Recently, the issue of au pairs and fair wages has been circling in the national media. Typically, families engage au pairs, not businesses. Consequently, you may be confused as to whether your au pairs are legally your employees. This will affect whether you owe them the same benefits that employees of a company would receive. This article will set out the obligations that are placed on families engaging au pairs directly.

What are Au Pairs?

Globally, there are many countries where au pairs are not considered employees. Historically, these arrangements were intended to allow young people to travel and earn money in exchange for providing child-minding and domestic jobs for a family. The spending money is often referred to as pocket money or a weekly allowance. However, no such system exists in Australia. Therefore, young people visiting Australia as au pairs must come on a working holiday visa.

Many families use au pairs as an alternative to hiring nannies or using after-school care. As a result, the focus on cultural exchange factors that may have existed in the past has diminished. Instead, for many families, au pairs are merely a cheaper childcare alternative. Young travellers are also more likely to think of the engagement as a job to assist with their travel expenses rather than focusing on the cultural exchange aspect.

Who Classifies as an Employee?

There are certain circumstances under which an individual performing work will not be considered an employee in accordance with the Fair Work Act 2009 (the ‘Act’). Ordinarily, this will occur where the work performed is a requirement of a university degree or other approved training course the individual is undertaking. In these circumstances, you may engage the worker as an unpaid intern.

Despite an au pair’s work being private and domestic in nature, they do not fall within these exceptions to the definition of employment, and, therefore, you must consider them as employees. However, when you engage an au pair through an agency, they may be acting as an employee of the relevant agency and therefore, no employment relationship will exist between you and the worker. Where this is the case, you personally will not have any employment obligations to the individual, and all employment obligations will rest with the agency.

Employment Contracts

If you are directly engaging an au pair, you can arrange their paid employment through an employment agreement or contract. This should, at the very least, include terms describing the:

- duties the au pair will perform;

- expected hours of work (or stipulate that there is no agreed roster and engage the individual on a casual basis); and

- wages or rates of pay.

There are many other standard terms and conditions of employment that are ordinarily included in an employment agreement, including but not limited to clauses relating to:

- the right to work in Australia;

- termination;

- confidential information;

- remuneration offset;

- intellectual property; and

- expectations of employment.

However, it will be prudent to think about whether these are relevant for an au pair arrangement. Whilst it is always recommended to have a written agreement in place, it is not a legal requirement. An employment relationship will still exist regardless of whether a written agreement is in place, and therefore, you should still generally be aware of your employment obligations.

Continue reading this article below the formCall 1300 544 755 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

What Entitlements Do I Owe Au Pairs?

National Employment Standards

The Act broadly governs all employment relationships and sets out the general obligations of employers in Australia. The Act includes ten standards known as the National Employment Standards (NES). These set out the minimum entitlements applicable to all employees in Australia. They cover issues such as:

- maximum working hours per week;

- leave entitlements;

- notice of termination; and

- redundancy.

Casual employees do not receive the same entitlements under the NES as permanent employees. The basis of casual employment is that there is no ongoing expectation of employment. As such, they are not awarded entitlements such as annual or personal leave and are instead awarded a casual loading on the minimum wage of 25%.

Minimum Wage

The Act also contains a separate provision for the national minimum wage for employees not covered by a modern award. From 1 July 2024, Australia’s national minimum wage will be $24.10 per hour, excluding superannuation ($915.90 for a 38-hour week). Employees covered by a modern award will have their minimum wage set out within the award. There are several awards that may cover your au pair and therefore, it will be best to seek legal advice on this point before agreeing to a rate of pay.

As above, you must also pay casual employees a 25% casual loading in addition to the applicable minimum wage. Employees who are younger than 21 years old and not covered by a modern award or enterprise agreement are subject to a scaled minimum wage which is based on a percentage of the national minimum wage.

Further, it is typical for au pairs to be provided with room and board as part of the arrangement. Importantly, you should not consider this as a contribution towards their minimum wage entitlements.

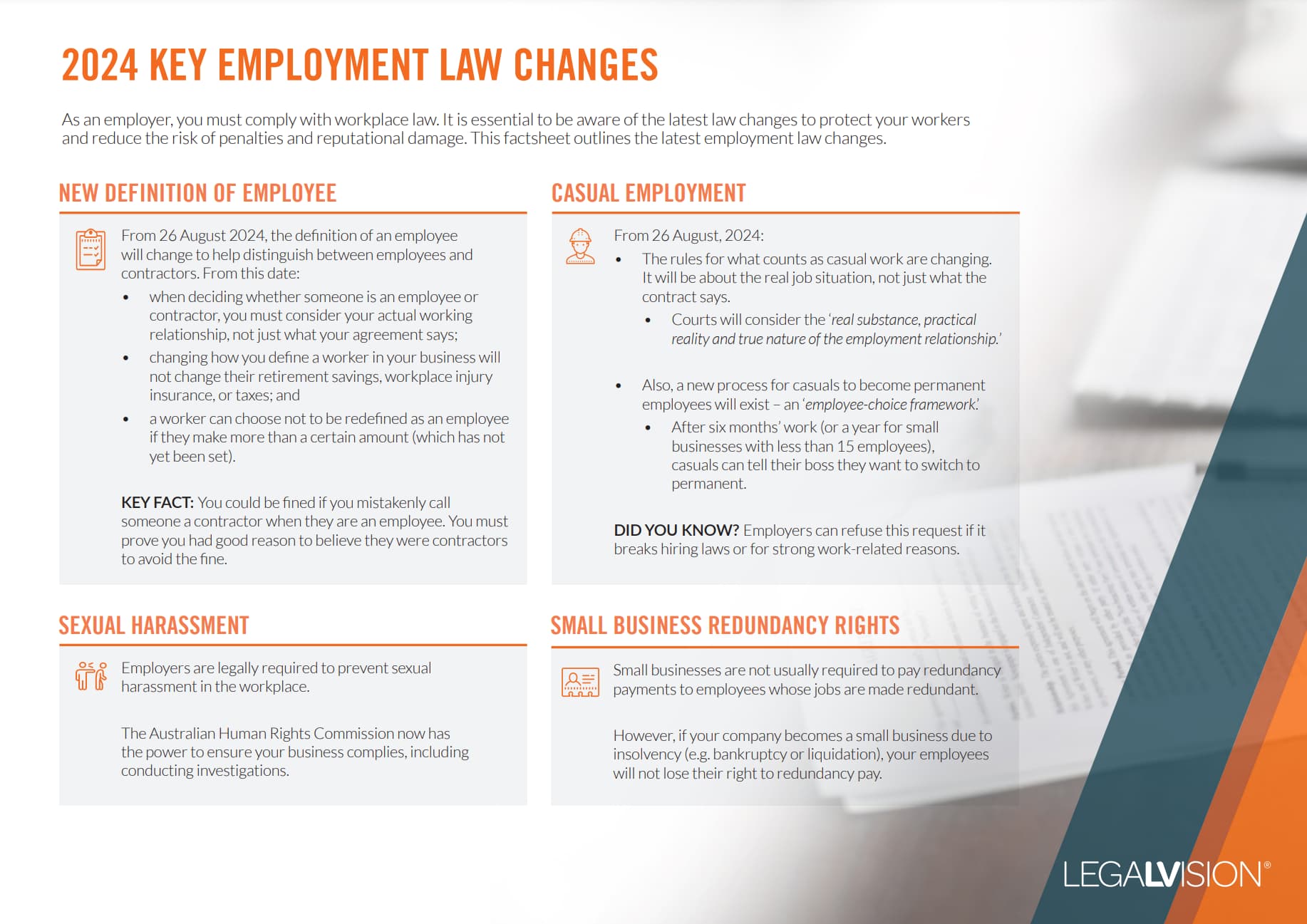

As an employer, it is essential to understand what employment laws have changed and their implications for your business — particularly the changes to the Fair Work Act 2009 through the new Closing the Loopholes legislation.

Superannuation

Under Australian law, you must contribute a percentage of an employee’s earnings into a complying superannuation fund. There are a number of exceptions to this requirement which may be relevant if you engage an au pair. The most relevant exception applies where an employee performs primarily private and domestic work for 30 hours a week or less.

The services provided by an au pair will typically fall into the category of private and domestic work. Therefore, you must contribute 11% to a complying superannuation fund only if the employee works more than 30 hours per week.

Key Takeaways

Overall, au pairs often fall within the legal definition of an employee in Australia. The Fair Work Act 2009 includes certain minimum standards for all employees, which you should be aware of before you hire an au pair. You should also be aware of any minimum wage and superannuation requirements.

If you are thinking about hiring an au pair and have any questions about your obligations as an employer, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 1300 544 755 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.