In Short

- A drawer is only liable for a cheque once it is presented for payment.

- A cheque must be presented within a reasonable time (typically 15 months) to avoid becoming stale.

- If dishonoured, the drawer must compensate the holder for the cheque amount and any interest due.

Tips for Businesses

Ensure cheques are presented for payment within a reasonable timeframe to avoid them becoming stale. Regularly check details like the date, amount, and payee information when handling cheques. If a cheque is dishonoured, follow up promptly with the drawer to resolve the issue or consider legal action if necessary.

Cheques are becoming increasingly obsolete. Plastic (card) transactions and electronic fund transfers (EFTs) offer a safe, reliable and, most importantly, instant method of money transfer. Unlike cheques, there is no risk of the transactions ‘bouncing back’ or becoming ‘stale’.

Consumers want to be able to source products from all around the world via the Internet. For obvious reasons, many e-traders do not accept cheques as a method of payment. Cheques, however, are not yet entirely extinct, and many government organisations and businesses continue to issue them.

The question is then, what is the drawer’s liability when issuing a cheque and in what circumstances can they refuse to honour it?

Liability of a Drawer Upon the Issue of a Cheque

Under sections 58 and 71(a) of the Cheques Act 1986 (Cth), a drawer of a cheque is not liable unless and until it is presented for payment. However, a cheque once presented for payment must be paid. Similarly, sections 70 and 71(b) of the Act set out that a drawer of a dishonoured cheque continues to be liable, regardless of whether or not he or she is aware of this fact.

In such circumstances, the drawer will be required to compensate the holder for:

- the sum ordered to be paid under the cheque; and

- any interest that has become payable on the cheque.

The Consequence of Delaying in Presenting a Cheque for Payment

The general liability of a drawer is not absolute. A drawer will not be liable unless the cheque has been presented for payment within a ‘reasonable time’. What amounts to a reasonable time is determined on a case-by-case basis.

Under section 60(3) of the Act, the below factors determine what is a reasonable period:

- it is reasonable to expect that cheques will be presented for payment promptly;

- industries such as trade and finance typically accept cheques;

- the nature of the cheque, including the date of issue and the cheque’s value;

- whether any circumstances beyond the holder’s control caused delay; and

- whether the holder’s default, misconduct or negligence caused the delay.

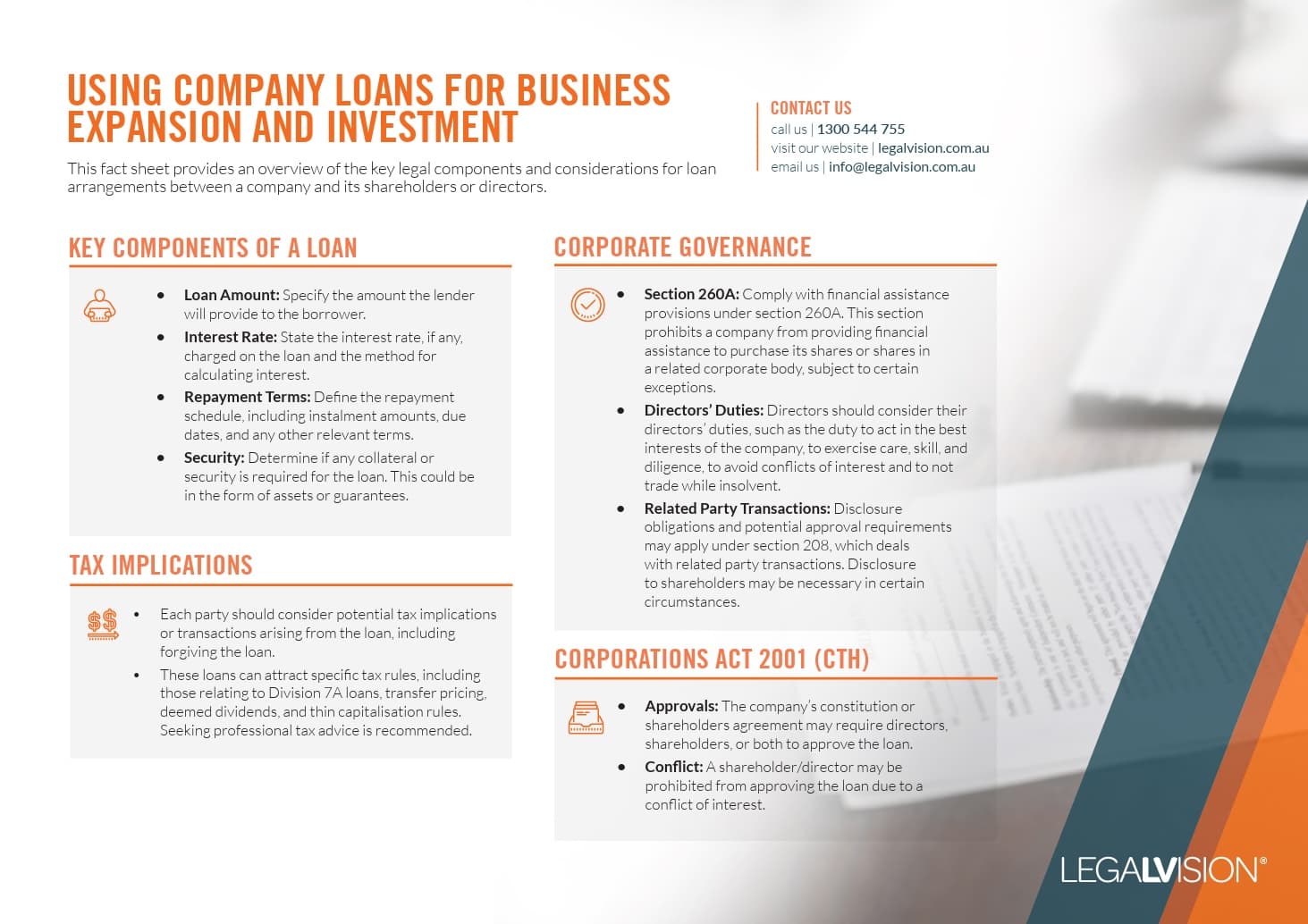

This factsheet provides an overview of the key legal components and considerations for loan arrangements between a company and its shareholders or directors.

Key Takeaways

Cheques remain in use despite the rise of instant digital transactions. Under the Cheques Act 1986 (Cth), a drawer is only liable when a cheque is presented for payment. If a cheque is dishonoured, the drawer must compensate the holder for the amount and any applicable interest.

A cheque must be presented within a “reasonable time,” typically 15 months, or it may become stale. Factors such as industry standards and delays beyond the holder’s control influence this timeframe. Businesses and individuals should verify cheque details carefully and be aware of potential fees, risks, and legal obligations when handling cheques

Glossary

- Drawer: The person or entity who writes and signs the cheque.

- Drawee: The bank on which the cheque is drawn (usually the drawer’s bank).

- Payee: The person or entity to whom the cheque is payable.

- Stale cheque: A cheque that has not been presented for payment within a reasonable time (usually 15 months from the date of issue).

- Dishonoured cheque: A cheque that the bank refuses to pay, usually due to insufficient funds.

- EFT: Electronic Funds Transfer, a digital method of transferring money between accounts.

- Presenter: The person or entity presenting the cheque for payment.

Frequently Asked Questions

In Australia, cheques are typically valid for 15 months from the date of issue. After this period, they may be considered ‘stale’ and may not be honoured by banks.

First, contact the drawer to request payment. If unsuccessful, you may need to send a formal demand letter or consider legal action, depending on the amount involved.

Yes, you can request a stop payment from your bank, but this must be done before the cheque has been presented and processed.

Yes, many banks charge fees for issuing cheque books, stopping payments, and in some cases, for processing cheques. Check with your bank for specific fee information.

Verify that the date, amount (in words and figures), payee name, and signature are all present and correct. Also, check that the cheque isn’t post-dated or stale.

While not illegal, post-dated cheques carry risks. Banks may process them before the date shown, potentially leading to complications if funds aren’t available.

A personal cheque is drawn on an individual’s account, while a bank cheque is issued by the bank itself, providing more security as it is guaranteed by the bank.

We appreciate your feedback – your submission has been successfully received.