Corporate governance is the framework of laws, rules and guidelines through which a company makes business decisions. Directors are ultimately responsible for a company’s decision-making and will refer to this framework when running the company.

For small to medium businesses, good corporate governance is as simple as understanding how decisions should be made and following the appropriate processes. By doing so, you will be creating accountability and transparency, protecting decision makers and giving confidence to those who deal with (or invest in) your business.

This guide focuses on decision-making for small to medium private (proprietary limited) companies. The goal of this guide is to help you understand:

- Who is responsible for corporate governance?

- Who makes decisions?

- How decisions are made?

- How decisions are recorded and implemented?

Understanding Who is Responsible For Corporate Governance

The three key players in corporate governance are directors, shareholders and the company secretary. Not all companies will need a company secretary, but all will have at least one director and one shareholder.

For many businesses, the directors are also the major shareholders, so it can be difficult to separate their roles and responsibilities. But it is important to do so, as directors are responsible to the company as a whole and not just themselves when making decisions. If directors breach their duties to the company, there can be personal legal consequences (e.g. fines, disqualification, etc.). This is why proper decision-making processes are so important. So when putting these in place, the first question to ask is ‘who makes decisions’?

How to Make Decisions

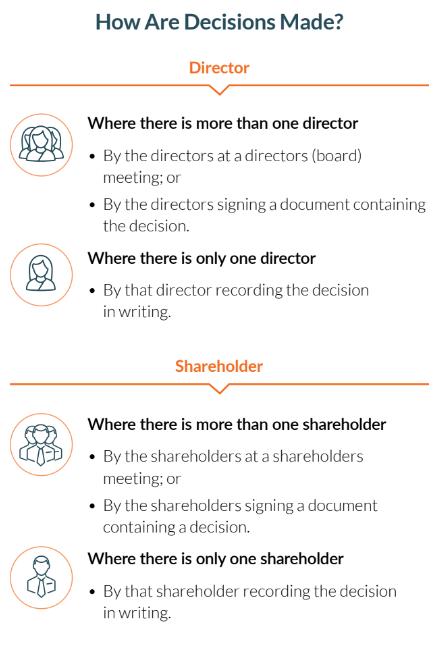

Directors make most company decisions. Some very important decisions, however, are made by shareholders. Whether a decision is made by the directors or shareholders is determined by what is stated in the company’s constitution, shareholders agreement and/or the Corporations Act 2001 (Cth).

- Constitution – A standard document that contains basic decision-making processes.

- Shareholders Agreement – A document tailored specifically for the company, which sets out in detail who is in charge of what decisions.

- Corporations Act – Company law which sets out certain decision-making legal requirements.

The constitution and shareholders agreement are referred to as ‘governance documents’ in this guide.

Decisions typically made by directors and shareholders are outlined in the table below.

| Decisions Typically Made by Directors | Decisions Typically Made by Shareholders |

| Entering into contracts, hiring people, leasing premises, issuing shares in the company, appointing a director to the board, declaring and paying dividends, and authorising the company to take out a loan. | Adopting a constitution or changing the constitution, varying and cancelling class rights of shares, authorising an initial public offering (IPO) or sale of the company, and winding up the company. |

Call 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

How to Hold a Directors Meeting

So you are looking to lease new premises or kick start a capital raise and need to get director approval. What comes next?

How to Hold a Shareholders Meeting

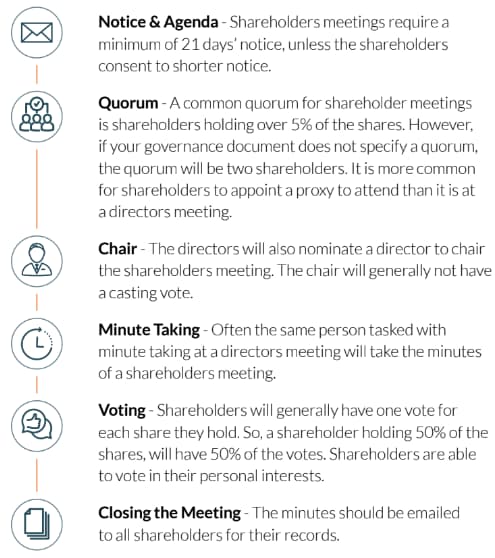

The process for a shareholders meeting is the same as a directors meeting but with the following key differences:

Passing Decisions Without a Meeting

Sometimes companies find it easier and faster to pass a decision with a ‘written resolution’ (also referred to as a circular or circulating resolution). This is a popular way to pass decisions as you do not need to wait out the notice period or go to the trouble of holding a meeting. To pass a decision in this way, you will need the following:

- a document that explains the background of the decision and sets out the resolution; and

- to sign the document. By signing the document, each director/shareholder agrees to the passing of the resolution. Once all directors/shareholders sign, the decision will be passed.

Your governance documents will specify whether your company can pass written resolutions. Most commonly, a written resolution will need to be signed by all directors/shareholders, regardless of what type of resolution is required (so if you have a director/shareholder who is away or unresponsive, it is probably best to hold a meeting instead).

Finally, if you are the sole director or sole shareholder, there is no need to hold a meeting with yourself! Just keep a written record of your decisions with your company documents.

How Decisions Are Recorded and Implemented

Decisions at a meeting are recorded in the minutes of the meeting and decisions passed by written resolution are recorded in the document itself. In some circumstances however, more steps will be necessary to implement the decision.

A great example of this is when decisions relate to shares in the company. If the directors resolve to issue shares to a new shareholder, that decision will be recorded in the minutes. However, the directors will also need to update the Company Members Register (the register containing all shareholding details of the company) and update the Australian Securities and Investment Commission (ASIC) of the change to the Company’s share register.

Another example of how a company implements decisions is entering into and signing a contract. Once that decision is made, either the sole director (where there is only one), two directors or a director and company secretary signs the relevant document on behalf of the company. Once the document is signed, the company has now bound itself to its terms.

Key Takeaways

Good corporate governance is important for companies, regardless of their size. Not only does it help ensure compliance with company laws, but the practices and values that corporate governance instils in the business, such as transparent decision-making and reducing conflicts of interest, can contribute to the long-term health and prosperity of your business. To help set your business up for corporate governance success, you should:

- understand your company type and the rules that govern it;

- adopt a constitution for your business;

- if you have more than one shareholder, implement a shareholders agreement;

- follow due process for meetings, including recording all decisions made;

- ensure decisions are made by the correct people (i.e. directors or shareholders); and

- keep your company registers and ASIC up to date.

For more information, our experienced corporate lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Directors, shareholders and company secretaries are responsible for a company’s corporate governance. Their duties are contained in a combination of company law (i.e. the Corporations Act), the company’s constitution and shareholders agreement.

To validly hold a directors meeting, there are specific notice requirements that must be followed. Likewise, the meeting can only proceed if it meets a quorum, which is a minimum amount of directors that must be present for the meeting to be valid.

We appreciate your feedback – your submission has been successfully received.