When a shareholder exits a company, a company can buy-back shares that the exiting shareholder previously held. This article will canvas the steps you can take as a shareholder to buy-back shares.

Buying a Company’s Own Shares

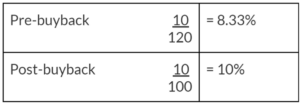

The first point to note is that your company cannot hold its own shares. If you undergo a share buy-back, you will be terminating those shares, reducing the total number of shares on issue in the company. As there will be a smaller pool of total shares on issue once you have conducted a buy-back, each of your shareholders will experience a reduction in dilution as they now hold a higher percentage of the company.

An Example

Inverstor A Pty Ltd holds 10 shares in your company. The company buys back 20 of its 100 shares on issue, resulting in a final total of 100 shares on issue.

After the share buy-back, Investor A Pty Ltd 10 shares represent around 1.7% more of the company than they did immediately prior to the buy-back.

Procedure for a Buy-Back

If you are undergoing a share buy-back, there are certain legal requirements you will need to meet.

1. Identify the Type of Buy-Back

First, as there are different types of share buy-backs, you will need to identify which type of buy-back you are undertaking. Your company will need to meet different statutory requirements for the different types of buy-backs, including:

- any minimum holding;

- employee share schemes;

- on market buy-backs;

- equal access schemes; or

- selective buy-backs.

2. Obtain Shareholder Approval

Once you have identified the type of buy-back you wish to undertake, you must obtain the requisite shareholder approval. You may need to call a general meeting and pass the required resolutions at the meeting. Each relevant shareholder must sign the resolution.

3. Notify ASIC

You will also need to notify ASIC as to the instigation of the share buy-back. You can do this by lodging ASIC Forms 280 and 281.

4. Proceed With the Buy-Back

Once you have provided ASIC with the necessary notice and your shareholders with the required disclosure information, you can proceed with the share buy-back. Following this, you must notify ASIC again about changes in your company’s share structure by lodging a Form 484.

5. Further Steps

After the buy-back has been conducted, you will need to complete further paperwork, including updating your company’s member register. If the shareholder no longer has a right to appoint a director – as they cannot meet the threshold set in your shareholders’ agreement for appointing directors (if any) – you must notify ASIC about the resignation of such director.

If you are a company director, complying with directors’ duties are core to adhering to corporate governance laws.

This guide will help you understand the directors’ duties that apply to you within the Australian corporate law framework.

Call 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Key Takeaways

There are several laws and regulations to note when conducting a share buy-back. If you are unsure of the correct procedure or if you require any assistance with drafting the necessary paperwork, our experienced business lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

Frequently Asked Questions

If you circulate a written resolution to your shareholders, you must get each shareholder to sign the resolution. If one of your shareholders is non-responsive or drags their feet, you can alternatively hold a shareholders meeting to pass the shareholders resolution by a vote. Depending on how many votes the delaying shareholder has, you may be able to meet the required threshold to pass the resolution.

This will depend on whether your shareholders deed or employee share option plan (ESOP) rules contain a Power of Attorney clause. If so, the attorney (usually the company’s directors) can act on behalf of a defaulting shareholder and sign the necessary documents on their behalf.

We appreciate your feedback – your submission has been successfully received.