In Short

- Choose a unique company name and confirm its availability with the Delaware Division of Corporations.

- Appoint a registered agent with a physical address in Delaware to receive official correspondence.

- File your Certificate of Incorporation, appoint directors, adopt bylaws, and apply for an EIN to meet US tax requirements.

Tips for Businesses

Incorporating a Delaware subsidiary can help your Australian business expand into the US with a clear legal and financial structure. Engage a professional to manage filings, appoint a registered agent, and ensure compliance with US tax and corporate laws to avoid delays and costly administrative errors.

A Delaware subsidiary gives your Australian business the legal framework to operate effectively in the US market while maintaining clear separation from your parent company. From opening US bank accounts to signing commercial contracts, incorporating a Delaware entity helps remove operational barriers and provides the liability protection that international businesses need. Follow these seven essential steps to establish your US subsidiary correctly from the start.

Step 1: Determine Your Company Name

Most company names end with a suffix like ‘Inc.’ or ‘Incorporated’, or ‘Corp.’ or ‘Corporation’. A business name might end in ‘LLC’ if it is a limited liability company, however this is not the recommended business structure for a subsidiary.

For example, your company name might be “Acme, Inc.” or “Acme Corporation”.

Your company name must be unique and not the same as or similar to other already-registered business names in Delaware.

This means that you could not apply for “Acme, Inc.” if there was already an “Acme Corporation”, or even an “Acme, LLC”.

Step 2: Appoint a Delaware Registered Agent

Delaware law requires all companies to maintain a registered agent with a physical address in the state to receive official correspondence and other legal documents. You must have a registered agent in order to file an application for incorporation. They also assist with renewing your company each year. You can find registered agents online, or we can appoint one for you when we incorporate your Delaware subsidiary.

Continue reading this article below the formStep 3: Prepare and File Certificate of Incorporation

You must file the Certificate of Incorporation with the Delaware Division of Corporations to form your subsidiary. The Certificate of Incorporation is a foundational document for your new company. This document will set out (at minimum):

- the proposed name of your company;

- the details of your registered agent;

- the details of your company’s registered office;

- the approved purpose of your company; and

- the total amount of stock authorised to be issued.

The ‘Incorporator’ – the person submitting the filing application – signs the Certificate of Incorporation.

Step 4: Appoint Directors and Adopt Corporate Bylaws

Once the Delaware Division of Corporations has approved the incorporation of your subsidiary, the Incorporator must pass a set of resolutions to adopt the founding bylaws of the company and appoint the initial directors. Companies typically pass a written resolution in lieu of holding a formal meeting.

The bylaws of a company set out how the company operates, and is similar to a ‘constitution’ that Australian companies might have.

Step 5: Obtain Federal Tax Identification Number

The IRS assigns an Employer Identification Number (EIN) to a business as its tax identifier. It is a legal requirement for a US company to have an EIN so that they can complete federal and state tax returns. It is also essential for opening a business bank account, and for hiring employees.

Most foreign-owned companies need to apply for an EIN by mail or fax, unless one of the business’ officers has a social security number. In that case, the officer can submit the application online. An application by fax can take 4-5 business days to receive an EIN, whereas mail applications can take 4-6 weeks to process.

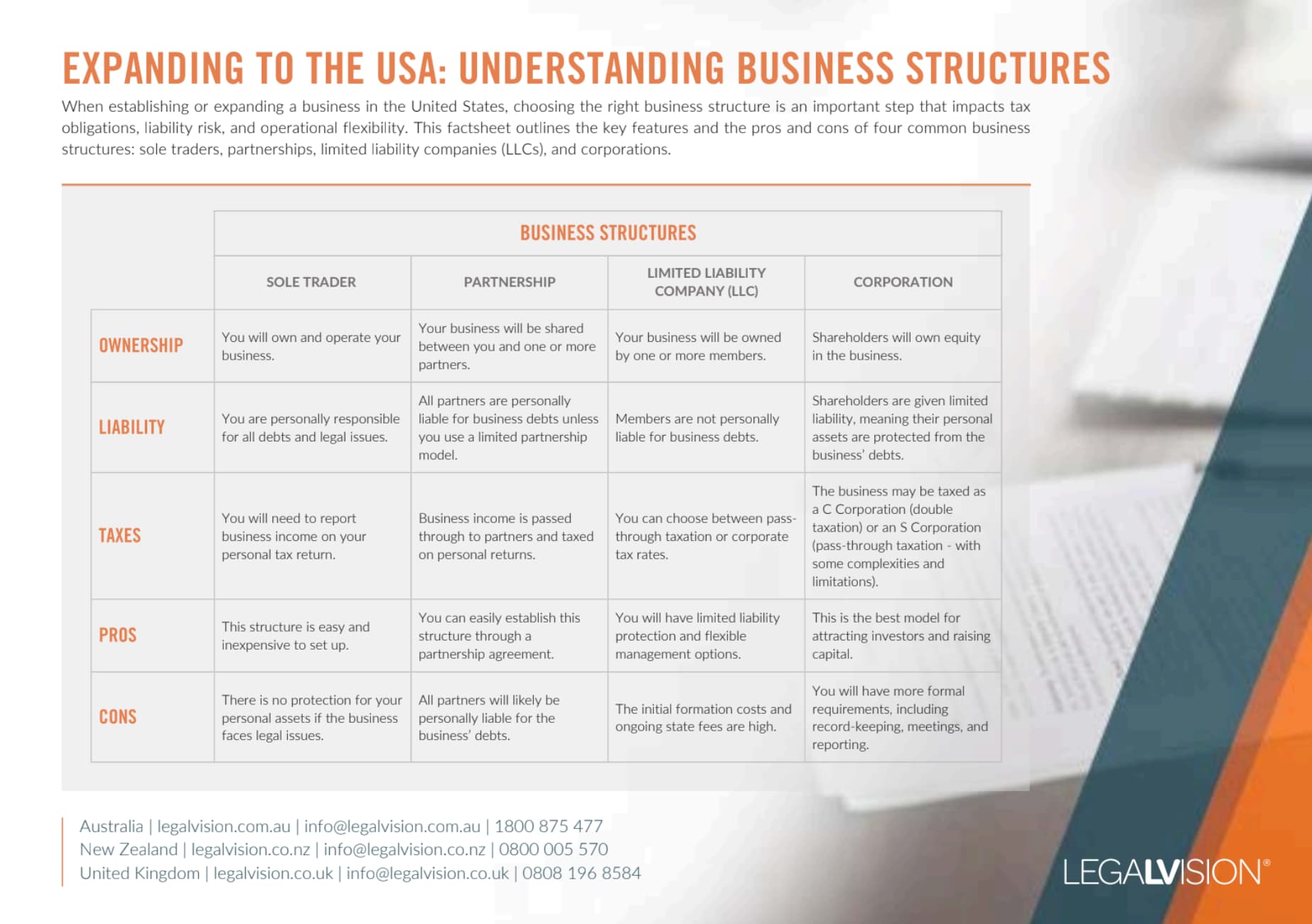

This factsheet outlines the key features and the pros and cons of four common business structures: sole traders, partnerships, limited liability companies (LLCs), and corporations.

Key Takeaways

Setting up a new company in Delaware is a relatively straightforward process, but navigating the various forms and governance documents can be challenging for Australian businesses.

LegalVision can form your Delaware subsidiary for a fixed fee. Call us today on 1300 544 755 or send us an enquiry.

Frequently Asked Questions

The standard processing time for a Delaware company is 3-5 business days, but there are options to pay for shorter processing times.

An LLC offers liability protection and single taxation, meaning profits are only taxed when distributed to members. However, a corporation provides stocks, making it easier to raise investment or go public, but profits are taxed twice, at the business level and again when distributed to shareholders.

We appreciate your feedback – your submission has been successfully received.