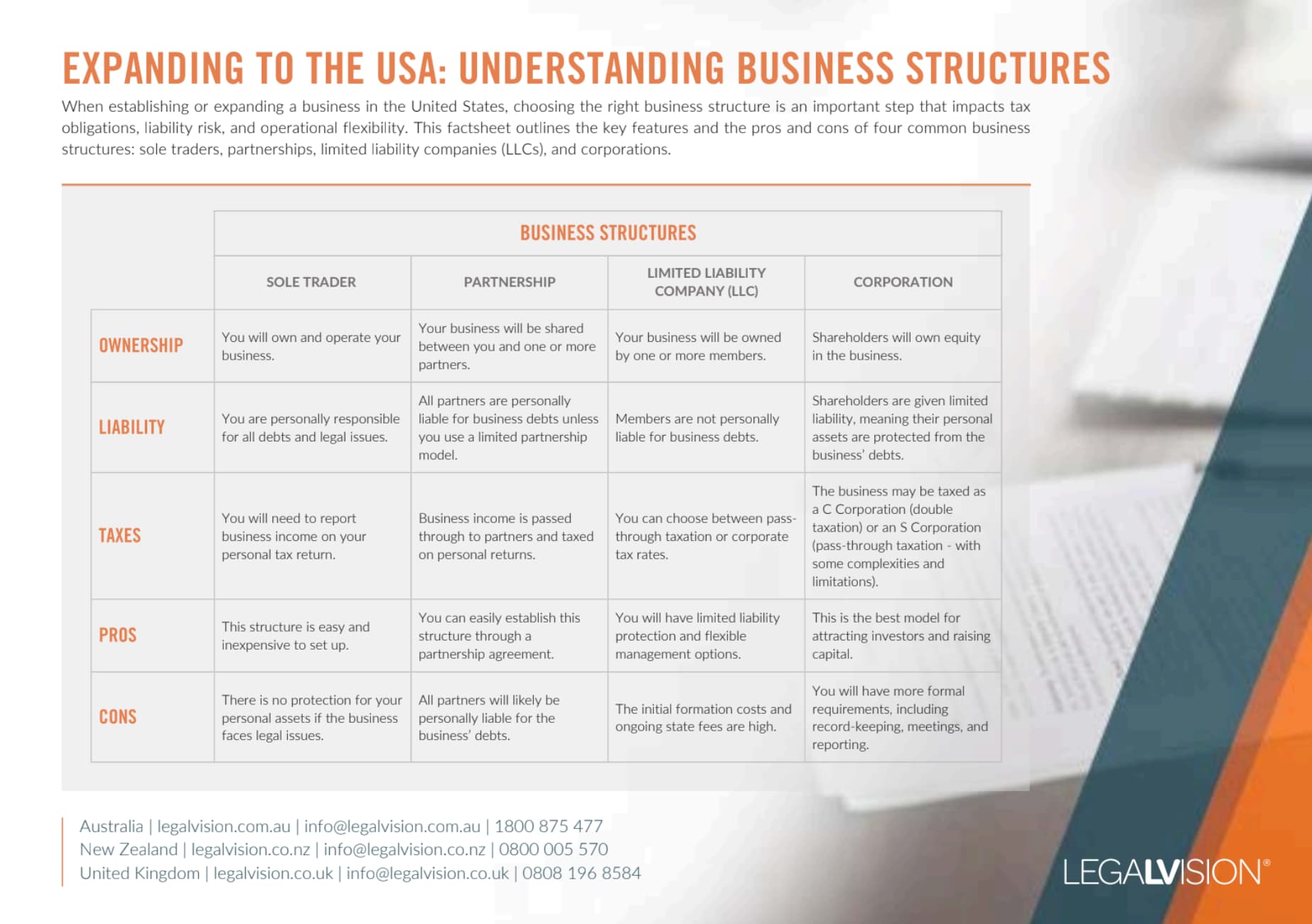

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

Key Takeaways

Expanding your franchise to the U.S. offers great opportunities but comes with complex legal requirements. For the smoothest market entry, you should:

- own a registered U.S. trademark for your brand (to be exempt from many onerous state franchising and business opportunity laws);

- have a franchise disclosure document that complies with the Federal Trade Commission’s Franchise Rule (this also forms an exemption from many state franchising and business opportunity laws); and

- consider setting up a local U.S. entity to minimise tax burdens and streamline enforcement against franchisees.

If you want to learn more about doing business in the United States, call us today on 1300 544 755 or send us an enquiry.

Frequently Asked Questions

U.S. federal law does not legally require it. However, if you do not own a U.S. federal trademark, your franchise may need to comply with additional state-level obligations. Owning a registered U.S. trademark can simplify your expansion by reducing the number of states that require extra filings or approvals.

You must provide a Franchise Disclosure Document (FDD) that complies with the Federal Trade Commission’s Franchise Rule. You must give this document to potential franchisees at least 14 days before they sign any agreement or exchange money. In some states, you must also file or register the FDD before you can offer your franchise.

We appreciate your feedback – your submission has been successfully received.