In Short

- Legal Compliance: eCommerce businesses in the U.S. must follow federal and state laws on taxes, consumer protection, privacy, and product safety.

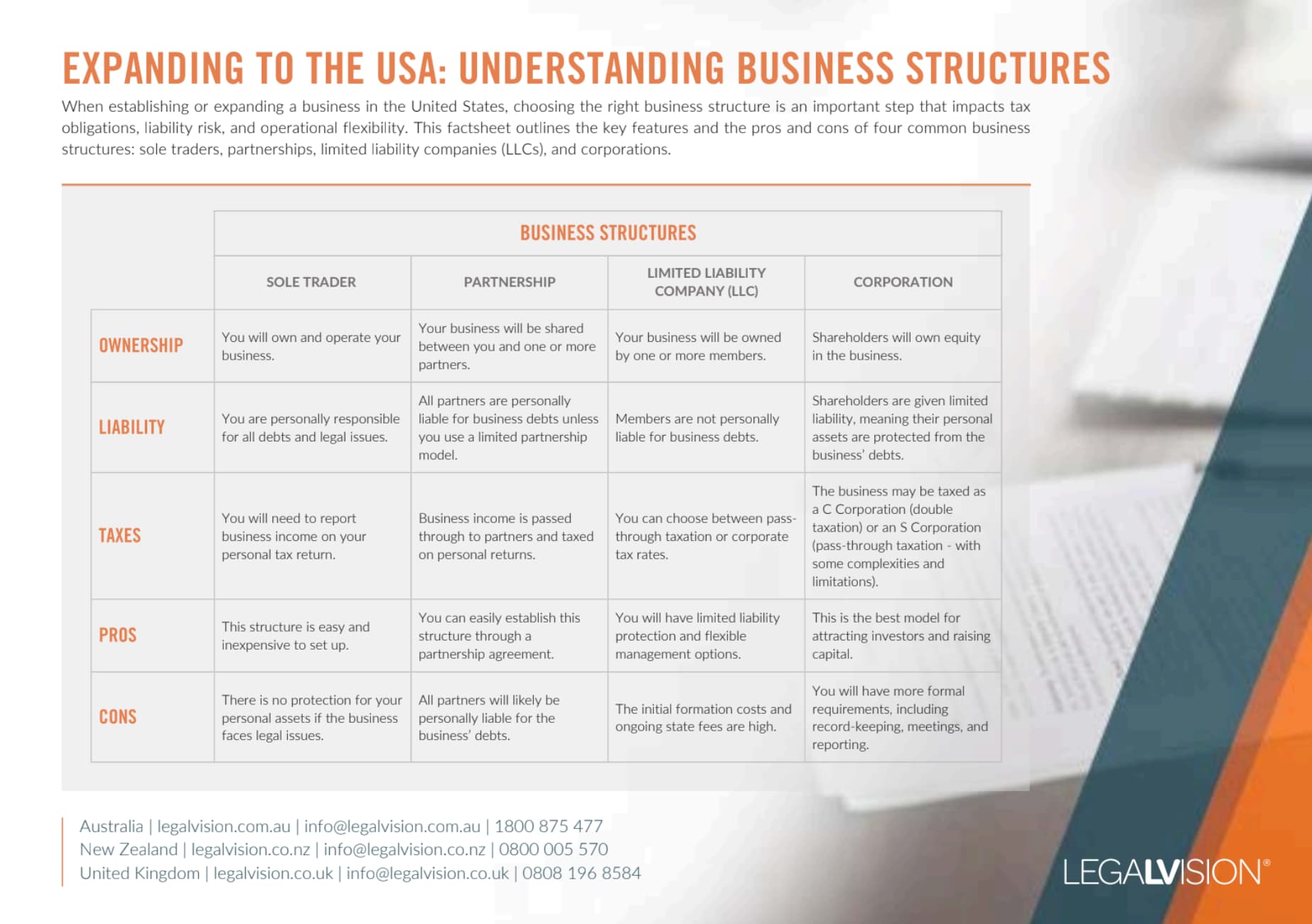

- Tax & Structure: Choosing the right business structure affects liability and tax obligations. Sales tax rules vary by state and depend on business presence.

- Brand & Data Protection: Trademark registration secures brand rights, while strong privacy policies ensure compliance with data protection laws.

Tips for Businesses

Before launching in the U.S., choose a business structure that protects your assets and meets tax requirements. Register trademarks early to safeguard your brand. Ensure compliance with consumer laws, sales tax rules, and data privacy regulations. Keep clear records and seek expert legal or tax advice to avoid costly mistakes.

Launching an ecommerce business in the United States can be a lucrative opportunity to access a sizeable market. However, this market is not for the faint of heart. It comes with many layers of compliance to navigate. This article explores the key legal considerations for those considering operating an ecommerce business in the United States.

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

Business Structure

Before you start operating your ecommerce store, it is essential to consider the most appropriate business structure for your needs. Many different business structure options are available in the United States. While the fastest option is to operate as a sole trader, there is no separation of liability between yourself and your business. This means that if something goes wrong or there is a product liability claim, your personal assets might be at risk. For this reason, you might consider setting up a company to take on this liability. However, if you are based outside of the United States, you must get tax advice in your home country, as there may be cross-border tax considerations.

Tax Obligations

The tax system in the United States is highly complex. Businesses must navigate federal and state tax requirements, which vary significantly and lack uniformity across states. All businesses must pay federal income tax on their taxable income. This will be influenced by the business structure chosen. Most states impose their own taxes. Determining your tax obligations in a particular state can be complicated. This usually depends on whether your business has a physical presence or economic nexus in that state

For ecommerce businesses, one of the most complex tax obligations to navigate is state sales tax. This is a tax levied on the sale of products in a particular state (or local county in some cases). As with income tax, your liability to collect and remit sales taxes is based on whether you have a nexus with a particular state. This can occur by having:

- a physical presence in that state; or

- an economic nexus once you exceed a certain level of transactions or sales activity.

In most states, the threshold for economic nexus is $100,000 in sales or 200 transactions over 12 months. You may still have sales tax obligations even if you have no physical connections to a state.

Continue reading this article below the formConsumer Protection Laws

In the United States, consumer protection laws exist at the federal and state levels.

Some states have stricter consumer laws than others. However, all businesses operating in the United States must follow the Federal Trade Commission Act. This law prohibits unfair competition and deceptive business practices. The Federal Trade Commission has also published regulations for particular products or industries. Other federal consumer protection laws may also be applicable. For example, if you offer a warranty against defects to customers, you might be required to comply with the requirements of the Magnuson-Moss Warranty Act.

Intellectual Property Rights

With the United States being home to one of the largest markets in the world, it is imperative that your brand and other intellectual property are adequately protected. For brand owners, this means applying for a trademark with the United States Patent and Trademark Office. By registering your brand, you:

- establish a public record of your brand ownership; and

- increase the damages you can recover in a trademark infringement claim against a competitor or counterfeiter.

If you are using Amazon to sell your products, it also allows you to access their Brand Registry service to issue takedowns against infringing products. You can also access better marketing tools.

You might also consider the following forms of protection for your business:

- patents to protect unique features about how your product functions;

- designs to protect how your product looks; and

- copyrights to protect your ecommerce content and photos (for non-U.S. businesses, registering your copyright is essential to maximising the damages you can recover in a U.S. court).

Privacy and Data Security

As an ecommerce business, you will collect a range of personal information about your customers, such as:

- delivery addresses; and

- phone numbers.

Your business must have strong measures in place to protect customer information. You must also have a clear privacy policy detailing how you handle customer information. This should include details of:

- the types of information you collect;

- who you disclose it to and why; and

- how long you hold onto it.

While no single privacy law framework applies across the United States, the Children’s Online Privacy Protection Act (COPPA) applies to websites and online services directed to children under 13.

Product Safety and Liability

Products sold in the United States must also comply with mandatory safety standards and regulations designed to protect consumers against risks of serious injury or death. The primary regulator in the United States is the Consumer Product Safety Commission. However, some states have their own enforcement bodies and product safety laws. For example, products sold in California must comply with Proposition 65. This requires the seller to provide a warning when the product contains one or more of the over 1,000 chemicals known to the State of California to cause cancer and reproductive harm.

Key Takeaways

Starting an eCommerce business in the U.S. offers great opportunities but comes with complex legal requirements. You must:

- choose a suitable structure;

- comply with federal and state tax laws; and

- meet consumer protection and data privacy regulations.

Trademark registration safeguards brand rights, while product safety laws ensure compliance with federal and state standards like Proposition 65 in California. Careful planning is key to navigating these regulations and protecting business interests.

If you want to learn more about doing business in the United States, call us today on 1300 544 755 or send us an enquiry.

Frequently Asked Questions

Your choice depends on liability protection and tax considerations. Operating as a sole trader is the simplest but offers no liability protection. Contrarily, forming a company can help shield personal assets. If you are based outside the U.S., seek tax advice to address cross-border tax implications.

Businesses must comply with federal and state income taxes, and many states require sales tax based on physical presence or economic activity. If you have U.S.-based employees, employment taxes, including Social Security and Medicare contributions, may apply.

We appreciate your feedback – your submission has been successfully received.