In Short

- Most exports of goods and services are GST-free if specific conditions are met, such as export timeframes and overseas use.

- You can still claim GST credits on expenses related to making GST-free exports.

- Overseas sales may trigger sales tax obligations in other countries, depending on local laws.

Tips for Businesses

If you sell overseas, check whether your goods leave Australia within the required timeframe and keep clear proof of export. Confirm where your services are used or enjoyed, especially for digital supplies. Even if exports are GST-free, you can usually claim GST credits on related costs. Consider local sales tax rules in other countries and seek advice before expanding.

As an Australian business selling goods or services internationally, understanding your tax obligations is critical. Goods and services tax (GST), being Australia’s sales tax, can play a significant role in Australian businesses’ domestic and international transactions. While most sales of goods and services in Australia attract GST, this is not always the case when selling to overseas customers. This article will explain when an Australian business may need to charge GST on the goods and/or services it sells overseas (known as ‘exports’).

GST Treatment of Exported Goods

Goods exported from Australia are generally GST-free, so GST is not usually included in the price. To qualify, specific conditions must be met, including:

- exporting the goods within 60 days of receiving payment; or

- issuing an invoice.

If payment is made in instalments, the 60-day period begins after the final instalment is received or invoiced. You may request an extension of this 60-day period through the Australian Taxation Office’s (ATO) Online services for business.

GST Treatment of Exports Other Than Goods

Beyond goods, GST-free treatment often extends to supplies which are not goods, provided they meet specific criteria.

The rules also cover:

- specific digital; and

- intangible supplies.

Call 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Claiming GST Credits on Business Purchases

Even if your exports are GST-free, you can still claim GST credits on the tax paid for expenses related to supplying those goods or services. This ensures that GST does not become a cost embedded in your export pricing.

Special Considerations for External Territories

Australia’s GST laws consider certain external territories, such as:

- Norfolk Island;

- Christmas Island; and

- the Cocos (Keeling) Islands, since they are outside the indirect tax zone.

Therefore, sales of goods to residents of these territories may be treated as GST-free export sales. It is essential to be aware of these distinctions to apply the correct GST treatment to your transactions.

Sales Tax in a Different Country

While this article focuses on GST, other countries may impose their own sales taxes. Depending on local thresholds, you may need to register for and pay sales tax overseas. It would be worthwhile discussing this with an advisor in that country. This is particularly true if you have a high sales volume in a particular country.

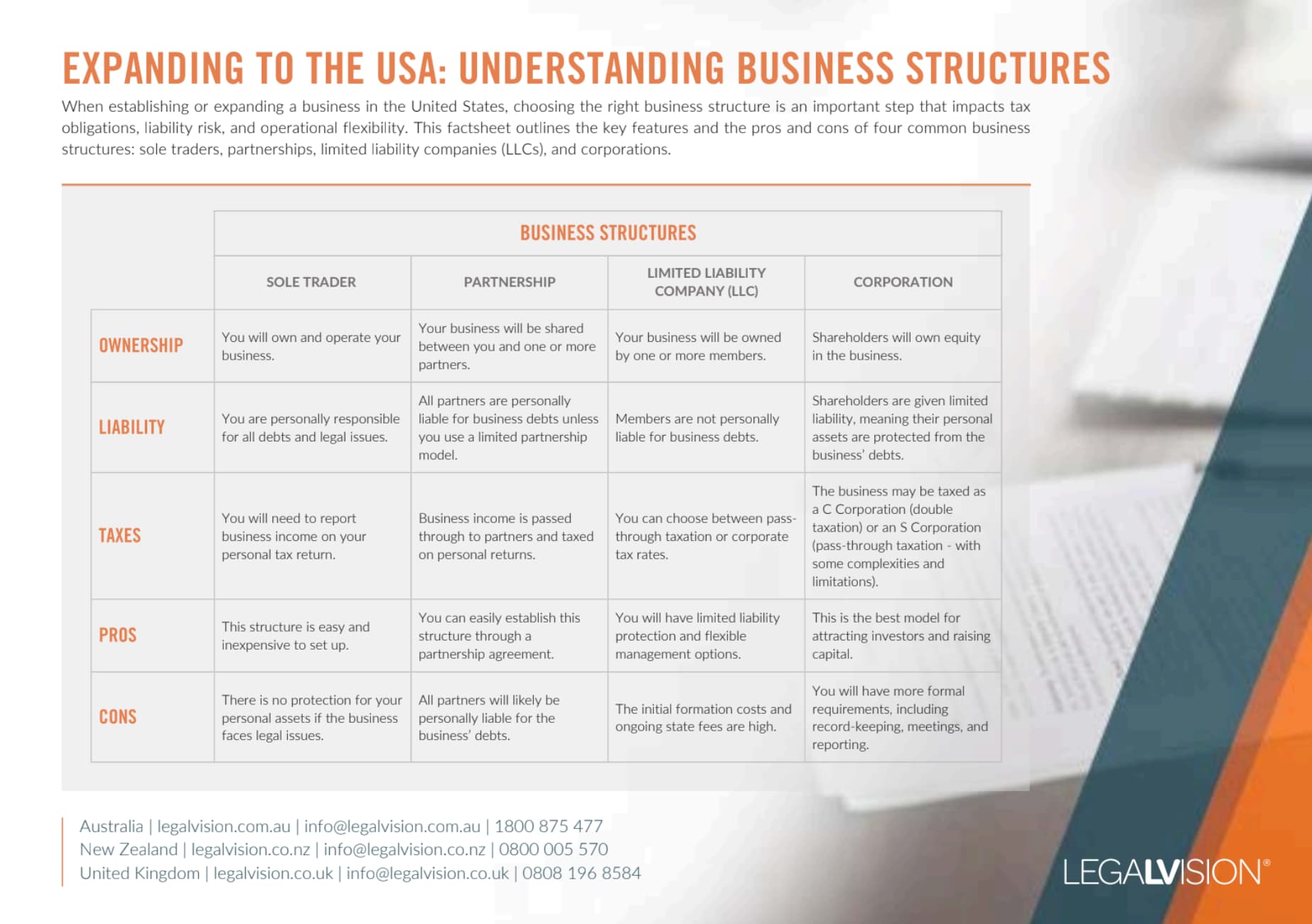

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

Key Takeaways

An Australian business generally does not need to pay GST on its exports, provided specific conditions are met. Australia’s GST rules are complex and vary by situation, so it is important to seek professional advice before treating exports as GST-free. Even where exports are GST-free, the income remains subject to Australian income tax and may also be taxed overseas under local sales tax rules. However, this is subject to the advice from a local professional.

LegalVision provides ongoing legal support for Australian businesses through our fixed-fee legal membership. Our experienced lawyers help businesses manage contracts, employment law, disputes, intellectual property and more, with unlimited access to specialist lawyers for a fixed monthly fee. To learn more about LegalVision’s legal membership, call 1300 544 755 or visit our membership page.

Frequently Asked Questions

Generally, no. Most exports of goods and services are GST-free if the relevant conditions are met, such as meeting export timeframes or supplying services used overseas.

Yes. Even if your exports are GST-free, you can usually claim GST credits on business expenses related to making those supplies.

We appreciate your feedback – your submission has been successfully received.