As a business owner or manager, you know the importance of a written contract, especially regarding payment and financial obligations. However, you might be unaware that informal conversations can sometimes significantly impact the obligations within valid contracts. This article will help you understand how verbal exchanges can alter contractual rights under Australian contract law.

Contract Variation

In the course of business, it is common for you to have informal discussions with suppliers, customers or landlords about ongoing legally binding agreements. You might not realise that these casual conversations could alter your written agreements. In Australia, it is a legal rule that a verbal conversation can vary written agreements.

Example

Consider the following scenario: a customer calls you and says they are having some cash flow issues, which means they cannot pay this month’s invoice. You tell the customer not to worry and to make up the difference next month. You might think this is just a temporary, informal arrangement, but it could be seen as a binding variation to your terms and conditions. If this were ultimately the case, in practical terms, you would not have a contractual right to recover the debt until the following month.

For businesses, this principle could apply in various scenarios, including a:

- verbal agreement with a supplier to extend payment terms;

- discussion with a customer about modifying their repayment schedule for goods or services provided; and

- discussion with a subtenant about their unpaid rent.

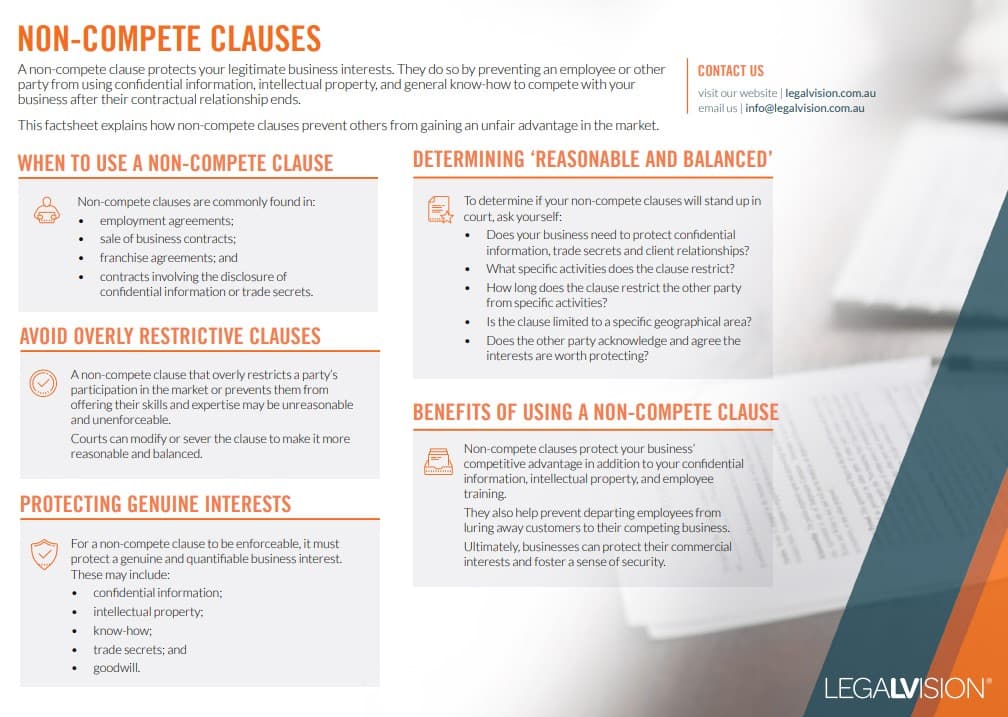

This factsheet explains how non-compete clauses prevent others from gaining an unfair advantage in the market.

Estoppel

Another legal concept for businesses to understand is estoppel. In simple terms, estoppel can prevent one party from breaking their word if the other party has relied on that word to their detriment. This principle can significantly impact debt obligations, especially when verbal assurances are made.

For businesses, this could play out in several ways, including if:

- you assure a customer that you will not enforce strict payment deadlines, and they rely on this assurance in managing their cash flow;

- a supplier tells you not to worry about immediate payment, leading you to allocate funds elsewhere; and

- your landlord verbally agrees to accept late rent payments due to temporary financial difficulties.

Waiver

Another relevant legal concept you must be aware of is waiver. In essence, a waiver occurs when one party voluntarily gives up a right to which they are entitled under a contract. This is particularly relevant to our discussion because it can often arise from conduct or conversations, even when a written agreement remains unchanged.

For a business owner, waiver could manifest in various scenarios, such as:

- consistently agreeing to accept late payments without protest, potentially waiving the right to enforce strict payment deadlines;

- verbally agreeing to accept partial payments, which might waive the right to demand full payment as per the original agreement; and

- assuring a debtor that you will not enforce certain contract terms, which could be seen as waiving your right to do so later.

In each of these scenarios, if the ‘paying’ party can successfully argue that a waiver of rights would prevent the other party from being able to enforce these rights.

How Can I Protect Myself?

Some effective strategies for protecting yourself when engaging in conversations regarding contractual obligations are:

- Document Everything: Make it a habit to follow up verbal conversations about financial obligations with an email summary. This creates a paper trail and reduces the risk of misunderstandings.

- Conduct Contract Reviews: Periodically review your debt agreements and update them to reflect any verbal changes. This ensures your written contracts always reflect current arrangements.

- Be Cautious in Conversations: Be mindful of what you say regarding debt enforcement or modifications. Avoid making promises or assurances unless you’re prepared to honour them.

- Train Your Team: Ensure that employees who deal with financial matters understand the potential implications of their conversations with customers, suppliers, or financial institutions.

- Seek Legal Advice: If you are unsure about the implications of a conversation or want to modify a debt agreement, speak to a legal professional.

Key Takeaways

While written agreements remain the cornerstone of business relationships, businesses must be aware that conversations can have legal consequences, particularly regarding debt obligations. To safeguard your interests, document all verbal exchanges, regularly review your contracts and be mindful of exchanges in informal discussions. Training your team and seeking legal advice when necessary can help ensure your business avoids costly mistakes from casual conversations.

If you think you have verbally varied a contract, our experienced disputes lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

Estoppel prevents a party from breaking a promise if the other party relies on it. For example, if you verbally allow late payments and the other party depends on this, you may be unable to enforce the original terms.

You may waive your rights if you repeatedly allow late payments or verbally agree to changes without objection. To avoid this, document all verbal agreements in writing and review contracts regularly.

We appreciate your feedback – your submission has been successfully received.